Informal sector traders across Africa are often excluded from the traditional financial system. Recognizing this issue, tech entrepreneurs have developed innovative solutions to offer alternatives to conventional financial institutions.

Proboutik is a fintech solution developed by Senegalese startup ProXalys to transform the way informal sector traders manage their financial operations. Launched in 2021 by Thierno Sacko and Abdoulaye Faye, Proboutik enables local merchants to digitize their financial transactions, bringing them into the fold of modern financial systems.

In January 2024, ProXalys raised $500,000 to support the growth of Proboutik. The mobile application, available on both iOS and Android, has already been downloaded over 10,000 times from Playstore. Users can register with their phone numbers and access various financial management services. These include cash flow management, customer portfolio management, real-time tracking of receivables and payables, automated payment reminders via SMS, and the generation of account statements and reports.

"The application records all your deferred payment transactions, ensuring transparent traceability and better management of your business operations," explains the startup. Additionally, Proboutik offers financing to users based on the credits they have extended to their customers. This feature aims to facilitate business growth and prevent financial strain for traders.

Proboutik provides two subscription options: a monthly plan priced at 990 CFA Francs (approximately $1.63) and an annual plan at 10,000 CFA Francs. On May 23, Proboutik was selected, along with 19 other African fintechs, for the second cohort of Visa's acceleration program.

Adoni Conrad Quenum

As part of its initiatives in Africa, Google is significantly increasing its investments in digital infrastructure. The goal is to harness the opportunities presented by the internet economy, contributing to a prosperous and sustainable digital future for the continent.

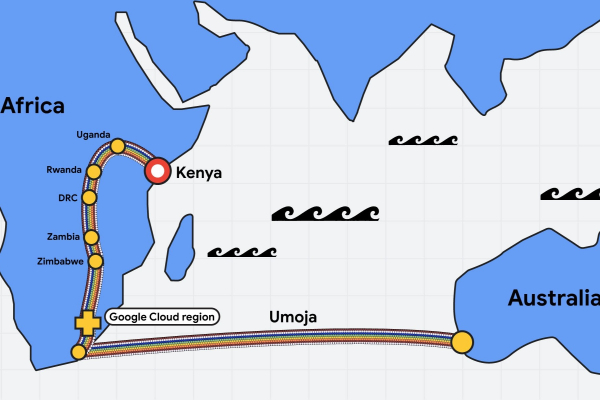

Google on Thursday announced the Umoja fiber optic cable project, aiming to significantly enhance the reach and reliability of digital connectivity across Africa. This initiative aligns with Google's broader Africa Connect strategy, following the successful deployment of the Equiano cable connecting Africa to Europe.

The Umoja network leverages a partnership with Liquid Intelligent Technologies to establish a terrestrial segment connecting Kenya, Uganda, Rwanda, the Democratic Republic of Congo, Zambia, Zimbabwe, and South Africa. From South Africa, a subsea connection will traverse the Indian Ocean to link directly with Australia.

Google's investment in Umoja comes at a critical juncture. Recurrent outages in existing subsea cables serving Africa have resulted in widespread internet disruptions. The most recent incident occurred on May 12th, when failures in the SEACOM and EASSY systems caused disruptions in several East and Southern African countries. Similar issues arose in March, affecting numerous cables – WACS, MainOne, ACE, SAT3, Seacom/TGN, AAE1, and EIG – impacting internet access across a dozen West, Central, and Southern African nations.

"This initiative is crucial in ensuring the redundancy and resilience of our region’s connectivity to the rest of the world, especially in light of recent disruptions caused by cuts to sub-sea cables," stated Kenyan President William Ruto. "By strengthening our digital backbone, we are not only improving reliability but also paving the way for increased digital inclusion, innovation, and economic opportunities for our people and businesses."

Isaac K. Kassouwi

A communications graduate with experience in Moroccan industry, she identified a gap in communication between healthcare providers and patients. To address this challenge, she and her team developed a mobile application aimed at streamlining these interactions.

