Despite their crucial role in the entrepreneurial landscape and their potential to drive economic development, small and medium-sized enterprises (SMEs) in sub-Saharan Africa face limited access to financing.

Singapore-based fintech company Proxtera announced a partnership with Ghana's Development Bank of Ghana (DBG) on Wednesday, May 15, during the 3iAfrica Summit in Accra. The collaboration aims to establish a digital platform offering $100 million in loans to Ghanaian small and medium-sized enterprises (SMEs).

Kwamina Duker, CEO of DBG, highlighted the platform's potential to streamline the loan application process and reduce borrowing costs for SMEs over time. “If today, it takes about three to six months to get a loan, with a huge amount of documentation, and we can cut that down to turnaround of literally a real time of 24 hours… then we can appreciate the benefits of digitalization,” he stated.

Through the partnership, DBG will leverage Proxtera's digital platform to provide loans for SME growth and expansion. Eligible businesses must be Ghanaian-owned and operating within the country, with a sound financial plan. Priority will be given to SMEs in key sectors like agriculture, manufacturing, information and communication technology (ICT), and other high-value-added industries.

This collaboration marks a significant step towards digital financial inclusion in Ghana. By facilitating access to financing for SMEs, the partnership is expected to stimulate economic growth, create jobs, and strengthen the country's economic fabric. It aligns with Ghana's national financial inclusion and development strategy, developed in collaboration with the World Bank, which aims to increase financial inclusion from 58% in 2020 to 85% by 2023.

Samira Njoya

The success of platforms like Airbnb and Booking.com has ignited a fire among African tech entrepreneurs. Recognizing the significant growth of the tourism sector and the rising need for short-term accommodation for both leisure and business travel, these entrepreneurs are seizing the opportunity to develop innovative solutions.

Camansa, a digital solution developed by an Ivorian startup, provides users with the ability to locate short-term accommodations for vacations or business trips across various cities in Côte d'Ivoire. The startup, headquartered in Abidjan, was established by Aziz Doumbia, Khalifa Bayoko, and Yann Akoun.

“Our mission at Camansa is to connect travelers, tourists, hotels, and property owners through our booking platform. [...]We’ve developed a dedicated booking platform for hosts and travelers to streamline the reservation process and address common issues,” the startup explains.

For the time being, Camansa does not offer a mobile application, so users must access the web platform via a browser. While users can browse available properties on the site, an account is required to make reservations. Camansa collects necessary information to verify the identity of the account creator, whether for booking or hosting. Once verified, they can conduct their transactions on the platform.

The Ivorian startup offers a variety of accommodations to meet different client standards, ranging from hotels to villas and apartments owned by individuals. In addition to the properties displayed on the homepage, users can conduct more personalized searches. The website features a search bar where users can enter the city, arrival and departure dates, and the number of travelers, specifying the number of adults, children, and babies.

While using the platform is free, reservations carry a fee of 2,000 CFA Francs (approximately $3.30). The startup levies a commission of 10% from hotels and 15% from individual property owners. Payments can be made via credit cards or mobile money. Refund policies in the event of reservation cancellations are dependent on the terms of the property owner, whether a hotel or an individual.

Adoni Conrad Quenum

Algeria aims to position itself as a regional leader in technology and innovation. To achieve this ambition, the country is partnering with more advanced players in the field.

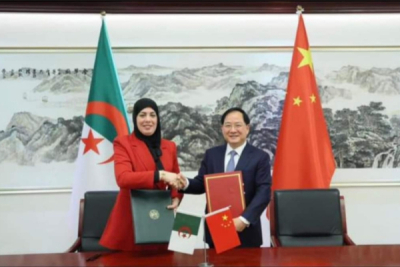

Algeria and China have signed a memorandum of cooperation to bolster collaboration in the fields of digitization and the digital economy, according to a May 16 statement from Algeria's High Commission for Digitization.

The agreement, formalized during a visit to China by a delegation led by High Commissioner Meriem Benmouloud (pictured, left), underscores the commitment to digital cooperation between Algerian President Abdelmadjid Tebboune and his Chinese counterpart.

This new partnership aligns with the High Commission's digitization action plan, which is currently shaping Algeria's national digital transformation strategy for 2024-2029. It follows a similar agreement signed earlier this year between the High Commission and Huawei, aimed at accelerating the country's digital transition.

