Google has opened applications for its 2025 Hustle Academy, a free five-day virtual bootcamp for small businesses in Kenya, Nigeria, and South Africa. The announcement was made on March 6.

The program will equip entrepreneurs with AI skills, digital tools, and strategies to drive growth and efficiency.

Led by expert trainers, the bootcamp features live sessions, personalized mentorship, and networking opportunities. Participants will learn to integrate AI into their operations, enhancing competitiveness in a digital economy.

Expanding access to cloud and AI tools paves the way for small businesses, startups, and government services to embrace digital transformation, enhancing efficiency and accessibility. With this investment, South African businesses will be better positioned to integrate AI and cloud computing, driving productivity gains and streamlining operations.

On March 6, Microsoft announced plans to invest ZAR 5.4 billion ($297,664,532) in South Africa to expand its cloud and AI infrastructure by the end of 2027. This investment will support the growing demand for Azure services while enabling businesses, government entities, and startups to harness the power of AI and cloud computing to drive efficiency and innovation.

Speaking on the announcement, President Cyril Ramaphosa emphasized the significance of Microsoft’s long-standing commitment to South Africa, stating: “The strategic investment announcements made by Microsoft today stands as further testimony to this enduring confidence. They signal to the business and investor community that South Africa’s economy continues to hold immense potential and that it is a favourable place to do business where their investments are secure.”

As part of its commitment, Microsoft plans to expand its digital skills initiative over the next 12 months by sponsoring 50,000 Microsoft Certifications in high-demand fields such as AI, data science, cybersecurity, and cloud computing.

This investment builds on Microsoft’s 2024 achievements, where the company trained 150,000 people, certified 95,000, and helped 1,800 secure employment through its Skills for Jobs program. In January this year, Microsoft announced plans to provide 1 million people in South Africa with artificial intelligence (AI) training opportunities by 2026.

South Africa grapples with a significant digital skills gap, limiting its capacity to compete effectively in the global digital economy. A 2020 survey by Harambee, South Africa's Youth Employment Accelerator, titled Mapping of Digital and ICT Roles and Demand for South Africa, found that the country's shortage of technical skills led to the outsourcing of over 28,800 digital and ICT jobs each year. This resulted in an estimated annual loss of R8.5 billion ($55 million) in export revenue. Efforts like Microsoft’s initiative seek to bridge the gap by strengthening digital competencies across multiple sectors.

By strengthening its cloud and AI infrastructure, Microsoft aims to empower South Africa and the broader continent with the tools needed to compete globally, foster local enterprise development, and drive economic growth.

Hikmatu Bilali

The rising tide of cyberattacks poses a significant challenge to Africa's economic stability and digital development. Enhanced cooperation is essential to safeguard the continent's infrastructure.

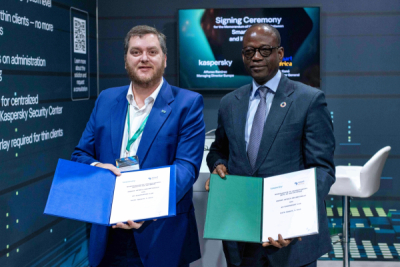

Cybersecurity firm Kaspersky signed a three-year strategic memorandum of understanding with Smart Africa, an alliance of more than 40 African countries committed to the continent’s digital transformation, on Wednesday, March 5. The partnership aims to strengthen cybersecurity in Africa through skills development, policy harmonization, and the reinforcement of critical infrastructure.

"This MoU marks a significant milestone in our quest to secure Africa’s digital future. By joining forces with Kaspersky, we are not only building essential cybersecurity skills and bridging the gender gap but also setting the stage for robust regional cooperation and state-of-the-art cyber infrastructure," said Lacina Koné, CEO of Smart Africa.

The initiative is part of a broader effort to improve the digital resilience of African nations. According to the United Nations Economic Commission for Africa, the low level of cybersecurity preparedness costs African states an average of 10% of their GDP, amounting to nearly $4 billion per year, solely due to cybercrime. The African Network of Cybersecurity Authorities (ANCA), recently launched by Smart Africa, represents a first step toward more effective intergovernmental cooperation on cybersecurity.

Through the agreement, Africa will benefit from advanced training programs via the Kaspersky Academy, support in developing appropriate regulatory frameworks, and the establishment of security operations centers (SOCs). By making cybersecurity a priority in the continent’s digital transformation, the collaboration aims to create a safer, more inclusive, and resilient digital space for the years ahead.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

Mobile payments are rapidly expanding across Africa, significantly increasing access to financial services. Leading providers like Orange Money are at the forefront of this digital shift, delivering innovative and accessible solutions tailored to the local population.