Sabrine Zahroubane (pictured), a Moroccan marketing and communication specialist, is the co-founder and CEO of SehaLink, a healthtech company aiming to streamline communication between doctors, patients, and laboratories.

Zahroubane, who holds a master's degree in marketing from ESCA School of Management in Casablanca (2016), co-founded the company (originally Ta7alil.ma) in 2020 with Maryem Renaja. Rebranded as SehaLink in May 2024, the company seeks to address challenges patients face in retrieving test results and managing appointments.

The SehaLink app offers several features, including online appointment scheduling with healthcare professionals, digitization and archiving of medical records, receipt of test results and reports, and management of blood donation requests.

SehaLink's innovative approach has earned them a spot among startups exhibiting at GITEX Africa, taking place May 29-31, 2024, in Marrakech.

In addition to her role at SehaLink, Sabrine Zahroubane is an associate director at Digital & Creativity, a digital communication agency she founded in 2017 with Maryem Renaja. She also chairs the Lueur d’espoir Casablanca association, which works in humanitarian and medical fields.

Zahroubane's professional journey began in September 2016 as a project manager at Bonzai Agency, a brand design and maintenance company. In September 2017, she transitioned to advertising manager at Klem, a Moroccan communications firm.

Melchior Koba

After earning her engineering degree and accumulating three years of experience in research and development, Marwa Moula decided to dedicate herself to entrepreneurship. In 2020, she founded her first company to revolutionize the e-commerce industry in Africa.

Marwa Moula (pictured) is a Tunisian DevOps engineer, digital marketing specialist, and entrepreneur. She is the co-founder and CEO of IleyCom, a social marketplace offering products crafted by entrepreneurs primarily based in Africa.

Founded in 2020, IleyCom provides African artisans with an omnichannel platform to sell their handmade creations, including traditional Berber clothing and culinary specialties. Its mission is to "reinvent fair e-commerce to create a more fulfilling and sustainable world, and we are committed to using the power of business to strengthen communities."

In addition to its marketplace, IleyCom runs an incubation program for young social entrepreneurs, helping them develop impactful projects and showcase their products.

Since Wednesday, May 22, 2024, Marwa Moula has been representing her startup at the VivaTech conference, which concludes on Saturday, May 25.

Apart from her work at IleyCom, Marwa Moula has served as the president of the association "La Tunisie De Demain" since 2020. This organization promotes the establishment of a social and solidarity-based economy (ESS) in Tunisia.

Marwa Moula graduated from the National Institute of Applied Sciences in Lyon, earning a master's degree in mechanical engineering in 2016, followed by a Ph.D. in materials science in 2020. In 2021, she obtained a DevOps engineering degree from Ib Cegos, a subsidiary of the Cegos Group, specializing in IT professional training.

Before venturing into entrepreneurship, Marwa gained extensive experience in France. In 2014, she was a computer-aided manufacturing (CAM) engineer at STELIA Aerospace, a manufacturer of components for the aerospace industry. In 2015, she joined LaMCoS, a mechanical laboratory, as a numerical simulation engineer. In 2021, she became a research and development engineer at the University of Lille.

Melchior Koba

Limited access to financing remains a critical hurdle for startups, especially in Africa and the Middle East. Bolstering these startups fosters innovation, creates jobs, and energizes the regional digital economy.

Orange Ventures, the investment arm of telecoms giant Orange Group, and Digital Africa, a pan-African initiative supporting early-stage businesses, joined forces on Thursday to co-invest in startups across the Orange Digital Centers (ODC) network in Africa and the Middle East.

The partnership, announced on the sidelines of the Vivatech technology fair in Paris, underscores both organizations' commitment to fostering innovation and growth within the region's burgeoning digital economy.

