Solutions (583)

After completing an acceleration program at EtriLabs, the healthtech company launched into the African market and quickly distinguished itself on the continental tech scene. The company continues to steadily progress and harbors big dreams for the future

Rema, an e-health solution developed by a Beninese startup, enables doctors and medical students to collaborate remotely and receive continuous training. Based in Cotonou, the startup has been led by Sedric Degbo since 2019. Its mission is to improve the quality of healthcare decisions in Africa by ensuring the reliable and rapid transfer of medical and scientific knowledge and data among individual and organizational healthcare stakeholders.

The mobile application is available on both iOS and Android and has been downloaded over 10,000 times from Play Store. After downloading, users create an account by filling out a registration form and providing proof of their professional or student status. The registration is manually verified, as account creation is restricted to doctors and medical students (at least in their second year of study).

Once registered, users can access various services offered by the startup. These include Rema Learning, which allows users to attend live or recorded interactive medical conferences hosted by international experts and explore clinical cases shared by peers; Rema Jobs, which curates job opportunities for healthcare professionals in Africa; Rema Business, which enables targeting and engaging a specific audience within the community for various purposes (medical surveys, brand awareness, influencer campaigns, etc.); and Rema Pharma, a service for non-community members needing confidential consultations with a pharmacist for tailored advice. This service requires users to save the start-up's number and contact it via WhatsApp. The telepharmaceutical consultations often involve recommendations for preventive health practices, over-the-counter pharmaceuticals, or health center referrals.

Rema also functions as an online community and social network for medical professionals. Users can make posts to seek opinions from other doctors. "There are two posting modes on REMA: 'Quick Post' and 'Clinical Case'. In 'Quick Post' mode, you access a publishing interface with a text field and an image upload button. In 'Clinical Case' mode, the interface includes fields to describe your case, add images, and select specialty and anatomical tags to identify your case," explains the e-health platform.

With additional offices in Nouakchott, Mauritania; Dakar, Senegal; Lomé, Togo; and Douala, Cameroon, Rema aims to establish itself as the leading community for doctors and medical students on the continent. The start-up has garnered multiple awards, including the first prize for best start-up at inwiDays 2019 in Casablanca, Morocco; best digital start-up at FIDEA 2019; second prize for best African start-up at the AfricUp Pitch Challenge 2019 in Tunis, Tunisia; and an award for the best solutions from La Francophonie with the most impact during the peak of the health crisis in 2020.

Adoni Conrad Quenum

The development of fintech startups in Africa has provided alternatives for populations excluded from traditional financial services. Thanks to these solutions, they can save or invest according to their means.

Ejara is a fintech solution developed by a Cameroonian startup, allowing users to access financial services through its mobile application. Founded in 2020 by Nelly Chatue-Diop, Baptiste Andrieux, and Tierno Tall, the Douala-based startup successfully raised $8 million in funding in 2022 to democratize access to digital investment and savings products and support its growth across the continent.

"In Africa, most people don't have the safety net of a pension fund, and some clients use Ejara for that. There are users, particularly mothers, who use the platform to invest in their children's university education. We also have a small portion of our customer base who are wholesalers, handling large volumes; they use crypto to fund and purchase goods from foreign suppliers through this method," explained Nelly Chatue-Diop.

The Ejara app is available on both iOS and Android and has already been downloaded over 100,000 times from PlayStore. After downloading, users create an account to access the startup's various services. Among other features, they can save funds and earn up to 5% annual interest or buy and sell cryptocurrencies. From Bitcoin to Tether, Ethereum to Binance Coin, the Cameroonian fintech offers Africans access to these digital currencies.

Ejara's system is based on blockchain technology, ensuring secure transactions. Additionally, the fintech has implemented a gateway that allows users to top up their digital wallets via mobile money. With just 1,000 CFA Francs (approximately $1.63), users can start saving or investing on the Cameroonian startup’s mobile platform.

"The integrated transparency and security offered by the blockchain, combined with the popularity of mobile banking services in Africa, made me realize that a mobile investment platform based on blockchain was the key to expanding financial inclusion," stated Nelly Chatue-Diop.

Adoni Conrad Quenum

Founded by two tech entrepreneurs, the solutions aims to make it healthcare access easier for people. It integrates an AI-based chatbot to make the process even smoother.

La Ruche Health, an Ivorian startup, has developed an e-health platform that allows users to book appointments online through an AI-powered instant messaging chatbot. The Abidjan-based startup was launched in 2023 by Benjamin Sasu and Rory Assandey.