Orange Money Burkina Faso announced the upgrade of its mobile financial services platform with Mobiquity® Pay X, a next-generation solution developed by Comviva, at the Mobile World Congress (MWC) in Barcelona on Wednesday, March 5. The evolution aims to enhance innovation and provide an improved user experience for Orange Money customers in Burkina Faso.

"Orange Money is one of our key growth drivers, contributing significantly to economic and social development in Burkina Faso. We are particularly impressed by Mobiquity® Pay's microservices architecture, open design, and API-first philosophy, which will enable us to significantly expand the Orange Money ecosystem in the region and provide disruptive services to our customers," said Christophe Baziemo, CEO of Orange Money Burkina Faso.

The mobile financial services market in West Africa is experiencing strong expansion, driven by the rise of digital payments and operators' initiatives to strengthen financial inclusion. According to the financial results of the Orange Côte d'Ivoire Group, which includes Orange Burkina Faso, the group closed 2024 with consolidated revenue of 1,084.1 billion CFA francs ($1.8 billion), a 6.6% increase. This performance is primarily fueled by key sectors such as mobile data, Orange Money, and fiber, illustrating the growing demand for mobile financial services in the region.

The new cloud-based platform represents a cutting-edge solution offering a comprehensive suite of information management services, particularly for digital money, wallets, and payments. Its robust and scalable architecture ensures a secure and user-friendly experience, while enhanced modularity enables faster market deployment of new services.

With over ten years of expertise in digital payments, Comviva has deployed its Mobiquity® Pay platform in more than 60 projects across 45 countries. This modernization is expected to enable Orange Money Burkina Faso to launch new services more quickly, improve interoperability with other financial systems, and enhance transaction security. Ultimately, the initiative will help boost the mobile payments ecosystem and promote greater financial inclusion in the country.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

Global digital transformation is reshaping industries, and the automotive sector is no exception, with the increasing integration of information and communication technology (ICT) in vehicles. Tunisia is strategically positioning itself to capitalize on these emerging technologies, particularly electric and smart vehicles.

Tunisia is positioning itself to become a major player in the smart vehicle industry, as highlighted during the second steering committee meeting of the "Automotive Smart City" project on Tuesday, March 4. The initiative aims to establish a smart city dedicated to the electric and intelligent vehicle sector, enhancing Tunisia’s role as a strategic hub and boosting its global competitiveness.

The smart vehicle market is expanding rapidly, driven by advancements in artificial intelligence, connectivity, and autonomous driving technologies. A report by consulting firm Modor Intelligence estimates that the automotive artificial intelligence market, valued at $2.3 billion in 2024, will grow to $16.2 billion by 2026, fueled by strong consumer demand and government efforts to reduce carbon emissions.

Tunisia’s Minister of Industry, Mines, and Energy, Fatma Thabet Chiboub, said the project aligns with the country’s national strategy for industry and innovation. It also supports the Pact for the Competitiveness of the Automotive Equipment and Components Manufacturing Sector by 2027. The initiative is expected to increase export revenues to 13.5 billion dinars ($4.4 billion) by 2027 and create 150,000 new jobs in the coming years.

The project is part of broader efforts to strengthen Tunisia’s automotive sector, which has already demonstrated significant growth. Tunisia ranks second in Africa for automotive component exports, underscoring the sector’s potential and its growing contribution to the national economy.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

Many small businesses still operate in cash-based systems with limited access to digital financial services. This initiative ensures that more businesses can participate in the digital economy, improving efficiency and security.

Payments technology company Flutterwave has partnered with the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) to enhance digital payment solutions for micro, small, and medium enterprises (MSMEs) across the country. This collaboration aims to provide businesses with the tools they need to thrive in an increasingly digital economy.

Flutterwave CEO Olugbenga ‘GB’ Agboola emphasized the company’s dedication to supporting Nigerian businesses. “As a business with Nigerian roots, we understand the challenges that small businesses face daily. This partnership ensures they have the financial tools they need to succeed in today’s digital economy.” By leveraging Flutterwave’s technology, MSMEs will be better equipped to navigate the evolving business landscape.

Aligned with SMEDAN’s Grow Nigerian initiative, the partnership will provide MSMEs with secure digital storefronts, seamless payment solutions, and improved financial access. Through this, businesses will be able to accept payments globally via mobile wallets, card payments, and bank transfers enhancing their reach and competitiveness.

Highlighting the impact of this initiative, SMEDAN Director-General and CEO Charles Odii noted, “One of the biggest challenges MSMEs face is access to digital tools, financial resources, and training that can help them scale. With Flutterwave as our partner, we have a solid ally providing Nigerian businesses with innovative solutions that will enable them to compete effectively on a global scale.”

