TurnStay.com, a South African travel fintech, has secured $300,000 in funding from DFS Lab and DCG, based in Silicon Valley and New York. The company plans to use this investment to expand across Africa and build on its existing momentum.

Founded by Alon Stern of Slide Financial and James Hedley of Quicket, TurnStay aims to reduce payment costs for African travel merchants by employing strategies used by major global booking companies to lower international payment fees without compromising safety or efficiency.

An IT engineer, he provides digital solutions to improve business operations. He also assists brands in increasing their visibility.

Edwin Bruno, a Tanzanian serial entrepreneur, is the founder and CEO of Smart Codes, a digital transformation company. The startup's mission is to address African challenges through technology.

Founded in 2010, Smart Codes provides digital solutions to tackle issues in Africa. The company specializes in advertising, social media, and the creation of websites and mobile applications. Among its flagship products are M-Paper, a digital newspaper app, and Kwanza, a platform that aggregates bloggers and websites to streamline the purchase of local media.

Smart Codes is part of the Smart Africa Group (SAG), where Edwin Bruno also serves as CEO. SAG is an innovation and digital consulting company aimed at creating integrated platforms that connect people and organizations to unlock limitless possibilities in Africa and beyond. SAG has four other subsidiaries: Smart Foundry focuses on innovation and product development, Smart Lab connects startups and businesses, Smartnology specializes in the development and management of cutting-edge technologies, and Smart Studio handles the production of innovative content.

Edwin Bruno is a member of the American Chamber of Commerce in Tanzania and the business leaders’ forum CEO Roundtable of Tanzania. Since 2020, he has also been part of the advisory committee of the Tanzania Private Sector Foundation, an organization promoting the social and economic development of Tanzania's private sector.

Before founding Smart Codes, Edwin Bruno established Popote Media in 2011, a social media and digital marketing agency, where he served as CEO until 2015. He holds a degree in computer science and engineering from St. Joseph University in Tanzania, earned in 2011.

Melchior Koba

Mastercard has partnered with Kalabash54, the fintech subsidiary of Wakanow Group, to launch a travel card for customers in Nigeria and Ghana, the company announced on July 15.

This initiative aims to provide a secure and convenient payment solution tailored for regional travelers. Users can fund their trips directly through the Kalabash54 app using physical or virtual cards, with options to use local currency or USD.

With the launch of these travel cards, Mastercard and Kalabash54 aim to redefine travel payments in West Africa, simplifying financial management for travelers.

After studying at prestigious American universities, two Nigerian tech entrepreneurs have embarked on a mission to solve the global challenge of receiving international payments. They decided to start this venture in their home country, Nigeria.

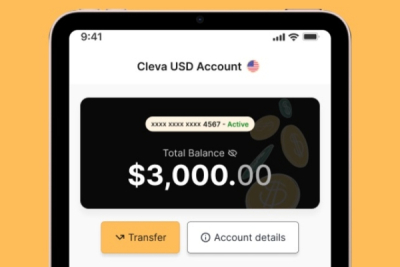

Cleva, a fintech solution developed by a Nigerian startup, enables individuals and businesses to receive international payments in US dollars directly into a US-based account.

Headquartered in Lagos, Nigeria, Cleva was founded in 2023 by Philip Abel and Tolu Alabi. In January 2024, it secured $1.5 million to fund the project's development and commercial offering. The fintech was also selected for the Winter 2024 cohort of the California-based accelerator Y Combinator.

Discussing Cleva's services, co-founder Tolu Alabi explained: "The problem that we're trying to solve, which is enabling people to receive international payments, is not a Nigerian problem nor an African one. It's a global problem; people in Latin America, Asia and even Canada need to receive dollars for their work and service."

Cleva has launched a mobile app available on both iOS and Android, which has already been downloaded over 10,000 times according to Play Store data. Users can create an account using their email address and must provide identification to verify their account. Currently, the solution is targeted at Nigerians. "We're starting with Nigeria because we know the market and it's also a big market," added Tolu Alabi.

Beyond receiving international payments, Cleva allows users to convert US dollars into local currency and conduct transactions with local bank accounts. The fintech also offers virtual US dollar bank cards to facilitate commercial transactions. "We feel like because of our backgrounds, we're very well positioned to solve this problem at a global scale," concluded Tolu Alabi.

Adoni Conrad Quenum

As part of the digitalization of various sectors, Algerian authorities have made significant strides in human resources management.

The Algerian Ministry of the Interior, Local Authorities, and Territorial Planning has completed the digitalization of administrative documents related to human resources management at both central and local levels. The announcement was made in a statement released on Saturday, July 13.

"This initiative has resulted in the digitalization of 25,792,410 documents, including those of senior executives, employees, contract agents in service, and retirees. These documents are organized into 735,926 electronic files, each containing 35 digitized documents," the statement reads.

