Kenya’s government has trained over 390,000 youth in digital skills and generated 139,000 online jobs within the past year. Information, Communication, and Digital Economy Cabinet Secretary Eliud Owalo revealed this at the launch of the Jitume ICT Hub in Ruiru on May 20.

Since 2016, Kenya's Information and Communications Technology (ICT) sector has grown by an average of 10.8% annually, emerging as a key driver of economic development and job creation, with positive impacts extending across various sectors of the economy, according to the “Kenya Economic Update: Accelerating Kenya’s Digital Economy” 2019 report by the World Bank.

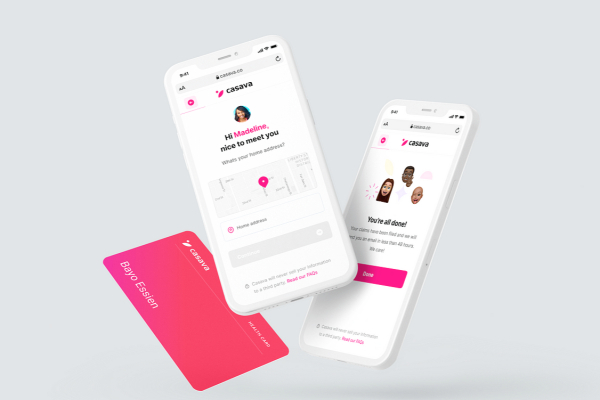

The insurtech solution is designed to streamline everyday life management, with a focus on illness and disaster preparedness.

Casava is an insurtech solution developed by a Nigerian startup, offering users online access to insurance policies. Based in Lagos, the startup was founded in 2016 by Bode Pedro. In February 2022, it raised $4 million to enhance its technology and expand its operations, aiming to provide affordable insurance to Nigerians and other Africans.

Speaking in 2022 about his venture capital firm's decision to invest in the Nigerian insurtech, Avi Eyal, General Partner at Entrée Capital, stated: "The Casava team has developed a unique and disruptive product that we believe has the potential to transform Africa’s insurance market. We are confident in the Casava team that they have what it takes to be leaders in this field."

Casava operates without a mobile application. Users must access its services via a web browser by visiting the Casava platform. The startup offers two main services for individuals: Health Insurance and Health Cash. Health Insurance provides coverage for a wide range of medical needs, from dental care to surgeries, at over 400 partner hospitals. Health Cash allows users to get reimbursed for healthcare expenses incurred due to accidents.

For businesses, Casava offers two primary services: Credit Life and Business Gro. Credit Life protects businesses “from the financial burden of sudden tragedy faced by borrowers.” Business Gro, on the other hand, provides access to business loans and various types of business insurance.

Adoni Conrad Quenum

Google is accepting applications for the 2024 Hustle Academy, a 5-day bootcamp to boost small and medium-sized enterprises (SMEs) in Sub-Saharan Africa (SSA). This year's program features a new focus on business-oriented artificial intelligence (AI) training.

Since 2022, the Hustle Academy has supported over 10,000 businesses in securing funding and creating jobs through education, mentorship, and networking. New AI modules will help businesses make data-driven decisions, optimize operations, and develop AI-powered marketing strategies.

Applications for the 2024 cohort are open to SME owners in Kenya, Nigeria, and South Africa.

Kenyan youth have secured free ICT training through a partnership involving Zone 01, the United Cities and Local Governments of Africa (ULCGA), the County Government of Kisumu, and Lake Hub. The County Government of Kisumu revealed on May 17 in a release.

The selected cohort, 96, out of 13,000 applications received, will undergo a two-year training program for free using a peer-to-peer learning model.

The program aims to develop skilled professionals in web app development, data engineering, AI, video game development, blockchain, and cybersecurity.

The adoption of digital health tools represents a significant opportunity for African economic development. By improving healthcare access and efficiency, these innovations can drive broader socioeconomic progress and help bridge the development gap with other regions.

The African Export-Import Bank (Afreximbank) and MobiHealthCare Limited (MobiHealth) have signed a $1.5 million agreement to expand MobiHealth's telemedicine services in Nigeria and explore feasibility in Egypt, Ghana, Kenya, and Côte d'Ivoire, Afreximbank announced May 21.

For Mrs. Kanayo Awani, Executive Vice President of Afreximbank, “This initiative will reshape healthcare delivery across the continent and improve equitable access to quality, affordable healthcare.”

The bank will finance activities to leverage MobiHealth’s telemedicine platform, initially piloted in Nigeria, aiming to establish a network of telemedicine clinics across Africa. The $1.5 million facility is expected to advance the project to bankability, unlocking further investments estimated at $65 million. This initiative will enhance access, efficiency, and quality of healthcare, leveraging local and diaspora medical professionals for remote diagnosis and prescriptions, benefiting underserved communities.

Afreximbank will also lead senior debt syndication and support bankable studies for the project's advancement. Supported by the Africa Investment Forum (AIF) and a $1 million grant from the United States Trade and Development Agency (USTDA), this initiative marks a significant step forward.