Building on its longstanding support for small businesses, Flutterwave has consistently introduced initiatives such as the Flutterwave Store, small business grants, annual trade fairs, and the ‘Keeping the Lights On’ campaign, which has helped thousands of businesses remain operational despite economic challenges. The partnership with SMEDAN further strengthens Flutterwave’s commitment to empowering entrepreneurs.

This latest development follows NITDA’s February announcement of a partnership with Flutterwave, Alami a fintech offering sharia-compliant financing for SMEs and SMEDAN. Together, these initiatives signal a broader push toward digital and financial inclusion for small businesses in Nigeria.

The significance of this collaboration is further underscored by the role SMEs play in Nigeria’s economy. According to the International Labour Organization (ILO) Country Office in Nigeria, SMEs contribute 48% of the national GDP, make up 96% of all businesses, and provide 84% of employment. As digital solutions become increasingly critical to business success, partnerships like this one will help ensure that Nigerian MSMEs remain competitive and continue to drive economic growth.

Hikmatu Bilali

Access to quality vocational training remains a major challenge for many African workers and entrepreneurs. To address this issue, Zydii, a Kenya-based edtech company, offers an innovative solution.

Zydii, a Kenyan startup, has developed an online training platform designed to meet the needs of African professionals, including employees and entrepreneurs. Founded in Nairobi in 2021 by Joyce Mbaya and Rhoda Kingori, Zydii offers a mobile application available exclusively on Android.

According to Play Store data, the application has been downloaded approximately one hundred times. Users create an account to access various online training programs covering key areas such as personal development and leadership, digital and technological skills, and entrepreneurship and business management.

In February 2025, Zydii partnered with the talent accelerator Venture for Africa (VFA) to launch a hands-on, execution-focused go-to-market strategy course designed for African businesses. "This partnership with Venture for Africa is about giving businesses the tools to navigate real challenges, from market entry to regional expansion. Think of it as the ultimate playbook for winning in African markets," said Rhoda Kingori.

In a context where companies struggle to find talent trained in market-relevant skills, Zydii aims to bridge this gap by offering training programs tailored to the realities of the continent. The courses are designed to meet the demands of the African job market, with practical modules that can be immediately applied in a professional setting.

Zydii also collaborates with companies seeking to enhance their employees' skills. Through customized solutions, organizations can train their teams continuously and effectively, without time or location constraints.

By Adoni Conrad Quenum,

Editing by Feriol Bewa

Africa, with its vast territories and growing population, faces an urgent need for digital connectivity. Despite progress made, many regions remain excluded from Internet access, hindering their economic and social inclusion in an increasingly digital world.

Orange Africa and Middle East (OMEA) and French satellite company Eutelsat announced a partnership on Tuesday, March 3, to accelerate the deployment of satellite internet across Africa and the Middle East. The goal is to reduce the digital divide in these regions by providing reliable and affordable high-speed access, particularly in underserved "white zones" lacking connectivity.

"This partnership illustrates our commitment to connecting all territories and bridging the digital divide in Africa and the Middle East. Today, Orange serves more than 160 million customers in the region, and is pursuing its ambition to provide digital access for all," said Jérôme Hénique, CEO of Orange Africa and Middle East.

The partnership leverages the Eutelsat Konnect satellite, an advanced technology enabling download speeds of up to 100 Mbps. Initial deployments will focus on Côte d'Ivoire, Senegal, and the Democratic Republic of Congo, with plans to gradually expand across the region. The initiative aims to bridge the connectivity gap in remote areas by providing tailored solutions for both individuals and businesses.

The agreement reflects a shared commitment to reducing the digital divide by offering high-speed access to currently underserved regions. According to the "The Mobile Economy Sub-Saharan Africa 2024" report by the GSMA, Sub-Saharan Africa is the world's least connected region, with only 27% of the population using mobile internet services, leaving a 13% coverage gap and a 60% usage deficit.

By combining Orange’s telecommunications expertise with Eutelsat’s technological innovation in satellite services, the partnership is expected to deliver tailored offerings for both individuals and businesses, ensuring secure, reliable, and high-performance connectivity. The complementarity of fixed, mobile, and satellite technology solutions will help connect isolated areas and meet the growing demand for internet access in the region.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

In its bid to grow its digital sector, Tunisia, like other African nations, is pursuing international partnerships, recently strengthening ties with India and France.

Tunisia and Italy discussed enhancing their information and communication technology (ICT) cooperation during a meeting on Monday, March 3, between Tunisian Minister of Communication Technologies Sofiene Hemissi (photo, right) and Italian Ambassador to Tunisia Alessandro Prunas (photo, right).