The platform has a mobile app accessible on both iOS and Android, which has already been downloaded more than 500 times from the PlayStore. Users can register to access various services, such as teleconsultation and home medical exams. After booking an appointment, users can discuss their symptoms with a qualified specialist within 60 minutes, and they will receive their prescriptions instantly through the mobile app.

In addition to the web and mobile platforms, La Ruche Health has Kiko, an AI-based chatbot with which users can chat on WhatsApp. This conversational agent is capable of conducting medical discussions and answering simple or complex technical questions. It understands messages via voice note, text, and images. The startup claims more than 150,000 "patient encounters" led by the chatbot, with only 2.33% converted into appointments with doctors.

Prior to its official launch in 2023, the startup was selected in 2022, along with 14 other African startups, for the "Google for Startups Accelerator" program. In 2024, it was among the startups chosen by the Ivorian authorities to participate in the VivaTech technology fair held in Paris from May 22 to 25.

Adoni Conrad Quenum

The solution was developed to help young Africans study in countries across the continent. It connects students with educational opportunities abroad, bridges gaps in access to quality education and fosters greater academic exchange.

Esseyi is an edtech startup developed by a Beninese company. It aims to connect African students with universities across the continent for various degree programs. Founded in 2023 by Emeric Koda and Max Agueh, the startup is based in Cotonou. The name "Esseyi," which means "knowledge," is derived from Ikposso, a language commonly used in Togo.

"We are convinced that by capitalizing on its youth, Africa will accelerate its economic and social development. Many countries currently experiencing strong development, such as Tunisia, Kenya, and Turkey, have invested in efficient and local higher education systems. Through this project, we also aim to limit Africa's brain drain to the west," says Emeric Koda.

Unlike many digital solutions, Esseyi does not have a mobile application. Instead, users access the platform through a web browser. By creating an account and filling out their student profile, users can access over 10,000 degree programs at 2,000 public and private institutions in 52 countries across the continent. Depending on their study plans, students can find suitable courses and proceed with the application process with the startup's assistance.

"We hope our platform will become a companion for students throughout their academic journey. In the medium term, students using Esseyi will be able to find housing, benefit from health insurance, open a bank account, and search for internships or jobs in Africa," explains Emeric Koda.

In June 2024, Esseyi was selected, along with five other Beninese edtech startups, to participate in the first cohort of the Mastercard Foundation EdTech Fellowship program at the Beninese incubator EtriLabs, in partnership with the Mastercard Foundation. The eight-month program includes non-equity funding of $75,000.

Adoni Conrad Quenum

African populations are increasingly relying on fintech solutions to access financial services. From mobile money transfers and digital savings accounts to online loans, this Nigerian startup has taken steps to provide these services to underserved communities across the continent.

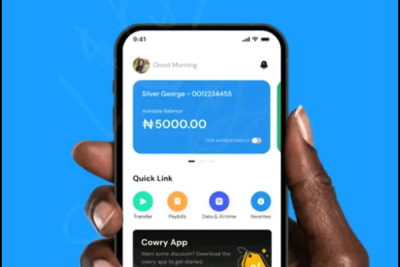

AwaCash is a fintech solution developed by a Nigerian startup. It allows users to make payments, transfer money, and manage their finances via a mobile application. The startup, based in Lagos, was founded in 2021 by Dayo Okunfolami, Bonaventure Igboanugo, and Oladele Dada.

AwaCash aims to simplify the lives of Nigerians by providing customized on-demand banking experiences and expanding its range of services in the dynamic fintech sector. "We understand the obstacles encountered by the average Nigerian in obtaining credit and efficiently managing their finances. Our primary objective is to streamline their lives by offering an on-demand banking experience that is tailor-made to meet their ever-evolving needs," said Dayo Okunfolami.

The solution features a mobile iOS and Android application, which has been downloaded over a thousand times from the PlayStore. Users can create an account in just a few clicks to access various services. Among other things, they can pay electricity bills and various subscriptions, buy airtime and mobile data, save money, access loans, and obtain virtual bank cards for online purchases.

In June 2024, the fintech was selected by the Nigeria Sovereign Investment Authority (NSIA) for its eponymous award. AwaCash will benefit from an acceleration program that includes a five-week training course at Draper University in Silicon Valley, USA.

Adoni Conrad Quenum

In 2019, two tech entrepreneurs, a Moroccan and a Senegalese, embarked on a mission to track informal buses in Dakar, Senegal, to estimate their arrival times and develop a solution for this pervasive issue. Later, they relocated the project to Morocco.