In its 2023 “How digital tools could boost efficiency in African health systems” report, market consultancy firm McKinsey reveals that though digital health is still in its early stages in many African regions, advancements in smartphone connectivity, data management policies, and data infrastructure are beginning to reshape the landscape of healthcare. These innovations are not just improving the delivery of health services but are also poised to enhance the efficiency of health systems significantly. It further projects that by 2030, the expanded use of digital health tools could yield up to a 15 percent increase in efficiency for African health systems. The financial savings from these efficiency gains could then be reinvested to further improve healthcare access and outcomes.

Hikmatu Bilali

A management graduate, he has over eight years of experience working in various companies and organizations. As an entrepreneur, he has been repeatedly recognized for his creativity and leadership.

Thomas Belibi Fotso (photo) is a Cameroonian entrepreneur and the founder and CEO of Bookbookshop, an innovative startup in the educational sector.

Founded in 2019, Bookbookshop aims to simplify access to books by offering an ordering and delivery service, assisting parents during school start periods. Through its online platform, individuals, schools, and companies can order academic books. Additionally, Bookbookshop supports organizations in their social initiatives by donating books and supplies.

In addition to his role at Bookbookshop, Thomas Belibi Fotso serves as the executive director of Youth Touch, a non-governmental organization dedicated to the development of disadvantaged and vulnerable communities. Since 2015, he has overseen the volunteer program, strategic development, and resource management at Youth Touch.

Thomas Belibi Fotso graduated from the National Advanced School of Posts, Telecommunications and ICT in Cameroon, earning a bachelor's degree in telecommunications management and business administration in 2015. He also holds a master's degree in economic sciences and management, obtained from the University of Yaoundé II in 2018.

A mentor in the Tony Elumelu Foundation Mentorship Program in 2023, his professional career began in 2013 at Campost, the national postal service of Cameroon, where he was an intern. He later worked as an administrative and sales assistant at Proluxe in Yaoundé from 2016 to 2017, before becoming the manager and director of Massa Judith Corporation, a service startup, from 2019 to 2023.

Recognized for his commitment and impact, Thomas Belibi Fotso won the Orange Social Entrepreneur Award in Africa and the Middle East (POESAM) in 2020. The same year, he was one of the winners of the 1000 Entrepreneurs Challenge at the France-Africa Summit.

Melchior Koba

The Moroccan government has pledged to extend high-speed connectivity across the country. The goal is to provide everyone with quality and affordable internet.

Morocco announced a new program on Monday to bring internet access to 1,800 rural areas in the coming months, marking a significant step in its National Plan for the Development of High and Very High Speed Broadband.

Digital Transition and Administrative Reform Minister Ghita Mezzour (photo) unveiled the initiative, which builds on the ongoing first phase of the plan that aims to cover 10,740 previously unconnected rural areas.

This program aligns with Morocco's soon-to-be-launched National Digital Development Strategy 2030. The strategy also includes the introduction of 5G technology, expected to play a key role in the country's modernization. By embracing digital tools, Morocco seeks to boost economic growth, improve public services, and foster broader digital inclusion.

The internet access program is projected to improve the lives of millions in rural areas. Residents will gain access to various online public services through the government's established network of 600 digital platforms, offering essential services like healthcare appointments and administrative procedures.

Improved internet connectivity is expected to have a positive impact on education, healthcare, and entrepreneurship. Students will benefit from online learning resources, patients will have the possibility of remote consultations, and local businesses will have the opportunity to expand their reach through e-commerce.

Morocco's commitment to digital transformation demonstrates its resolve to bridge the digital divide and integrate all regions of the country into the global digital economy.

Samira Njoya

Glint Ventures, an Egyptian consulting and investment firm, announced on Monday, May 13, the first close of Glint Fund II, its second venture capital fund, at $3 million. The fund aims to support Egyptian startups with investments ranging from $250,000 to $500,000.

OpenseedVC, a U.K.-based venture capital firm focused on early-stage tech companies in Africa and Europe, announced the first close of its seed fund at $10 million on Monday, May 20. The fund will target investments in startups across various sectors, including e-commerce, fintech, healthtech, and productivity tools.

"Our thesis is that by backing experienced operators early in their journey with the right capital and support from peer operators, you can build a diversified portfolio that generates incredible returns for investors and provides crucial support for ambitious operators when they need it most," said Maria Rotilu (photo), founder of OpenseedVC.

His goal is to help businesses and individuals boost their ventures. To achieve this, he has launched several initiatives, including a freelance platform.

Boubacar Diallo (photo) is a Guinean-born computer engineer and entrepreneur. He is the founder and CEO of Jamaa, a startup dedicated to helping businesses and individuals recruit top African digital talent for their projects.

Founded in 2021, Jamaa is a marketplace that connects companies with skilled freelancers on demand, offering services in various digital fields. The platform features professionals in graphic design, digital marketing, telemarketing, writing and translation, software development demonstrations, and programming.

Jamaa also organizes events such as the Jamaa Summit, a conference bringing together investors and entrepreneurs. This year, the summit will be held on May 25 and 26 in France, expecting nearly 1,000 participants, including 20 investment funds, 70 speakers, 16 startups, and 50 exhibitors.