The Algeria-China collaboration will explore avenues for cooperation across various digital domains. Training programs and expertise transfer will be implemented to enhance local digital skills and foster technological innovation. This collaboration will allow Algeria to leverage China's experience and knowledge in information technology, facilitating the government's goals of economic development and modernization.

Beyond the focus on training and technology transfer, potential projects could encompass developing advanced digital infrastructure, digitizing public services to improve efficiency, and creating an environment conducive to technological innovation and digital entrepreneurship. These initiatives aim to position Algeria as a prominent player in the digital economy within Africa and beyond.

Samira Njoya

Africa's e-commerce scene is booming, with tech startups developing innovative solutions to streamline operations for merchants.

Maad, a Senegalese startup, has developed a business-to-business e-commerce solution that enables small retailers to source consumer goods directly from affiliated suppliers. The startup, with bases in Dakar, Senegal, and San Francisco, USA, was established in 2020 by Sidy Niang and Jessica Long. On Tuesday, May 14, it announced the successful completion of a $3.2 million funding round aimed at diversifying its services and bolstering its growth in Senegal.

Jessica Long explained their decision to handle all logistics in-house, stating, “We decided to bring all of logistics…the reason that we do that is just it's a low margin business. We think that this is the way to provide good service and to meet the reliability needs of clients. I don't think that we would be able to offer a similar service if we relied on a third-party provider.”

The startup’s mobile application, available on iOS and Android, has already been downloaded more than 10,000 times from PlayStore. After downloading, users create an account and gain access to a variety of services, including ordering. The startup estimates that 75% of orders are placed through the app, with the remainder coming from the call center and field agents. Maad also offers a delivery service that helps to optimize order prices.

As for the various brands featured on the startup’s mobile platform, they “can track live presence and market share data. They can also deploy promotion and merchandising services in targeted neighborhoods to increase sales of key products.”

In addition to facilitating orders, the startup offers various services such as “buy now, pay later,” which allows retailers to access stock on credit. Maad currently boasts over 6,500 active retailers and 80 suppliers.

Adoni Conrad Quenum

Egyptian fintech startup MNZL announced a successful $3.5 million funding round last week. The capital will fuel technology development and propel the company's growth within the Egyptian market.

"We at MNZL are going beyond a mere adjustment; it’s a complete revolution in credit access. This shift not only empowers families by providing financial leverage but also contributes to broader economic prosperity in the region," declared MNZL's co-founder Sameh Saleh.

Djibouti currently has only one operational data center. Known as the Djibouti Data Center (DDC), it is a Tier 3 facility that was commissioned in 2013.

Pan-African data center specialist PAIX Data Centres announced a joint venture with the Djibouti Sovereign Fund (FSD) on Tuesday, May 14. The partnership aims to build a cloud-neutral and carrier-neutral data center in Djibouti to address the growing demand for connectivity, content delivery networks, social media, and cloud computing services.

Dubbed JIB1, the new facility will boast roughly 50,000 square feet (approximately 4,645 square meters) of usable space up to 5 megawatts of computing capacity. The first phase of the project is slated for completion by 2026.

JIB1 will bolster Djibouti's telecommunications infrastructure as the nation undergoes a rapid digital transformation. Djibouti boasts connections to ten submarine cables, with three more under construction. However, the country currently has only one data center, the Djibouti Data Center (DDC), a Tier 3 facility launched in 2013.

"As the heart of Africa's digital economy, Djibouti plays a strategic role in facilitating connectivity between Africa, the Middle East, and Asia, PAIX Djibouti will serve as a catalyst for digital inclusion and economic development, empowering businesses to unlock new opportunities and realize their full potential in the digital age," said Jean-André Gbarssin, CEO of the FSD.

Isaac K. Kassouwi

The solution was launched in an effort to help farmers reach consumers and businesses.

CartAgro, a Nigerian startup, has developed an online marketplace that enables farmers to sell their produce directly to businesses or individuals. The startup, established in 2017 by Idris Adeshina and headquartered in Lagos, offers a mobile application compatible with both Android and iOS platforms.

Users, notably farmers, private individuals, and business representatives, are required to create an account after downloading the app. They must then follow the necessary steps to complete the account setup by providing the requisite information.