Weego is an e-mobility solution developed by a Moroccan startup, enabling users to navigate cities by choosing the optimal mode of transportation. Founded in 2020 by Saâd Jittou and Mor Niane and based in Casablanca, Weego aims to enhance the use of public transport and reduce travel time to less than thirty minutes.

"The solution ensures that at least one virtual station is within two minutes of users' homes, assigns them a bus and a driver, and designates a station where the minibus will pick them up. No human intervention is required," explains Saâd Jittou.

The mobile application is available on both iOS and Android, with over 10,000 downloads on PlayStore. After downloading the app, users create an account and access various services. "WeegoMaas" is the basic service that offers users ride-hailing options, carpooling, buses, or trams depending on their city.

To provide this service, Weego has integrated several e-mobility applications available in different regions. Apps like Heetch, Pip Pip Yalah, Train, and Tramway contribute to Weego's offerings. The startup also offers "WeegoLines," a service that helps companies reduce their employees' commute times and lateness. Employees can use the mobile app to track company shuttles in real-time, knowing arrival times and any delays.

Since its launch, Weego claims over 100,000 corporate shuttle trips, significantly reducing lateness and absenteeism and lowering transport costs by 30% for employees. Weego also offers "WeegoPro" for users with a fleet of vehicles, and "WeegoSchool" is slated for future release. The app includes a digital wallet that can be recharged via bank cards.

Adoni Conrad Quenum

The name of the startup means "quickly" in Lingala, a widely spoken language in Congo. Its goal is to redefine delivery standards in Africa.

Noki Noki is a digital solution developed by a Congolese startup that allows users to have their parcels delivered via its mobile application. The startup, based in Brazzaville, was founded in 2021 by Jonathan Yanghat. On Thursday, June 13, it raised $3 million to expand its distribution network, enhance its service offerings, and strengthen its presence in new markets.

"I founded Noki Noki in 2021, driven by a deep belief in the power of African innovation, particularly in Congo-Brazzaville. We started the venture with a few motorbikes and a clear ambition: to revolutionize delivery and e-commerce on the continent. This funding round brings us closer to our goal of becoming a reference in local delivery in Africa," said Jonathan Yanghat.

The solution features a mobile application available on iOS and Android, with over a thousand downloads. After downloading, users create an account with their personal information, giving them access to the startup's various services.

Among these services, Noki Noki has deployed Noki Food for ordering food from local restaurants; Noki Noki Enterprises to meet the logistical needs of businesses, ensuring the safe transportation of parcels and goods from point A to point B; and Noki Noki Shopping for performing various errands, such as delivering pre-ordered items, dry-cleaned clothes, and more.

The startup operates in six countries and eight cities, including Brazzaville and Pointe-Noire in Congo, Dakar in Senegal, Abidjan in Côte d’Ivoire, and Libreville in Gabon. With average delivery times of 10-15 minutes in city centers and 20-30 minutes outside city centers, Noki Noki offers a viable alternative for e-commerce platforms typically facing delivery challenges.

The Congolese startup boasts over 10,000 users, more than 5,000 satisfied clients, and over 200 business partners. In 2022, it won the best startup award at the International Tech and Innovation Fair of Central Africa (Osiane) and joined the TotalEnergies incubator in Pointe-Noire in 2024, following the Startupper Challenge.

Adoni Conrad Quenum

Driven by a personal tragedy, a tech entrepreneur founded Eight Medical to revolutionize emergency healthcare. After losing two close family members because they didn't get to the hospital fast enough, he decided to take action and improve the system.

Eight Medical is a Nigerian e-health startup that enables users to access emergency healthcare through its web and mobile platforms. Founded in 2021 by Ibukun Tunde-Oni, the startup is based in Lekki.

The solution includes a mobile application available on both iOS and Android. After downloading the app, users can sign up and access all the services offered by the startup through a subscription. This subscription ensures rapid care in case of emergencies; otherwise, users will have to pay for the service when utilizing the healthtech.

In medical emergencies such as illness, traffic accidents, or other incidents, Eight Medical positions itself as the "911 for Africa." Users can either call their service or press the emergency button in the mobile app. Once the request is sent, they respond within 25 minutes or less to transport the patient to the hospital.

To achieve this, the healthtech has a fleet of ambulances, vehicles, and motorcycles to navigate the traffic congestion in Nigeria's major cities. Besides emergency responses, the startup offers first aid services at events, non-emergency ambulance transportation, and aeromedical evacuation.