During the discussions, both parties emphasized areas related to promoting innovation, supporting entrepreneurship, and developing startups.

This potential cooperation could bolster the Tunisian government's digital transformation ambitions, a key pillar of its socioeconomic development strategy. In 2024, Tunisia ranked 87th globally in the United Nations' E-Government Development Index (EGDI), with a score of 0.6935 out of 1, surpassing both African and global averages. In cybersecurity, Tunisia was classified in the third category out of five by the International Telecommunication Union (ITU). The country acknowledges the need for further efforts in organizational measures, capacity building, and cooperation.

Italy, meanwhile, is recognized as a leader in cybersecurity. According to the ITU, this reflects a strong commitment to cybersecurity through coordinated and government-led actions. This includes the assessment, establishment, and implementation of generally accepted cybersecurity measures across all five pillars or up to all indicators. Italy also has an EGDI of 0.8355 out of 1, ranking 51st globally.

The discussions are in their early stages. The exact scope of the potential collaboration remains undefined, and no official agreement has been announced. The progress of negotiations will be monitored to provide further insight into the direction and potential implications.

By Isaac K. Kassouwi,

Editing by Sèna D. B. de Sodji

The increasing prevalence of fake diplomas, driven by readily available technology, seriously undermines global education standards. However, blockchain technology presents promising solutions to combat this growing issue.

The Tunisian government has adopted a blockchain-based diploma verification system across its higher education institutions, aiming to combat widespread fraud.

The move follows a 2023 investigation by the Tunisian Association for the Fight Against Corruption, which revealed that an estimated 120,000 to 200,000 civil servants were allegedly hired between 2011 and 2021 using fake diplomas.

On Friday, February 28, Tunisia implemented the Unified Arab System for Diploma Authenticity Verification, utilizing blockchain technology. The system stores each diploma as a unique, secure, and tamper-proof block, protecting academic records from forgery, fraud, and unauthorized modifications. Institutions, employers, and stakeholders can instantly verify diploma authenticity, bypassing lengthy administrative processes.

The use of blockchain in higher education is not new. The Massachusetts Institute of Technology (MIT) implemented a secure digital diploma program on blockchain in 2017. In Africa, similar initiatives are emerging. Some Nigerian universities are experimenting with blockchain-recorded diplomas to ensure authenticity and simplify verification.

A study by Market Research Future projects the blockchain market applied to education could reach $1.3 billion by 2030, with an estimated annual growth rate of 33.7%. This growth reflects increased adoption of the technology by educational institutions seeking secure and simplified diploma management.

In Tunisia, the project is part of the Ministry of Higher Education and Scientific Research’s digital transformation strategy. It aims to ensure diploma integrity, develop digital skills, and modernize the education sector. The initiative stems from a November 2024 cooperation agreement between Tunisia and the Arab League Educational, Cultural, and Scientific Organization (ALECSO). A pilot project in three Tunisian institutions demonstrated the solution's effectiveness, leading to nationwide implementation.

Beyond combating fraud, the innovation is expected to facilitate academic and professional mobility by ensuring immediate and unquestionable recognition of diplomas nationally and internationally. It also represents a strategic advancement for Tunisia’s education system, strengthening the credibility and competitiveness of its universities globally.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

More...

In Burkina Faso, Patrick Paré is revolutionizing e-mobility with his new ride-hailing solution. His initiative is part of a drive to modernize urban transport while addressing the country's environmental and economic challenges.

LetsGo, an e-mobility solution developed by a Burkinabé startup, launched last week by Patrick Paré, offers eco-friendly ride-hailing services via a mobile application to residents of Ouagadougou.

"Our ambition is to redefine the standards of private transport in Africa and make every ride an exceptional experience. At LetsGo, every trip is designed to offer a unique and pleasant experience. We are committed to ensuring a high-quality service by focusing on three essential pillars: a commitment to safety, a personalized experience, and impeccable service," Paré stated.

The service is accessible through a mobile application, available on iOS and Android, which has been downloaded more than a thousand times, according to Play Store statistics. Users create an account, then book a taxi in a few clicks, track their journey in real-time, and benefit from transparent and competitive fares.

LetsGo offers an eco-friendly alternative to conventional fuel-powered taxis. With a fully electric fleet, the service aims to reduce greenhouse gas emissions and combat air pollution, a growing issue in major African cities. In addition to its environmental impact, it aims to provide an affordable and efficient transportation solution for Ouagadougou residents.