Additionally, the ministry developed a decision-support system for human resources management, called "system power BI." This system utilizes data from the integrated and comprehensive Human Resources Information System (HRIS) to provide precise and real-time data analysis, as well as a forward-looking perspective in decision-making related to human resources management.

The acceleration of digital transformation in Algeria aligns with the directives of President Abdelmadjid Tebboune. Aiming for full digitalization of the country by 2034, the authorities are undertaking numerous actions across various sectors as part of the 2024-2029 digital transformation strategy.

The initiative is expected to enhance the efficiency and productivity of human resources services in state entities by reducing human errors and document processing delays, improving transparency and accountability within organizations and the government, eliminating phantom employees, and facilitating citizen access to services such as social benefit applications, payroll information consultation, and leave requests.

Adoni Conrad Quenum

In 2018, his brother passed away due to uncontrolled hypertension. Since then, he has been using his technical skills to combat heart disease and reduce health inequities.

Peter Njongwe (photo), a South African software engineer, product manager, and entrepreneur, is the founder and CEO of Oben Health, a startup focused on improving healthcare access for people of color in the United States. Founded in 2020, Oben Health, previously known as Lapis Health, aims to enhance the quality of care, improve the quality of life, and reduce sudden deaths related to heart disease in communities of color. The startup has developed an AI-based platform that delivers healthcare services in barbershops and beauty salons.

The Oben Health platform seamlessly integrates clinical screenings, social determinants of health (SDOH), health coaching, and treatments. It fosters team-based care, coordination, and population health management through interoperability and data analytics. The inspiration to start this company came after the loss of Njongwe's brother in 2018. "My brother passed away from uncontrolled hypertension at age 36. He went to bed and never woke up, leaving a wife and two children behind. If my brother had gotten screened for hypertension, I think he would still be alive" Njongwe explains on the reasons behind the platform.

Njongwe holds a degree in computer information systems and entrepreneurship, earned in 2013 from Mount Royal University in Canada. He began his professional career the same year at Hitachi Solutions Canada, an enterprise application consulting firm, as an IT consultant. In 2014, he became a software developer at Evans 2 Design, now E2 + Associates, a company specializing in housing construction and land development. In 2015, he was hired by Shopify as a product manager. From 2019 to 2021, he served as an executive-in-residence at Connection Silicon Valley, an organization that helps Canadian companies collaborate, innovate, and establish partnerships within the Silicon Valley tech ecosystem.

Melchior Koba

Streamlining vehicle registration and documentation processes aids in combating vehicle-related crimes such as terrorism, banditry, kidnapping, and armed robbery. Digital systems can be adapted to provide real-time data to help law enforcement agencies track and recover stolen vehicles, enhancing overall security.

In a recent development, the Inspector-General of Police (IGP), Kayode Adeolu Egbetokun, has ordered the immediate suspension of the proposed enforcement of the digitalized Central Motor Registry (e-CMR), which was initially set to commence on July 29, 2024. This directive was announced in a press release dated July 14, just a day after the Nigeria Police Force (NPF) announced the deadline for vehicle owners to register for the e-CMR, costing N5,375 per vehicle.

The decision aims to provide sufficient time for mass enlightenment and education of all citizens and residents on the e-CMR process, its benefits, and its effectiveness in addressing vehicle-related crimes and protecting vehicle ownership.

"The Inspector-General of Police, IGP Kayode Adeolu Egbetokun, Ph.D., NPM, has ordered an immediate suspension of the proposed enforcement of the e-CMR initially scheduled to commence on the 29th of July, 2024. This is to give ample opportunity for mass enlightenment and education of all citizens and residents on the process, benefits and effectiveness in solving the challenge of vehicle-related crimes, and protection of individual and corporate vehicle ownership," the statement read.

In light of the suspension, the IGP has instructed all police officers to refrain from requesting e-CMR certificates. Any officer found extorting or exploiting the public under the guise of enforcing e-CMR compliance will face strict sanctions. The NPF clarified that the e-CMR is not intended as a revenue-generating platform but as a digital policing initiative aimed at enhancing public safety and security.

The e-CMR system is designed to enhance the safety and security of all vehicle types, including motorcycles. By collecting data from vehicle owners, the system can flag vehicles if reported stolen, provide the police with a comprehensive real-time database, prevent multiple registrations, and integrate biometric and other data into a national database. This integration will contribute to overall security and streamline incident reporting across various government agencies.

This suspension provides an opportunity for better public understanding and preparation for the eventual implementation of the e-CMR system, ensuring it effectively enhances vehicle security and ownership protection.

The Central Motor Registry (CMR) was initially launched in December 2022 to enable citizens to report stolen vehicles and assist in processing motor vehicle information, supporting police operations, and enhancing national security. This digitalization effort is part of a broader trend where African nations are increasingly adopting digital solutions to combat crime, improve governance, and streamline services.

