The insurtech solution is designed to streamline everyday life management, with a focus on illness and disaster preparedness.

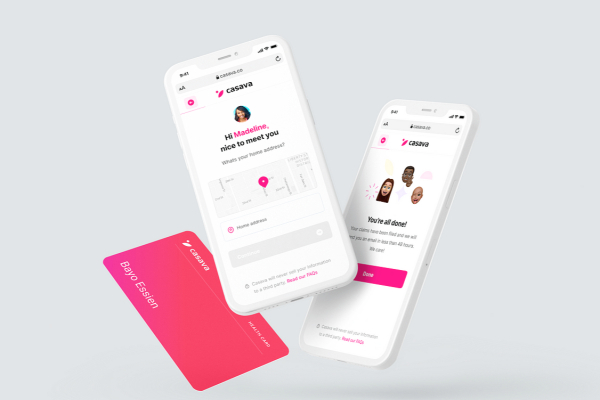

Casava is an insurtech solution developed by a Nigerian startup, offering users online access to insurance policies. Based in Lagos, the startup was founded in 2016 by Bode Pedro. In February 2022, it raised $4 million to enhance its technology and expand its operations, aiming to provide affordable insurance to Nigerians and other Africans.

Speaking in 2022 about his venture capital firm's decision to invest in the Nigerian insurtech, Avi Eyal, General Partner at Entrée Capital, stated: "The Casava team has developed a unique and disruptive product that we believe has the potential to transform Africa’s insurance market. We are confident in the Casava team that they have what it takes to be leaders in this field."

Casava operates without a mobile application. Users must access its services via a web browser by visiting the Casava platform. The startup offers two main services for individuals: Health Insurance and Health Cash. Health Insurance provides coverage for a wide range of medical needs, from dental care to surgeries, at over 400 partner hospitals. Health Cash allows users to get reimbursed for healthcare expenses incurred due to accidents.

For businesses, Casava offers two primary services: Credit Life and Business Gro. Credit Life protects businesses “from the financial burden of sudden tragedy faced by borrowers.” Business Gro, on the other hand, provides access to business loans and various types of business insurance.

Adoni Conrad Quenum