Solutions (583)

The success of platforms like Airbnb and Booking.com has ignited a fire among African tech entrepreneurs. Recognizing the significant growth of the tourism sector and the rising need for short-term accommodation for both leisure and business travel, these entrepreneurs are seizing the opportunity to develop innovative solutions.

Camansa, a digital solution developed by an Ivorian startup, provides users with the ability to locate short-term accommodations for vacations or business trips across various cities in Côte d'Ivoire. The startup, headquartered in Abidjan, was established by Aziz Doumbia, Khalifa Bayoko, and Yann Akoun.

“Our mission at Camansa is to connect travelers, tourists, hotels, and property owners through our booking platform. [...]We’ve developed a dedicated booking platform for hosts and travelers to streamline the reservation process and address common issues,” the startup explains.

For the time being, Camansa does not offer a mobile application, so users must access the web platform via a browser. While users can browse available properties on the site, an account is required to make reservations. Camansa collects necessary information to verify the identity of the account creator, whether for booking or hosting. Once verified, they can conduct their transactions on the platform.

The Ivorian startup offers a variety of accommodations to meet different client standards, ranging from hotels to villas and apartments owned by individuals. In addition to the properties displayed on the homepage, users can conduct more personalized searches. The website features a search bar where users can enter the city, arrival and departure dates, and the number of travelers, specifying the number of adults, children, and babies.

While using the platform is free, reservations carry a fee of 2,000 CFA Francs (approximately $3.30). The startup levies a commission of 10% from hotels and 15% from individual property owners. Payments can be made via credit cards or mobile money. Refund policies in the event of reservation cancellations are dependent on the terms of the property owner, whether a hotel or an individual.

Adoni Conrad Quenum

Africa's e-commerce scene is booming, with tech startups developing innovative solutions to streamline operations for merchants.

Maad, a Senegalese startup, has developed a business-to-business e-commerce solution that enables small retailers to source consumer goods directly from affiliated suppliers. The startup, with bases in Dakar, Senegal, and San Francisco, USA, was established in 2020 by Sidy Niang and Jessica Long. On Tuesday, May 14, it announced the successful completion of a $3.2 million funding round aimed at diversifying its services and bolstering its growth in Senegal.

Jessica Long explained their decision to handle all logistics in-house, stating, “We decided to bring all of logistics…the reason that we do that is just it's a low margin business. We think that this is the way to provide good service and to meet the reliability needs of clients. I don't think that we would be able to offer a similar service if we relied on a third-party provider.”

The startup’s mobile application, available on iOS and Android, has already been downloaded more than 10,000 times from PlayStore. After downloading, users create an account and gain access to a variety of services, including ordering. The startup estimates that 75% of orders are placed through the app, with the remainder coming from the call center and field agents. Maad also offers a delivery service that helps to optimize order prices.

As for the various brands featured on the startup’s mobile platform, they “can track live presence and market share data. They can also deploy promotion and merchandising services in targeted neighborhoods to increase sales of key products.”

In addition to facilitating orders, the startup offers various services such as “buy now, pay later,” which allows retailers to access stock on credit. Maad currently boasts over 6,500 active retailers and 80 suppliers.

Adoni Conrad Quenum

The solution was launched in an effort to help farmers reach consumers and businesses.

CartAgro, a Nigerian startup, has developed an online marketplace that enables farmers to sell their produce directly to businesses or individuals. The startup, established in 2017 by Idris Adeshina and headquartered in Lagos, offers a mobile application compatible with both Android and iOS platforms.

Users, notably farmers, private individuals, and business representatives, are required to create an account after downloading the app. They must then follow the necessary steps to complete the account setup by providing the requisite information.

The startup asserts, “We believe that by putting technology in the hands of farmers, we can empower them to optimize production, improve livelihoods, and make informed decisions that benefit their businesses and the entire agricultural ecosystem.”

The platform provides consumers with access to fresh produce, including vegetables, fruits, and grocery items. To streamline operations, CartAgro incorporates a digital wallet and a logistics tracking system, in addition to the virtual marketplace. The startup also provides agricultural market information to facilitate the best possible deals on the platform for all parties involved.