Hikmatu Bilali

Driven by a passion for both art and culture, he sees technology as a powerful tool to tackle challenges. He has created a platform that connects African artists across the continent.

Seydina Mouhamed Sene (photo), a Senegalese tech entrepreneur and passionate artist, is the founder of Welfin Sarl, a tech startup specializing in event communication.

Launched in 2022, Welfin aims to simplify and speed up the organization of professional events using artificial intelligence to offer unique, personalized experiences tailored to each company's budget.

One of Welfin's flagship solutions is Teralma, a platform dedicated to the cultural and creative industries. The platform lists and networks engaged artists across Africa, encouraging them to participate in sustainable development programs initiated by non-governmental organizations and associations on the continent.

Prior to founding Welfin, Sene co-founded Circus Morocco in 2016, a startup dedicated to recycling electronic waste from businesses, households, and rural communities. In 2019, he also co-founded Bsensei, a fintech startup developing solutions for financial institutions.

Sene graduated from the Faculty of Legal, Economic, and Social Sciences (FSJES) Ain Chock in Casablanca, where he earned a bachelor's degree in management economics. Since 2016, he has been a member of the international MakeSense community, which helps social entrepreneurs tackle their challenges.

His entrepreneurial efforts have been recognized with several awards. With Circus Morocco, he won the Orange Social Entrepreneur Award in Africa and the Middle East in 2018 in Morocco. With Bsensei, he received first prize in the Open Innovation organized by BNP Paribas in Africa in 2018 and first prize at the Africa Blockchain Summit organized by Bank Al-Maghrib and Paris Europlace in 2019. In 2021, he secured second place in the Free Innovation Xperience Challenge launched by the telecom operator Free.

Melchior Koba

The Nigerian Computer Emergency Response Team (ngCERT) has reported a surge in ransomware attacks by the Phobos ransomware group targeting critical cloud service providers in Nigeria.

Phobos attackers gain access through phishing emails and exploiting the Remote Desktop Protocol (RDP) weaknesses. At-risk entities include providers serving government agencies, financial institutions, telecommunications, education, healthcare, and NGOs.

Zimbabwean financial firm BARD Santner Incorporated launched TX Money Transfer on July 10. The new platform is designed to enhance reliability and transparency in the remittance sector.

BARD aims to improve transparency regarding charges to avoid hidden costs and foster collaboration to eliminate process bottlenecks.

With the launch of TX Money Transfer, BARD Santner aims to set a new standard in Zimbabwe's remittance sector, ensuring better service for clients and strong business returns.

More...

Many African countries face significant challenges in providing reliable internet access, especially in rural and remote areas. Satellite internet can offer high-speed connectivity where traditional infrastructure is lacking, helping to bridge the digital divide and bring more people online.

South Sudan's National Communications Authority (NCA) has announced approved tariffs for SpaceX's satellite internet service, Starlink. In a July 8 post on X, the NCA stated it collaborated with Starlink to offer affordable connectivity in South Sudan as Elon Musk's high-speed internet service prepares to launch.

This serves to inform the public about the approved tariffs & the forthcoming selection of local distributor(s) by Starlink.

— National Communication Authority - NCA (@NCA_SSD) July 8, 2024

It should be noted that the tariffs exclude applicable taxes and relevant statutory fees. #ConnectingSSD pic.twitter.com/zTWLFbsXo4

The NCA issued a provisional license for Starlink in June 2024, aiming to reduce internet costs and improve access, especially in rural areas.

The authority reports that Starlink will offer four pricing plans: USD 38.19 per month for the cheapest and USD 5,005.40 for the most expensive. The plans are Standard, Priority, Mobile, and Mobile Priority, with equipment costing USD 296.67 for the Standard Kit and USD 2,502.70 for the Flat High-Performance Kit. Prices exclude taxes and fees.

According to DataReportal's Digital 2024: South Sudan report, the country had 1.36 million internet users at the start of 2024, with an internet penetration rate of 12.1 percent. Additionally, there were 3.97 million active mobile connections, representing 35.5 percent of the population. With only 12.1 percent internet penetration, the introduction of Starlink could dramatically increase internet accessibility, especially in rural and underserved areas where traditional internet infrastructure is lacking.

Starlink is expanding in Africa, recently launching in Madagascar and obtaining licenses in Ghana, Botswana, and Zimbabwe, with services active in Sierra Leone. It operates in several other countries, including Benin, Nigeria, Rwanda, Malawi, Kenya, Mozambique, and Zambia. With these developments, Starlink is poised to play a crucial role in enhancing connectivity and supporting economic development in underserved regions.

Hikmatu Bilali

Fueling the continent's ongoing technological revolution, African nations are actively pursuing initiatives to bolster their digital security.