The startup asserts, “We believe that by putting technology in the hands of farmers, we can empower them to optimize production, improve livelihoods, and make informed decisions that benefit their businesses and the entire agricultural ecosystem.”

The platform provides consumers with access to fresh produce, including vegetables, fruits, and grocery items. To streamline operations, CartAgro incorporates a digital wallet and a logistics tracking system, in addition to the virtual marketplace. The startup also provides agricultural market information to facilitate the best possible deals on the platform for all parties involved.

CartAgro is committed to sustainable development, a principle that informs many of its decisions. The agritech firm believes that businesses have a significant role in addressing global challenges. Consequently, it aligns its actions with the United Nations’ Sustainable Development Goals (SDGs). Food security, good health and well-being, and responsible consumption and production are among the guiding principles of Adeshina’s firm.

Adoni Conrad Quenum

As African governments increasingly embrace digitalization to drive economic growth, international collaborations are essential for achieving this goal. These initiatives also help bridge the gap between African and global tech hubs, ensuring the continent remains competitive in the global digital economy.

The Federal Executive Council (FEC) has approved the conversion of a Federal Government property in San Francisco into the Nigerian Digital Technology Exchange Program Hub, also known as the Nigeria Startup House, Minister of Communications, Innovation and Digital Economy Bosun Tijani announced May 14 on X (formerly Twitter). This initiative aims to enhance Nigeria's global tech presence, attract foreign investment, and boost the visibility of Nigeria's startup ecosystem.

“As we work towards achieving key elements of our Trade and IEC Strategic Blueprint Pillars, the Nigerian Startup House will play a critical role in promoting Nigeria’s economic interest, attracting Foreign Direct Investment and improving the visibility and positioning of Nigeria’s Startup Ecosystem to attract funding and expertise from global markets and organisations represented in the San Francisco Bay Area and beyond,” said the Minister.

The hub in the San Francisco Bay Area - a major center for startup funding and innovation - will help Nigerian startups access capital, expertise, and market opportunities.

Ownership of the Nigeria Startup House will remain with the Federal Government, represented by the Federal Ministry of Communications, Innovation, and Digital Economy (FMCIDE) and the Ministry of Foreign Affairs (MFA). It will be managed by a consortium of Nigerian tech companies, which will fund its operations.

As part of its strategy to foster a robust startup ecosystem, the Nigerian government has launched various initiatives. The Digital and Creative Enterprise (IDICE) program stands out, with a $618 million investment to promote entrepreneurship and innovation in the digital technology and creative industries, particularly for youth employment. According to the "Ecosystem Report: Nigerian Startup Scene 2023," this initiative is expected to contribute $6.4 billion to the Nigerian economy.

The report also highlights the Three Million Tech Talents (3MTT) program, which seeks to equip young individuals with essential tech skills while positioning Nigeria as a talent exporter. Additionally, the Nigerian Startup Act, passed in October 2022, underscores the government's commitment to establishing the digital economy as a fundamental component of its economic framework. These initiatives reflect Nigeria's growing support for the startup ecosystem and digitalization.

Hikmatu Bilali

Djibouti has embarked on an ambitious effort to digitize its public services. This initiative aims to allow the country to reap the full benefits of the digital economy.

The Djiboutian government announced the upcoming launch of two new digital services: e-Cabinet and e-Building Permit. Unveiled at the 8th Council of Ministers session on Tuesday, May 14th, these initiatives aim to modernize governance, enhance administrative efficiency, and offer a digital solution for building permits.

Developed by the Ministry of Digital Economy and Innovation with technical support from the National Agency for State Information Systems (ANSIE), e-Cabinet expands the government's document management capabilities. This platform caters to high-level decision-making by providing advanced features for managing proposals, agendas, reference documents, and legal texts throughout their lifecycle. Additionally, it ensures seamless interaction between various government systems, centralizing document management and fostering secure communication.

As for the e-Building Permit platform, it will replace the current building permit issuance system which is now considered outdated. This new solution includes an online portal offering significant advantages for all stakeholders involved in the building permit issuance process. Key features include simplified permit submission, online payments, and real-time tracking of applications.