CartAgro is committed to sustainable development, a principle that informs many of its decisions. The agritech firm believes that businesses have a significant role in addressing global challenges. Consequently, it aligns its actions with the United Nations’ Sustainable Development Goals (SDGs). Food security, good health and well-being, and responsible consumption and production are among the guiding principles of Adeshina’s firm.

Adoni Conrad Quenum

E-health services are rapidly expanding across the continent. They offer an appealing alternative due to the shortage of hospitals and health centers in some regions of Africa.

Mavimpy Care is an e-health solution developed by a Congolese startup, enabling users to access a variety of health services online through its web platform. Based in Lubumbashi, the startup was founded in 2020 by Gracien Kibala, Osée Badi, and Lepetit Mashini.

"The genesis of my business venture and my burning entrepreneurial spirit can be traced back to a few years ago. It was during a simple search for a dentist for a routine checkup. As a matter of habit, I turned to Google and entered the keyword ‘dentist DRC.’ To my great surprise, the search results displayed dentists from America, Europe, and other parts of the world. Google even presented me with names of dentists from Europe and other countries. However, not a single result was found for the Democratic Republic of the Congo (DRC)," Gracien Kibala told PataTech media in February 2024.

Through its web platform, users can consult a doctor online, search for hospitals or doctors in specific cities. To access the healthtech's services, users need to create an account by providing details such as their first name, last name, email address, phone number, and password. Once registered, users can access the various services offered in Congolese cities where the platform is available.

Mavimpy Care has integrated artificial intelligence into its services. Gracien Kibala explained, "We are delving into artificial intelligence with the connected bracelet that digitizes the medical record. We personalize your health file. Our connected bracelets provide health information, requiring only a QR code to access your medical history."

On the platform, users can also access articles offering tips and advice on managing health situations effectively and preventing some ailments.

Adoni Conrad Quenum

With over 150,000 users in its four years of existence, according to the startup's data, Axa Zara offers several fintech solutions to African populations. The startup aims to become one of the leading players in this segment in Africa.

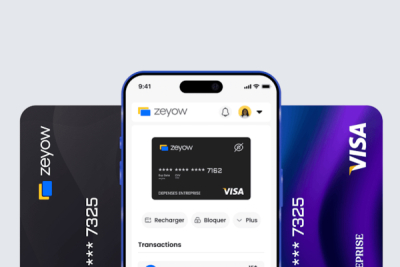

Zeyow is a fintech solution developed by the Beninese startup Axa Zara, allowing users to create virtual bank cards for conducting online financial transactions. Founded in 2019 by Elias Mahugnon Missihoun, the startup operates out of Abomey-Calavi (Benin) and Abidjan (Côte d'Ivoire).

“Axa Zara’s mission is to create infinite opportunities through technology. By leveraging the potential of technology, our goal is to provide access to new possibilities, break down barriers, and enable people from all walks of life to achieve their professional goals,” the startup explained to We Are Tech Africa. It continued, “We focus on developing digital solutions that are not only effective but also inclusive, ensuring that no one is left behind in the digital revolution.”

Zeyow does not have a mobile app. Users must access the service through a web browser by visiting the Axa Zara website. To use Zeyow, users click on “create an account” and provide information such as name, email address, and phone number.

After this step, users can create their virtual bank card and perform online operations like shopping on e-commerce platforms or subscribing to services. The card can be recharged using various methods, including mobile money, which is popular among African populations.

Talking about its continental expansion plans, Axa Zara says: “We are actively looking to expand into other countries. This process involves a rigorous market analysis to pinpoint exactly where the needs lie. We consider the local ecosystem and all available opportunities to ensure that our intervention is not only relevant but also beneficial to the communities we aim to serve.”

Adoni Conrad Quenum

To make learning more accessible and engaging, two Senegalese tech entrepreneurs launched a new e-learning platform aimed at students from middle school through senior high school. The platform has already secured partnerships with several Senegalese schools.

20/20 Edtech, an e-learning solution developped by a Senegalese startup, provides users with a wealth of educational content accessible via web and mobile platforms at their fingertips. The startup, headquartered in Dakar, was established in 2020 by Abderrahmane Sow and Ahmadou Ba. Its mission is to build a library of cost-effective educational content for students in Francophone Africa.