The Ghanaian Cyber Security Authority (CSA) issued licenses and accreditations to 51 entities operating in the digital security space on July 10th. This move aims to establish a regulatory framework for Cybersecurity Service Providers (CSPs), Cybersecurity Establishments (CEs), and Cybersecurity Professionals (CPs) authorized to offer digital security services in the country.

"Today’s ceremony is not just a culmination but a catalyst for continued collaboration and innovation in our cybersecurity ecosystem. The synergy among CSPs, CEs, and CPs will drive us towards adaptive resilience and continuous improvement," said Adelaide Benneh-Prempeh, a member of the CSA Board of Directors.

The licensing initiative comes amidst a rising tide of cyberattacks across Africa. The continent's rapid digital transformation has increased its vulnerability, making robust cybersecurity a priority for governments. Ghana has taken steps by establishing a national strategy through the "Ghana National Cyber Security Policy & Strategy" and implementing the Computer Emergency Response Team (CERT-GH). This team plays a vital role in real-time threat monitoring and coordinating responses to major cybercrime incidents.

The country has also ratified the African Union Convention on Cyber Security and Personal Data Protection. It has deposited the instruments of accession to the Budapest Convention on Cybercrime.

In terms of cybersecurity preparedness, Ghana ranks third in Africa with a score of 86.69 out of 100, according to the 2021 "Global Cybersecurity Index" published by the International Telecommunication Union. This places the nation ahead of Nigeria (84.76) but behind Tanzania (90.58).

Adoni Conrad Quenum

The digital sector offers numerous job opportunities for young people. By acquiring the right skills, they can take advantage of these opportunities and integrate more easily into the job market.

Chinese technology giant Huawei announced plans to train an additional 4,000 individuals in Information and Communication Technologies (ICT) in Mauritius by 2028. The commitment was unveiled on July 10th at the launch ceremony of DigiTalent 3.0, a program designed to address the nation's growing need for a skilled digital workforce.

"Mauritius has always been a pioneer in regional innovation. Our strategic investments in ICT infrastructure, combined with our commitment to fostering a knowledge-based economy, have laid a solid foundation for our digital future. Continuous training and skill enhancement are essential. Huawei's talent ecosystem is a brilliant example of how we can work together to build a thriving ICT talent pool in our country," said Deepak Balgobin, the Mauritian Minister of Information Technology, Communication, and Innovation.

This initiative aligns with Huawei's global strategy of cultivating digital talent in various countries. The approach emphasizes building ecosystems for educators and students, offering digital skills training to industry partners, and collaborating with governments on digital transformation initiatives.

In Mauritius, Huawei's contributions have resulted in the training of over 35 instructors and the development of courses in Artificial Intelligence, 5G, Datacom, and Cloud Computing. Over 350 students and professionals have earned Huawei's HCIA certification in recent years. The company has also established partnerships with seven local universities.

These combined efforts are expected to propel Mauritius towards achieving the objectives outlined in its "Digital Mauritius 2030" strategy. This national plan entails significant investments in infrastructure, digital skills training, and the transition to digital administration, all aimed at propelling the nation's digital sector. According to official figures, this sector thrived in 2022, experiencing a 6.5% growth rate and remaining the only sector unaffected by the global health crisis.

Samira Njoya

Since its launch in 2015, Groupe Vivendi Africa has been expanding its footprint across the continent. Now present in seven African countries, the company continues to grow its reach and influence in the region.

Groupe Vivendi Africa (GVA), a provider of high-speed fiber optic internet, officially launched its CanalBox FTTH (fiber-to-the-home) network in Uganda on July 10th. This marks GVA's eighth African market after entering Gabon, Congo, Côte d'Ivoire, Togo, Rwanda, Burkina Faso, and the Democratic Republic of Congo (DRC). Kampala becomes the 13th city on the continent to benefit from these services.

"With investments of 50 billion UGX so far, GVA has managed to lay fiber cables across Kampala, with an infrastructure currently capable of connecting a total area covering 140,000 homes in Kampala, with a target to grow our network to cover an area to be able to connect up to 500,000 in 4 years," said Julius Kayoboke, General Manager of GVA Uganda.

The arrival of CanalBox is expected to intensify competition in Uganda's internet market, currently dominated by telecom operators. This increased competition should lead to improved service quality and lower costs for consumers, coinciding with Uganda's accelerated digital transformation and growing demand for high-speed connectivity. According to the latest data from the Uganda Communications Commission (UCC), the country boasts 27.7 million internet users, representing a 61% penetration rate.

"The internet has transformed societies in unprecedented ways, shaping the way we live, work, and interact with one another through communication, information dissemination, business transactions, education, and improved service delivery," remarked Thomas Tayebwa, Vice President of the Ugandan Parliament, who attended the launch ceremony.

Isaac K. Kassouwi