The deployment of these platforms is part of the "Djibouti Fondement Numérique," a project that also includes the development of national broadband infrastructure, the promotion of e-learning, and the improvement of the quality of telecommunications services at affordable prices.

These digital solutions are expected to digitize government decision-making processes, facilitate secure communication and document sharing between ministries and government entities, and significantly save time in processing services.

Samira Njoya

Digify Africa has launched the 2024 Digify Pro Online program, a digital entrepreneurship initiative in collaboration with Meta and the Michael & Susan Dell Foundation (MSDF). The program targets unemployed youth aged 18-35 in South Africa, Nigeria, and Kenya. It aims to address youth unemployment by providing comprehensive digital marketing and entrepreneurship training.

The program consists of three levels: Foundational (6 weeks) introduces participants to digital marketing basics and professional skills; Intermediate (10 weeks) delves into strategic topics like content creation and data analytics through real-world tasks; Advanced (6 weeks) offers elective training in areas such as paid advertising and marketing data analytics with AI-driven methods.

Applications are open until June 2, 2024, for South Africans.

More...

Nigeria aims to expand its fiber optic network to at least 125,000 km to ensure complete coverage and offer high-speed internet services to its entire population.

Nigeria's Minister of Communications, Innovation, and Digital Economy, Bosun Tijani, announced the approval of a special purpose vehicle (SPV) on May 14. The SPV will oversee the construction of an additional 90,000 kilometers of terrestrial fiber optic cables, significantly expanding the country's broadband infrastructure.

This decision, made during the Federal Executive Council (FEC) meeting, is expected to benefit Nigerians across the board, particularly the nation's burgeoning startup ecosystem.

"Building on our existing work with the Broadband Alliance," Tijani wrote on a social media platform (formerly known as Twitter), "this increased connectivity will help plug the current non-consumption gap by connecting over 200,000 educational, healthcare and social institutions across Nigeria, ensuring that a larger section of our society can be included in the benefits of internet connectivity."

Partnering with public and private stakeholders, the SPV will build the additional fiber optic network, extending Nigeria's national connectivity backbone to at least 125,000 kilometers, up from the current 35,000 kilometers. Upon completion, this will position Nigeria with the third-longest terrestrial fiber optic backbone in Africa, behind Egypt and South Africa.

The fiber optic expansion is expected to have a substantial impact on the Nigerian economy. It is projected to increase internet penetration beyond 70%, potentially reduce internet access costs by over 60%, and connect at least half of the estimated 33 million Nigerians currently without internet access. Additionally, it could drive GDP growth from $472.6 billion in 2022 to $502 billion within the next four years.

Samira Njoya

By mitigating cyber threats and ensuring the integrity of digital transactions, this move demonstrates a commitment to strengthening regulatory frameworks to support the burgeoning digital economy, which is essential for driving innovation and advancing economic development across the continent.

President Bola Tinubu (pictured) has directed the Central Bank of Nigeria to pause the implementation of the controversial cybersecurity levy policy for a comprehensive review. This follows the House of Representatives' call last Thursday, May 9, to retract the directive imposing a 0.5 percent levy on electronic transactions.

The CBN circular issued on May 6, 2024, mandated financial institutions to enforce the levy under the Cybercrime (Prohibition, Prevention, etc) (Amendment) Act 2024. President Tinubu's directive urges a pause on the levy's implementation, reflecting his commitment to easing economic burdens on Nigerians amidst ongoing reforms.

The levy proposal was met with resistance from Nigerians, including the Nigeria Labour Congress (NLC). Under the leadership of President Joe Ajaero, the group argued that this imposition could worsen the economic plight of Nigerians. Ajaero emphasized the need for withdrawing the levy, highlighting broader concerns regarding its potential adverse effects on efforts to promote financial inclusion. He asserted, “We propose a joint effort between the government, regulatory bodies, and stakeholders to develop sustainable cybersecurity strategies that won’t impose an undue burden on the people.”

In the 2021 report “Taxing the digital economy in sub-Saharan Africa,” authored by Celia Becker and published by the International Bar Association, Professor H Sama Nwana, a technology and telecommunications consultant with Cenerva, highlights the adverse effects of digital taxes. He states, “Digital taxes in various forms are not only regressive, but they also disenfranchise poor and marginalized groups such as the informal sector, women, and the youth in rural areas – who need the internet the most.”