The startup explains, “By utilizing the 20sur20 platform, students can learn through hundreds of concise, straightforward, and highly engaging videos that enable them to review at their own pace, practice continuously by answering our quiz questions that ensure comprehension of the material, and improve by pinpointing their knowledge gaps and focusing their learning efforts accordingly.”

The solution includes a mobile app, which is exclusively available on Android and not on the Play Store. Users must navigate to the web platform to download the app and register an account by providing their personal information. Once registered, users can access a range of edtech content, from sixth grade to senior high school. Currently, only the content for sixth grade, ninth grade, and twelfth grade is available on 20/20 Edtech.

In addition to a variety of courses, quizzes are provided to enable users to gauge their proficiency levels. An analytical dashboard offers real-time performance visualization, identifies areas of weakness, and automatically addresses them with the platform’s content. The objective is to generate 1,500 videos and 50,000 quizzes across seven subjects (including mathematics, physics-chemistry, life, and earth sciences, philosophy, etc.) for secondary school classes. The aim of 20/20 Edtech is to simplify studies for students at the various levels mentioned.

Adoni Conrad Quenum

Present in Burkina Faso, Mali, Niger, Togo, Benin, Côte d'Ivoire, Senegal, and Guinea, this fintech solution is rapidly expanding. The goal is to establish itself as a continental benchmark.

LigdiCash is a fintech solution developed by a Burkinabe start-up. It enables users to access a variety of financial services through its web and mobile platforms. Based in Bobo Dioulasso, the startup was founded by Souleymane Traoré.

"The idea was born from the observation that many entrepreneurs, companies, and e-commerce merchants were struggling to find an online payment method for the websites and apps they had developed for their clients," Souleymane Traoré told Croissance Afrique in 2022.

The solution features a mobile app available on iOS and Android –the Android app has already been downloaded over 100,000 times, according to Play Store statistics. After downloading, users must create an account to access the fintech's services. Individuals can, among other things, have an electronic wallet from which they can conduct transactions such as mobile money transfers to various telecom networks, purchase airtime and internet bundles, or make online payments.

For businesses, the fintech offers tailored services to help them grow. It provides an API for online payments via various methods such as credit cards (Visa, Mastercard, American Express, etc.) or mobile money. The Bulk feature allows for transactions like salary or supplier payments to be made in one go using the aforementioned payment methods.

PayLink enables the creation of a payment link through which the user can receive online payments for online sales or fundraising campaigns. "When a merchant uses PayLinks, they publish their items with a link or button next to them. The client can click on it and make a payment if interested in that particular item, and the merchant will be notified of the purchase," explains the startup.

Adoni Conrad Quenum

Fintech solutions are multiplying across the continent to address various financial service issues. In Togo, a startup has focused on mobile money interoperability and offers a solution in this regard.

eGo Transfer, a fintech solution developed by a startup in Togo, enables users to send and receive money via mobile, irrespective of their telecom provider. The startup, headquartered in Lomé, was established in 2020 by Attisso Luz Koumedzro.

"The inspiration for eGo Transfer came when my younger brother asked me to send him money via Flooz, but I was using T-Money. So, I conceived eGo Transfer, which facilitates money transfers from T-Money to Flooz and vice versa. It also allows for money received from Ria to be deposited into T-Money or Flooz accounts," Koumedzro explained.

The solution includes a mobile app for Android smartphones, which can be downloaded from the eGo Transfer website, although it is not available on the Play Store. After downloading, users create an account by providing details such as their first and last names, phone number, and a six-digit PIN code.

Once the account is set up, users can transfer funds to any telecom network operating in Togo. Within the app's interface, users simply select the network they want to transfer from and to, enter the amount, phone number, and PIN code to confirm the transfer. Transfers via this mobile app require a minimum of 300 CFA francs (approximately $0.49).

In 2020, eGo Transfer won the first prize at the Open Hack organized by the Nunya Lab incubator. The aim was to propose an innovative solution, and eGo Transfer captured the jury's attention, walking away with a check for one million CFA francs. In 2023, the fintech, along with seven other Togolese startups, was selected to participate in the Tech Africa-Europe International Summit, Emerging Valley, held on November 27-28 in Marseille, France.

Adoni Conrad Quenum

Healthtech is one of the most sought-after segments in the tech sector. Solutions are emerging from all corners to simplify daily life for African populations.