Since its launch, Eight Medical has handled over 12,705 calls, with an average response time of ten minutes. Earlier this month, it was selected as a finalist in the Pitch2Win competition, along with 14 other Nigerian startups, with a prize of $10,000.

Adoni Conrad Quenum

Set up by three tech entrepreneurs with over 25 years of experience combined, the solution aims to facilitate the distribution of pharmaceutical products.

i'SUPPLY is an e-health solution developed by an Egyptian startup, enabling pharmacies to restock pharmaceutical products via its web and mobile platforms. Founded in 2021 by Ibrahim Emam, Moustafa Zaki, and Ramzy Mohamed, the Cairo-based company has quickly made a significant impact on the market.

On June 6, i'SUPPLY raised $2.5 million to support its expansion plans, improve financing capabilities for small and medium-sized pharmacies, and advance its fintech offerings. "Our sights are set even higher as we strive to obtain a license from the Egyptian Financial Regulatory Authority to meet the evolving financing needs of small and medium-sized pharmacies. Our unwavering commitment to meeting the escalating market demand for funding, addressing working capital shortages among pharmacies and small distributors, remains at the core of our mission," stated Ibrahim Emam.

The solution features a mobile application available on iOS, AppGallery, and Android, with over 10,000 downloads on the Play Store. After downloading, users create an account to access the startup's services. Through its digital marketplace, they can source pharmaceutical products from numerous distributors.

i'SUPPLY aims to resolve all supply chain issues in this segment. It provides users with tools for real-time market information and analysis. This includes a comprehensive view of product distribution, stock levels, commercial performance, supply chain efficiency, and market trends.

The Egyptian healthtech boasts over 10,000 pharmacies on its marketplace and more than 200 small and medium-sized distribution companies offering a portfolio of over 10,000 pharmaceutical products.

Adoni Conrad Quenum

Named "astonishment" in Bambara, Mali's prevalent language, this education startup lives up to its name by fostering innovation and surprising users with its approach, particularly through its mobile application.

Kabakoo is an edtech solution developed by the Malian startup Kabakoo Academies. Founded in 2019 by Yanick Kemayou and Michèle Traoré, the Bamako-based company offers users access to online training in various fields. The goal is to equip young people with the skills to design and implement solutions tailored to the specific challenges of their communities.

To achieve this, Kabakoo operates physical campuses in several cities across the continent and has launched a mobile application available exclusively on Android. Since its inception, the app has been downloaded over 100,000 times, according to Play Store data. After downloading the app, users can create an account and access the various training programs offered on the platform.

"We connect young people, local communities, and open-minded individuals from around the world to collaboratively solve real-world problems using cutting-edge technologies and indigenous knowledge. The Kabakoo learning experience enables young Africans to acquire the skills necessary to create value by establishing businesses, finding jobs, and overcoming gender inequalities," states the startup.

Kabakoo focuses on a learner-centered curriculum, emphasizing creative project-based learning and the integration of local knowledge. The program is designed to help learners acquire and develop skills in digital fabrication and distributed manufacturing technologies. Its innovative approach has been recognized by numerous institutions, including the African Union, UNESCO, and the World Economic Forum, as a major innovation in the global education landscape.

Adoni Conrad Quenum

More...

The tailored solution was developed by two tech entrepreneurs to support farmers, particularly smallholder farmers.

FarmHouse is an agritech solution developed by the Zambian startup eMsika. It allows users to purchase agricultural products and seek farming advice from an AI-based chatbot. The startup, based in Lusaka, was founded in 2016 by Gilbert Mwale and Elton Chirwa. On Thursday, June 13, Gilbert Mwale announced the company's plans to expand into Tanzania, Nigeria, Egypt, and Zimbabwe.

The solution features a mobile application available on iOS and Android, which has already been downloaded over a thousand times, according to Play Store statistics. After downloading the app, users create an account to access the various services offered by the startup. FarmHouse focuses on providing technical advice on farms and selling quality agricultural inputs for the needs of small poultry and livestock farmers in urban areas.

“Using FarmHouse, farmers can access training, inputs, and connections with other farmers, while eMsika recently launched a farmer membership programme called Farmhouse Plus. It has also set up a physical store, and partnered with multinational suppliers,” Gilbert Mwale told Disrupt Africa.