Hikmatu Bilali

He has over 20 years of experience in information technology and payments. He applies his skills to the development of fintech and technology in Africa.

Martin Warioba, a Tanzanian entrepreneur and investor, established Warioba Ventures, a consulting and investment firm based in Dar es Salaam, in 2022. The firm’s primary objective is to foster an environment that encourages fintech and startups to address Africa’s significant challenges through technology. Its offerings include investment, fintech and startup development, corporate strategy, payments, and technology consulting.

Warioba Ventures concentrates on East Africa, providing not only financial support to entrepreneurs but also technical expertise, advanced market understanding, and assistance. The firm primarily focuses on early-stage and seed-phase startups with innovative business models, increasing revenues, a robust economic base, and the potential for expansion throughout Africa.

In addition to his role at Warioba Ventures, Martin Warioba is a non-executive director at Dawa Mkononi, a pharmaceutical company committed to enhancing access to medicines in Tanzania and across Africa. He also presides over the board of the CRDB Bank Foundation.

Martin Warioba earned a bachelor’s degree in computer science and mathematics from Louisiana State University in 2003 and a Master’s in Information Management from the W. P. Carey School of Business at Arizona State University in 2007. Before launching Warioba Ventures, he co-founded WS Technology Consulting, a technology and consulting firm, in 2011.

Warioba began his professional journey in 2004 at the Central Bank of Tanzania as an IT analyst and programmer. In 2006, he advanced to the role of project manager at CVS Health, a company specializing in health solutions. He joined Deloitte as a technology integration consultant in 2007. From 2009 to 2013, he worked as a technology analyst and project manager at the Central Bank of Tanzania.

Melchior Koba

Cameroon is making a strong push towards digitizing services for its citizens. As a result, the biometric identity card has become crucial for accessing these services.

Cameroon and German-Portuguese consortium INCM-Augentic have partnered for a new secure identification system. According to reports by national radio CRTV, on May 13, Cameroon's Delegate General for National Security (DGSN), Martin Mbarga Nguele, signed a contract in that regard with Labinot Carreti, CEO of INCM-Augentic. Financial details were not disclosed, but Augentic will reportedly finance the turnkey project.

This project includes the construction of 68 state-of-the-art multifunctional centers across Cameroon's 10 regions and 58 departments. Additionally, it involves the renovation of 219 existing identification stations to modernize them. The new identification system will introduce an application for scheduling appointments online and will ensure widespread availability throughout the country, stated Labinot Carreti. "We will also ensure the dispatch of cards through all identification stations across the Cameroonian territory," he added. This system is expected to enable the issuance of the National Identity Card (CNI) within 48 hours of submitting the application, by the end of 2024.

On December 29, 2023, Martin Mbarga Nguele announced that the Head of State authorized the establishment of this new system, including an online pre-enrollment platform. Three autonomous CNI production centers will be built in Yaoundé (Centre), Douala (Littoral), and Garoua (North), as well as modern enrollment centers in each regional capital, he explained. He affirmed that this new system would be operational this year, based on assurances given during the New Year's greetings presentation on January 24. It will be similar to the system implemented for biometric passports, for which a contract worth XAF131 billion (200 million euros) was awarded to INCM-Augentic.

Increase in Costs

This contract mandated the consortium to build and operate the infrastructure. According to the German embassy in Cameroon, the company invested 30 million euros in constructing the national passport production center. The investments made by the providers justify the increase in the cost of the stamp, which rose from XAF75,000 to 110,000, stated the Minister of Finance, Louis Paul Motaze, at the time. According to the head of the Cameroonian Police, the investment made by the providers will justify an increase in the CNI cost, whose current issuance fee is XAF2,800.

This initiative comes as some citizens have been waiting for a year or even years to obtain their CNI, thus exceeding the regulatory three-month waiting period. This situation led to a social media campaign under the slogan "Je veux ma CNI (I want my ID card)." The government attributed these delays to the need to secure the Cameroonian identity, in a context where frauds could compromise its reliability. In addition to the CNI, other identity documents such as residence cards, resident cards, refugee cards, police professional cards, and national disability cards will also be produced within 48 hours.

Patricia Ngo Ngouem