Before Jamaa, Boubacar Diallo co-founded Tutorys, where he served as CTO until 2015. Established in 2010, Tutorys provides online training for using web applications like Twitter, Mailchimp, and Blogger. In 2015, he founded AfrikaTech, a platform promoting African startups and those in the diaspora. In 2020, he co-founded Business Africa, a weekend event focusing on African entrepreneurship, where he served as marketing director.

Boubacar Diallo holds a master's degree in computer engineering from EFREI, a digital school where he graduated in 2009. His career began in 2005 at the Effor training center, where he worked as a sales representative and trainer before becoming president in 2007. In 2006, he was a database developer at Bouygues and later worked as a Java developer at Infotel in 2008.

Melchior Koba

More...

After her biomedical and electrical engineering studies, she developed an interest in artificial intelligence. Today, she is considered one of the most influential figures in the AI field worldwide.

Pelonomi Moiloa (photo) is a South African entrepreneur. As the co-founder and CEO of Lelapa AI, she is dedicated to developing artificial intelligence products.

Founded in 2022, Lelapa AI is an AI research lab focused on Africa. By creating this company, Pelonomi Moiloa, convinced that developing countries need their own language models, uses AI to aid in the natural language processing of African languages.

"Language models created elsewhere lack an understanding of the local context. They can harbor perspectives that can be damaging to the communities that use them. If there is anyone who should benefit from profit generated from a language — a cultural heirloom — it should be the people to whom that language belongs," she explains.

One of Lelapa AI's innovations is Vulavula, an application that performs transcriptions to facilitate reading and allows for quick analysis of the emotional tone of voice messages. Translation features are being developed to enrich the platform.

In addition to her responsibilities at Lelapa AI, Pelonomi Moiloa is the director of The Ungovernable NPC, an organization that offers programs and projects to rethink entrepreneurship. She graduated from the University of Witwatersrand in 2015 with a degree in electrical engineering and from Tohoku University in Japan in 2019 with a master's degree in biomedical engineering.

Pelonomi Moiloa worked at the Council for Scientific and Industrial Research (CSIR) between 2014 and 2016 as a data science intern. From 2019 to 2022, she was a data scientist and team leader at Nedbank in Johannesburg.

In recognition of her achievements, Pelonomi Moiloa was named by Time magazine in 2023 as one of the 100 most influential people in AI worldwide.

Melchior Koba

Commerce and distribution are cornerstones of Morocco's economy, playing a significant role in driving both GDP and job creation. Embracing new technologies in this sector is crucial to boost its efficiency and sharpen its competitive edge.

Global digital advertising firm Aleph and Morocco's Ministry of Industry and Commerce signed a framework partnership agreement on Monday, May 20, in Rabat. The initiative aims to propel the digital transformation of the commerce sector and enhance merchant competitiveness.

"Our 'Digital Ad Expert' program is specifically designed to educate and empower our partners to leverage digital technologies," stated Mohamed Megahed, General Manager at Aleph Group, ensuring "a smooth transition to modern, efficient business models."

Under this partnership, Aleph will provide merchants with educational resources through the Digital Ad Expert platform and offer local support from Google-certified experts. The company will also organize training sessions and innovative workshops to effectively integrate digital advertising into their marketing strategies. The Ministry of Commerce will implement a joint action plan, mobilizing chambers of commerce and other entities to support the digitization of SMEs and organizing events to encourage the use of new technologies.

This partnership aligns with the government's trade recovery plan, which emphasizes sector modernization and job creation. The commerce and distribution sector, representing 10.8% of GDP and employing over 15.4% of the workforce (according to official figures), is a key target for this digitization push.

The Aleph-Ministry alliance is expected to assist businesses in digitizing services, ensuring their competitiveness in the increasingly digital commercial landscape. This collaboration is seen as a crucial step in fostering innovation, technology adoption, and ultimately, the growth of Morocco's digital economy.

Samira Njoya

Congo is implementing a €66.55 million project to build its national data center, according to an AFDB release dated May 17. Co-funded by the AfDB (€52.47 million) and the Republic of Congo (€14.50 million), the project includes constructing a data center and laying a 600-kilometer fiber cable.

The data center, a three-story building, will feature server and monitoring rooms, meeting spaces, and essential energy and air-conditioning equipment. Set for completion by December 2024, it is expected to be the main hub for the country’s digital data and support national projects like the digital identification initiative, boosting Congo’s digital infrastructure and security.

Kenya’s Ministry of ICT and Digital Economy has proposed the Information and Communications Technology Authority Bill 2024 to improve the technology sector. The draft bill, published in April 2024, outlines a licensing regime for ICT operators and establishes a framework for improved service delivery. For Cabinet Secretary for ICT and Digital Economy, Eliud Owalo, the bill aims to strengthen ICT service delivery by ensuring security, efficiency, and high quality, and simplifying ICT integration into public services.

The bill creates accreditation categories based on experience and technical skills. If passed, the relevant authority will assign accreditation levels to individuals or organizations that meet the prescribed requirements.