"Orange Digital Centers are true catalysts for innovation, where ideas take shape and dreams become reality," said Asma Ennaifer (pictured left), Executive Director of CSR, Communication, and the Orange Digital Center program for Orange Africa and the Middle East . "By joining forces with Orange Ventures and Digital Africa, we're giving African startups the means to thrive and make their mark in a rapidly expanding digital world."

This initiative builds upon a strategic agreement signed between Orange and Digital Africa in June 2023 to streamline financing and support for ODC network startups. Under the new collaboration, the partners can leverage Fuzé, an investment scheme implemented by Digital Africa, to potentially double the funding offered to individual startups through joint application review and co-investment.

This enhanced partnership marks a significant step towards bolstering support for African entrepreneurs within the ODC network. In its first year, the previous collaboration provided funding of up to €50,000 to five startups through the Fuzé program. With Orange Ventures now on board, the initiative is expected to empower a growing number of African entrepreneurs from the early stages of their ventures by offering comprehensive financial and strategic backing.

Samira Njoya

Investing in digital infrastructure is a significant step for African development as it is crucial in enhancing government efficiency, improving data management, and fostering economic growth. By integrating advanced technology, Nigeria sets a precedent for other African nations to modernize their operations, support digital transformation, and boost overall development.

Nigeria will launch a state-of-the-art data center with a storage capacity of 1.4 petabytes before May 29, 2024, to house critical national information, including citizens' bio-data. The Minister of Interior Dr. Olubunmi Tunji-Ojo announced this during a meeting with the National Union of Nigerian Associations in Italy (NUNAI) on May 20, a statement from the Interior Ministry dated the same day revealed.

Dr. Olubunmi Tunji-Ojo emphasized that adopting advanced technology would enhance efficiency and accountability across national operations, the statement read.

In its 2019 publication titled “Nigeria Digital Economy Diagnostic: A Plan for Building Nigeria’s Inclusive Digital Future,” the World Bank assessed that “Nigeria is capturing only a fraction of its digital economic potential and will need to make strategic investments to develop a dynamic, transformative digital economy.” In line with this, in 2015, the Nigeria Communications Commission proposed transitioning the economy into a digital economy through investments in digital infrastructure.

The launch of this data center directly addresses this assessment, marking a strategic investment in Nigeria's digital infrastructure. This move is expected to unlock more of Nigeria's digital economic potential, promoting an inclusive and robust digital economy.

Hikmatu Bilali

A technology expert, he has over 15 years of experience working with international firms. Since 2016, he is dedicated to facilitating access to energy for all Africans.

Abdala Dissa, a Burkinabe national, is a telecommunications expert and entrepreneur. He is one of the co-founders and the CEO of AliothSystem, a start-up focused on renewable energy and energy efficiency design and innovation.

Founded in 2016, AliothSystem established a domestic solar system (SHS) assembly unit to promote access to solar energy and advance renewable energy in Africa. Through a Pay-as-you-go system, the start-up enables users to pay according to their consumption, thereby helping rural inhabitants quickly access clean, affordable, and reliable energy.

AliothSystem's products are marketed under the brand "téréBox" in Burkina Faso. To date, the company has deployed over 3,500 domestic solar systems on behalf of the Ministry of Energy and the Burkinabe Rural Electrification Agency (ABER) over the past two years. The company aims to install one million SHS units by 2030.

Since May 13, 2024, the company has been participating in the third season of Orange Fab, organized by Orange Digital Center. Represented by its CEO, AliothSystem is attending the VivaTech conference in Paris, which has been ongoing since Wednesday, May 22, 2024.

Abdala Dissa holds an engineering degree in telecommunications and networks, earned in 2009 from Télécom Saint-Etienne. His professional career began in 2008 at N-SOFT, a technology company, where he served as a technical support engineer and project manager for the Europe, Middle East, and Africa region.

In 2012, he became a senior core network engineer at the telecommunications and technology company SFR. The following year, he joined Ericsson as a senior core network engineer. In 2014, he moved to Hub One, a digital technology operator, where he worked as a senior core network operations engineer and then as a core network VoIP/ToIP architect from 2017 to 2020.