PharMap, a healthtech solution developed by a Beninese startup, allows users to locate and order medications online in less than ten minutes. The startup, co-founded by Anourah Mazu in 2021, aims to streamline access to high-quality medications in Africa, with a particular focus on Benin.

The startup explains, “In Africa, a patient may have to visit over 15 different pharmacies before finding a needed medication. This often leads to the use of counterfeit drugs, resulting in medical complications, or even worse, fatalities. We’re creating the first system that enables you to locate the nearest pharmacies that stock the medications you need.”

To accomplish its mission, PharMap utilizes a mobile app, available on iOS and Android. The Android app has been downloaded over 10,000 times according to Play Store statistics. It also uses the WhatsApp messaging application. After downloading the mobile app, users need to create an account to access services such as "Trouver un médicament (Find a Medication)" and "Trouver une pharmacie (Find a Pharmacy)."

The “Find a Medication” feature enables users to check the availability and price of a medication at nearby pharmacies based on their location. Users can either type the name of the medication into the search bar or send a photo of the prescription. The “Find a Pharmacy” service helps users locate pharmacies in a specific geographical area or those nearest to their current location.

Users can also order medications directly from pharmacies via the app’s interface, make an online payment, and then pick up their order at the pharmacy. For PharMap’s service via WhatsApp, users simply need to save the healthtech’s number and send their request via message. They will receive a response to their query in less than ten minutes, according to the startup.

Adoni Conrad Quenum

The solution was developed to streamline meal deliveries in Nigerian cities. It notably focuses on secondary cities.

Chowopa, a Nigerian startup, has developed a last-mile delivery solution that allows users to order food from their favorite restaurants and have it delivered straight to their homes or offices. The startup was founded in 2022 by Umebe Anthony and Umoru-Musa Abdullahi and is headquartered in Akure, a city in Ondo State.

The Chowopa solution is accessible through a mobile app, available on both iOS and Android platforms. After installing the app, users can create an account by entering their personal details. Once registered, they can place orders from a variety of partner restaurants listed on the platform.

The app allows users to search for restaurants based on location, type of cuisine, or customer ratings. Users can input a specific location within a city or state in the search bar to find restaurants that cater to that area. They also have the option to select a particular type of cuisine, such as African, fast food, Indian, and more. Customer reviews are available to help users choose between restaurants. After their meal is delivered, Chowopa encourages users to rate the service based on the quality of the food and the speed of delivery. Users can also leave comments to provide feedback on their experience.

Restaurants interested in joining the platform can do so by clicking on the "Sell on Chowopa" button and following the registration process. They will be asked to provide details such as the restaurant's name, the owner's name, email address, and phone number.

Adoni Conrad Quenum

More...

After working in the mobile money sector for several telecom operators in West Africa, two tech entrepreneurs ventured into the same market in the mid-2010s by establishing a fintech company.

Wizall Money is a fintech solution established by a subsidiary of Groupe Banque Centrale Populaire. It offers both individuals and businesses access to a variety of financial services. Headquqrtedred in Dakar, it was founded in 2015 by French entrepreneur Sébastien Vetter and Congolese entrepreneur Ken Kakena.

Wizall Money includes a mobile app that’s available on both iOS and Android platforms, with the Android version boasting over 100,000 downloads. Once the app is downloaded, users can set up an account and gain access to a wide range of services. The Wizall Money Pro feature allows businesses to pay employee salaries, settle bills, collect payments, and carry out bulk payments.

The startup explains, “If your employee has a Wizall Money account, the funds will be directly deposited into their account. If they don’t have an account, they’ll receive a withdrawal code via SMS. All withdrawals with Wizall Money are completely free.”

Individuals can use the Wizall Money feature to send money to family members, regardless of whether they have a Wizall Money account. They can also pay merchants with just a few clicks, buy airtime, and settle electricity and water bills, among other services.

Like many other fintech startups in Africa, Wizall Money has a network of agents that make its services more accessible. In addition to Senegal, the startup operates in Côte d’Ivoire, Burkina Faso, and Mali.

Adoni Conrad Quenum

This innovative solution is designed to help two groups of people: those seeking safe and affordable rides without a car, and drivers looking to share travel costs with reliable passengers.