The deployment of this solution contributes to job creation and the modernization of the transport sector in Burkina Faso. "We actively contribute to Burkina Faso’s economy and culture through several commitments, such as supporting local employment by exclusively hiring Burkinabé drivers," Paré emphasized.

By Adoni Conrad Quenum,

Editing by Feriol Bewa

Successful digital transformation requires identifying challenges and implementing effective solutions. In Madagascar, key obstacles include limited infrastructure access, high connectivity costs, and a digital skills shortage.

Madagascar's Ministry of Digital Development, Posts, and Telecommunications, in collaboration with the United Nations Development Programme (UNDP), launched a Digital Readiness Assessment (DRA) on Feb. 27 in Antsirabe. This initiative aims to provide a comprehensive diagnosis of the country's digital sector and identify priority actions to address existing gaps, supporting Madagascar's goal of full integration into the digital economy.

In recent years, the has made significant progress, notably through the development of mobile money and the rise of local tech startups. However, several challenges remain. The country continues to face major structural obstacles, including limited access to digital infrastructure, high connectivity costs, and a digital skills gap.

According to DataReportal, in January 2024, the internet penetration rate in Madagascar was 20.6%, with 6.31 million users out of a total population of 30.68 million. However, this coverage remains uneven, particularly in rural areas. Regarding the cost of connectivity, the Malagasy government announced last October its intention to reduce telecommunications service tariffs to improve the population’s access to the internet. Despite these efforts, the cost of mobile internet access still represents 15.5% of the monthly gross national income (GNI) per capita, well above the International Telecommunication Union (ITU) recommendation of 2% of the monthly GNI per capita.

The digital skills gap also remains a major obstacle. The 2023-2028 Digital Strategic Plan highlights a shortage of approximately 40,000 specialized technicians needed to enable an effective digital transformation of the country. In this context, the Ministry of Digital Development has launched a program aimed at training 6,000 people in emerging digital professions over the next three years to address this urgent need.

To meet these challenges, the DRA represents a fundamental first step. This assessment is based on five key pillars: connectivity, to strengthen infrastructure and reduce the digital divide; governance, to improve coordination between sector stakeholders; regulation, to create a legal framework suited to the digital economy; businesses, to encourage innovation and technological entrepreneurship; and human capital, an investment in digital skills training.

The DRA is not limited to a simple assessment of the situation. It also serves as the basis for a strategic roadmap, aligned with Madagascar’s sustainable development priorities. Through this assessment, the country hopes to define a coherent digital vision that will not only accelerate its transformation but also help reduce inequalities in access to opportunities offered by the digital sector.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

IHS Nigeria, a subsidiary of IHS Holding Limited, has launched incubation and acceleration programs at the Ilorin Innovation Hub in Kwara State ahead of its official opening, the company announced on February 27.

Built in partnership with the Kwara State Government, the hub aims to drive innovation, entrepreneurship, and economic growth.

Together, their vision is to create over 10,000 jobs, focusing on digital skills, AI, agritech, and energy innovation.

Digital applications help authorities vet travelers in advance, improving security while reducing administrative burdens. By allowing travelers to apply for visas online before arrival, Namibia reduces congestion at borders, improving the overall travel experience.

Namibia has introduced an online application system for visas on arrival, marking a major step toward modernizing its visa process. Minister of Home Affairs, Albert Kawana, officially launched the initiative on March 3, 2025, at the ministerial conference hall.

Minister Kawana emphasized that while this new system enhances travel convenience, the visa application process for countries that do not qualify for visas on arrival remains unchanged. These travelers must continue to apply in advance via the Ministry’s online platform and await approval before entering Namibia.

The system allows eligible travelers to apply for visas before arrival, ensuring a smoother and more efficient entry process. The minister also reaffirmed Namibia’s commitment to fostering diplomatic and economic ties by engaging with nations interested in reciprocal visa agreements.

Starting April 1st, the new policy will apply to countries such as Benin, Burundi, Chad, the Central African Republic, Ghana, Guinea, Niger, Rwanda, and Togo. Citizens of African nations will pay approximately $70 for a tourist or holiday visa application.

Namibia has been actively digitalizing its immigration processes to enhance efficiency and accessibility. Key initiatives include the launch of an online application system for Short-Term Employment Permits (Work Visas) and Namibian Ordinary Passports in 2023, allowing applicants to apply, schedule appointments, and monitor application statuses online, reducing the need for in-person visits. Also, in 2022, Namibia introduced the Digital Nomad Visa to attract remote workers. The Visa permits eligible individuals to reside in the country for up to six months while working remotely for foreign-based employers.

These initiatives mark significant progress in Namibia’s digital transformation, enhancing security, modernizing services, and facilitating seamless travel.

Hikmatu Bilali