Melchior Koba

In September 2023, Kenyan President William Ruto visited Silicon Valley to meet with several tech company leaders. Since then, many of these companies have announced investments in this East African country.

Microsoft and G42, a United Arab Emirates-based firm specializing in artificial intelligence and cloud computing, have announced plans to invest $1 billion in Kenya's digital sector. The announcement was made through a press release issued by Microsoft on Wednesday, May 22.

The investment will be directed towards the construction of a data center in Olkaria, which will be powered entirely by renewable geothermal energy. G42 and its partners will oversee the development of this infrastructure to utilize Microsoft Azure in a new cloud region in East Africa. The data center is projected to be operational within 24 months after the signing of definitive agreements, scheduled to take place on Friday, May 24, in Washington, D.C.

“A letter of intent formalizing the relationship will be signed on Friday as part of Kenyan President William Ruto’s state visit to the United States of America, the first state visit to Washington, D.C., by a sitting African head of state in nearly two decades. The letter of intent will be signed between Microsoft, G42 and Kenya’s Ministry of Information, Communications and the Digital Economy, and was crafted with the assistance of the governments of the United States and the United Arab Emirates,” the statement read.

This initiative builds upon a memorandum of understanding signed between Kenya and Microsoft last September, focusing on integrating the cloud services of the Redmond-based company to enhance public service delivery through a cloud-first approach. Kenya aims to position itself as the digital hub of the region, attracting investments from various tech giants. In addition to Microsoft, Oracle is preparing to establish its second data center in Africa in Nairobi.

The investment will also involve the development of four key pillars in collaboration with local stakeholders. These pillars include creating AI models in local languages and related research, establishing an innovation lab in East Africa, providing extensive digital skills training in AI, investing in international and local connectivity, and working with the Kenyan government to promote cloud services across East Africa.

Despite having a promising startup ecosystem, Kenya currently ranks 19th with a score of 54.2 out of 100 in the 2023 ICT Development Index for African countries, as reported in the "Measuring Digital Development: The ICT Development Index 2023" by the International Telecommunication Union (ITU).

Adoni Conrad Quenum

The horticultural sector in Ethiopia is experiencing remarkable growth. To achieve even impressive results, various digital initiatives are being implemented.

On Tuesday, May 21, the Ethiopian Horticulture Producer Exporters Association (EHPEA) and Trade Mark Africa, an African trade assistance organization, signed a partnership agreement in Addis Ababa. This initiative aims to develop comprehensive online learning and knowledge management systems in Ethiopia's horticulture sector.

Tewodros Zewdie (photo, center), Executive Director of EHPEA, highlighted the importance of this partnership, emphasizing that the project will help maintain competitiveness in the country's dynamic horticulture sector. "Through this project, we are investing not just in technology but in the future of Ethiopia’s horticulture sector. Our partnership with TradeMark Africa will enable us to equip our members with the necessary resources to thrive in an increasingly digital marketplace," he stated.

The partnership will benefit from a €139,000 grant from the European Union, provided through the French Development Agency (AFD). This financial support will facilitate the implementation of the learning platform, offering access to valuable resources, training materials, and interactive modules to enhance skills and knowledge sharing in horticultural production and export practices.

This collaboration is part of a broader program focusing on the Ethiopia-Djibouti corridor. It comes at a time when the Ethiopian horticulture sector has seen significant growth in recent years, becoming a fundamental pillar of the national economy. According to official data, the sector contributes 86% to the agricultural GDP.

A web developer, he is passionate about creating innovative solutions to address his clients' problems. He has already developed dozens of digital projects.

Mamadou Dieye, a Senegalese web developer, IT consultant, and entrepreneur, has founded Peelo, a startup specializing in creating chatbots for e-commerce and financial institutions. These chatbots are designed to boost online sales and automate customer support, revolutionizing commerce and communication with smart, no-code WhatsApp chatbots that make interactions with a broader audience easier.