The startup offers subscriptions, with the most affordable priced at 149 Zambian kwachas (approximately $5.64), granting access to several services. This subscription model, along with the profit margin from the sale of various agricultural products, generates revenue for FarmHouse. The company claims to have trained around 8,000 farmers through its training programs.

Adoni Conrad Quenum

With the release of the second version of its mobile app in June 2024, the fintech company Zepargn is making significant strides in its growth process. The company aims to launch new features and offer additional products to its users.

Zepargn is a fintech solution developed by a young startup from Benin, allowing users to save money by setting financial goals. Founded in 2023 by Alao Lawal, this Cotonou-based startup aims to democratize access to financial services, enabling individuals to manage and optimize their savings easily and securely, regardless of their banking status.

"Zepargn is a financial companion designed to help you achieve your dreams. It allows you to set personalized savings goals, whether for a major purchase, a dream vacation, or an emergency fund. Zepargn automates the savings process, sends reminders, and tracks your progress, making it easier to realize your financial aspirations," explains the startup.

The mobile app is available on iOS and Android and has already been downloaded over a hundred times. To access the company's various services, users must download the app and create an account in just a few clicks. They then configure a savings goal and define the parameters. After this setup, users can start making regular or one-time deposits from their bank cards or mobile money accounts.

From the dashboard, users can track their savings progress with various tools provided by the startup. This allows them to know their status at any point in their savings journey. Alao Lawal told We Are Tech Africa that Zepargn has over 1,500 active users and more than 15 million CFA Francs (24,370 USD) saved on the platform since its launch.

"However, to continue increasing adoption, we plan targeted awareness campaigns to educate the unbanked about the benefits of our solution, continuous improvement of the user experience based on feedback, and the launch of new attractive features and products such as interest-bearing and group savings and credit," he added.

The Beninese fintech is present in ten countries but aims to strengthen its presence in the West African sub-region. It plans to introduce a financial education feature with targeted content in a gamified format, expand its service offerings to other population segments, including small businesses, and establish strategic partnerships with financial and insurance institutions to offer diverse and tailored products to meet the population's needs.

Adoni Conrad Quenum

In Soussou, a widely spoken Guinean language, Arabinènè "New unpacking." The eponymous startup aims to revolutionize the Guinean e-commerce sector.

Arabinènè is an e-commerce platform developed by a Guinean startup. Organized as a marketplace, it allows users to purchase various items online from their computers or smartphones. Based in Conakry, the startup was founded in 2019 by Thierno Mamoudou Sow. Its goal is to encourage Guineans to buy and sell their products online and to promote local products to an international audience.

"Arabinènè aims to revolutionize the Guinean commercial sector and create hundreds of direct jobs and thousands indirectly across the national territory in various activities, from the marketplace to dropshipping and product delivery," the startup states.

Currently, Arabinènè offers a mobile app available exclusively on Android. Downloaded over a thousand times according to PlayStore data, the app allows users to create accounts and access the various online stores within the marketplace. Electronics, beauty products, home and office equipment – a diverse range of products awaits, categorized into dedicated tabs for easy navigation.

The platform curates its homepage to showcase relevant products. "Top Sales of the Day" highlights the most popular daily purchases, while other sections like "Latest Trends" and "Customer Favorites" guide user discovery. Arabinènè even provides a built-in delivery service within Conakry and surrounding regions, with delivery times varying from 2 to 72 hours based on distance.

However, Arabinènè is not yet available throughout the entire territory of Guinea. Expanding its reach nationwide is the next step to support its growth.

Adoni Conrad Quenum

In 2021, Beninese entrepreneur Raynald Ballo launched RMobility, a carpooling service modeled after the French company Blablacar. Recently, the company has expanded its offerings to include a ride-hailing service, providing cars with drivers (VTC).

On June 7, Beninese ride-sharing app RMobility launched a new ride-hailing service offering cars with drivers (VTC). This announcement was made during a press conference organized by the company.

"We believe that mobility should be accessible, safe, and convenient for everyone. By launching a VTC service, we aim to offer a more flexible and efficient solution […] as we have observed a growing demand for modern and reliable transport options," said Raynald Ballo, founder of RMobility.

The company has deployed a fleet of about fifty vehicles to compete in the increasingly competitive VTC market in Benin. To attract users, RMobility has enhanced its offerings by allowing customers to book bus tickets and event tickets through its app, in addition to carpooling and VTC services.

To promote these services, RMobility relies on its app and digital tools. According to the company's founder, these tools have already helped RMobility attract 20,000 users.

Servan Ahougnon