Nabhorelan, a Guinean startup, has developed a carpooling solution that allows users to share rides with others traveling in the same direction or to the same destination. The startup, based in Conakry, was established in 2022 by founders Diallo Aissatou Bailo and Diallo Thierno Mamadou Oury.

“Our platform bridges the gap between passengers and drivers who have a shared objective: reaching the same destination. We ensure a safe and convenient travel experience in terms of cost and comfort by assisting you in finding the journey that aligns best with your needs,” the startup explains.

The Nabhorelan solution includes a mobile app, available on both iOS and Android platforms. After installing the app, users create an account to access a variety of services. Users wishing to also have a driver profile are required to provide their ID, driver’s license, or the vehicle’s registration certificate for account validation.

To book a ride, travelers input their journey details, such as departure and arrival cities, departure date, and the number of travelers, into the search bar. The platform then displays available trips. Drivers have the option to approve the ride if the conditions suit them. Also, drivers can post their route and set their prices. Passengers can then decide whether to accept the offer based on the driver’s terms. If both parties agree, a meeting is arranged.

Adoni Conrad Quenum

Inspired by a service he found incredibly useful during his time in the Middle East, a tech entrepreneur returned to his home country to launch Fikaso Plus.

Fikaso Plus, a mobile application developed by the Malian startup Fikaso, offers a solution for residents of Bamako to order food from local restaurants and have it delivered. The startup, founded in 2019 by Mahamadou Cissé, was born out of a simple observation.

“During my stays in Mali, I often struggled to find food, either due to a lack of knowledge about the available restaurants or the desire to avoid the city’s notorious traffic,” Cissé explains. “The real catalyst, however, was during a visit to the Near East, specifically Abu Dhabi, where I became accustomed to using a food delivery app.”

The Fikaso app, available on iOS and Android –already downloaded more than 5,000 times– addresses this issue. After downloading the app, users create an account with their personal information. They can then browse partner restaurants on the platform to place their order. Users input their commune and neighborhood into the search bar to receive a list of relevant restaurants based on their geographic location.

By selecting “Commandez maintenant (Order Now),” users can view the menu, dish prices, restaurant operating hours, and reviews from other users. Fikaso Plus also features a digital wallet for paying restaurant bills and delivery fees.

In addition to food orders, Fikaso offers other services such as parcel delivery and on-demand mobility. Users can order a taxi or motorcycle taxi online for errands. The startup plans to expand to other cities to support its growth in the local market before potentially venturing overseas.

Cissé believes in the power of technological innovation. “Technological advancements level the playing field; so-called underdeveloped countries can benefit from the same progress as developed countries. As such, African youth should not merely be playing catch-up; they should be leading the charge,” Cissé says.

Adoni Conrad Quenum

In an effort to contribute to the sustainable development of their country, three tech entrepreneurs have established a solution for financing collaborative projects through e-commerce.

DealKhir, a Moroccan startup, has introduced an innovative online commerce platform that allows users to purchase service products in support of sustainable association projects. The Casablanca-based startup, established in 2021 by Layla Medkouri, Hamza Bakkach, and Rim Machhour, is transforming the landscape of fundraising and patronage.

The platform operates by setting up a specific fund for each project. Users can directly access these projects on the website and make a purchase to support the ones they choose. The process is straightforward: select a project, purchase one or more products associated with it, and upon validation of the purchase, 70% of the amount is directly allocated to the project’s fund.

Layla Medkouri explains, “When you make a purchase of 100 dirhams (approximately $9.92), 70 dirhams are donated to the selected association projects. These projects are supported through these deals and indirectly by our partner companies who agree to lower their prices to increase attractiveness.” She further adds, “For instance, in the case of school transportation, each product purchased by a user contributes 70 dirhams to the dedicated fund. Once the target amount is achieved, all contributors, including consumers and partner companies, are notified.”

Initially, DealKhir concentrated on service products such as leisure, entertainment, travel, and fitness centers. However, it has evolved into a comprehensive online commerce platform where users can find a variety of items related to the projects being funded. Notably, it offers local cooperatives a free platform to market their products. Users can also contribute to a project without necessarily making a purchase.

Adoni Conrad Quenum