Peelo's chatbots enable e-merchants and financial institutions to efficiently respond to customer messages and comments, thereby increasing conversion rates and collecting data to personalize the user experience. On May 21, 2024, Mamadou Dieye presented Peelo at the Orange Fab Demo event in France, and since May 22, he has been participating in the VivaTech expo, organized by the Les Echos-Le Parisien group.

In addition to Peelo, Mamadou Dieye is also the founder of Mojay.pro, a startup he founded in 2022 to assist established companies and startups in their digital transformation process by offering technology solutions tailored to their daily challenges. Through Mojay.pro, he has successfully completed over 50 projects.

Mamadou Dieye graduated from the University of Dakar’s Polytechnic School and began his career in 2016 as a programmer analyst at Agence 3W, a digital agency providing innovative communication solutions. In 2019, he joined the Impact Hub Dakar incubator as a business developer, and in 2021, he became a web development instructor at Go My Code, a startup that trains people in digital skills.

Melchior Koba

More...

Kenya’s government has trained over 390,000 youth in digital skills and generated 139,000 online jobs within the past year. Information, Communication, and Digital Economy Cabinet Secretary Eliud Owalo revealed this at the launch of the Jitume ICT Hub in Ruiru on May 20.

Since 2016, Kenya's Information and Communications Technology (ICT) sector has grown by an average of 10.8% annually, emerging as a key driver of economic development and job creation, with positive impacts extending across various sectors of the economy, according to the “Kenya Economic Update: Accelerating Kenya’s Digital Economy” 2019 report by the World Bank.

The insurtech solution is designed to streamline everyday life management, with a focus on illness and disaster preparedness.

Casava is an insurtech solution developed by a Nigerian startup, offering users online access to insurance policies. Based in Lagos, the startup was founded in 2016 by Bode Pedro. In February 2022, it raised $4 million to enhance its technology and expand its operations, aiming to provide affordable insurance to Nigerians and other Africans.

Speaking in 2022 about his venture capital firm's decision to invest in the Nigerian insurtech, Avi Eyal, General Partner at Entrée Capital, stated: "The Casava team has developed a unique and disruptive product that we believe has the potential to transform Africa’s insurance market. We are confident in the Casava team that they have what it takes to be leaders in this field."

Casava operates without a mobile application. Users must access its services via a web browser by visiting the Casava platform. The startup offers two main services for individuals: Health Insurance and Health Cash. Health Insurance provides coverage for a wide range of medical needs, from dental care to surgeries, at over 400 partner hospitals. Health Cash allows users to get reimbursed for healthcare expenses incurred due to accidents.

For businesses, Casava offers two primary services: Credit Life and Business Gro. Credit Life protects businesses “from the financial burden of sudden tragedy faced by borrowers.” Business Gro, on the other hand, provides access to business loans and various types of business insurance.

Adoni Conrad Quenum

Google is accepting applications for the 2024 Hustle Academy, a 5-day bootcamp to boost small and medium-sized enterprises (SMEs) in Sub-Saharan Africa (SSA). This year's program features a new focus on business-oriented artificial intelligence (AI) training.

Since 2022, the Hustle Academy has supported over 10,000 businesses in securing funding and creating jobs through education, mentorship, and networking. New AI modules will help businesses make data-driven decisions, optimize operations, and develop AI-powered marketing strategies.

Applications for the 2024 cohort are open to SME owners in Kenya, Nigeria, and South Africa.

Kenyan youth have secured free ICT training through a partnership involving Zone 01, the United Cities and Local Governments of Africa (ULCGA), the County Government of Kisumu, and Lake Hub. The County Government of Kisumu revealed on May 17 in a release.

The selected cohort, 96, out of 13,000 applications received, will undergo a two-year training program for free using a peer-to-peer learning model.

The program aims to develop skilled professionals in web app development, data engineering, AI, video game development, blockchain, and cybersecurity.