Solutions (581)

The Fintech solution was developed to help Kenyan SMEs easily manage their accounting operations at a fraction of the usual costs.

Lipana is a fintech solution developed by a Kenyan startup. It allows Kenyan SMEs to keep their accounts as well as send and receive payments through M-Pesa.

“We saw a need for a cheaper, easier-to-use bookkeeping solution since the existing players include Sage and Quickbooks, which are usually too complicated and expensive for the small business owner to use. Lipana solves this by being the easiest bookkeeping application for small businesses in Kenya,” says Shadrack Apollo, co-founder of Lipana.

The solution has no mobile app. On its web platform, users can register for an account to access the numerous services offered, including sending invoices and quotes, accepting payments, sending invoice reminders, and monitoring the paid, and unpaid invoices. They can also send payments via M-Pesa, bank cards, or any other mobile money or bank account.

Lipana also makes it easy to classify client information, payments, and invoices and monitor company expenses. It charges its users Ksh999 (US$8) monthly, Ksh4,999 per semester and Ksh9,999 per year.

Adoni Conrad Quenum

Agriculture is the main sector in most African countries. Tech entrepreneurs are stepping in to improve living conditions in this vital sector of the concerned economies.

Iwolonet is a digital solution developed by a Cameroonian startup. It is a business space where farmers can showcase their products online to attract buyers.

Via its Android app, farmers can register to access its services. They can also do so via its web platforms.

With their account, they can post their products, see the products posted by other users and connect with buyers and suppliers.

On Playstore, the app has been donloaded more than 10,000 times. Users present on the platform inlcude international companies, cooperatives and associations.

Adoni Conrad Quenum

Masroofi takes tech-enabled financial inclusion to the next level by reducing the age barrier in Egypt. Indeed, while the minimum age required to get a bank card is 16 years, the solution offers a tailored solution for children.

Masroofi is a digital solution developed by an Egyptian startup. It allows children aged between five and fifteen to get virtual payment cards for various transactions. The solution targets closed communities like school sports clubs to enable children to get used to the various digital and cashless solutions around them.

“As parents, many of us struggle with our children having cash in their hands because they are usually unaware of its worth. They either spend irresponsibly or they lose the cash. This is our seamless solution to parents, with regular notifications to parents of their childrens’ spending habits,” says Masroofi co-founder and CEO, Mostafa Abd Elkhabir.

The solution has a mobile app accessible for iOS and Android devices. Using the app, parents can create accounts to request Masroofi cards for their children (for EGP75 or about US$2.72) and load those cards.

The payment cards issued by Masroofi use NFC technology but, they are neither Visa nor Mastercard-branded. On Playstore, the Android version of its app has been downloaded more than 50 times. Despite that low download count, the founders want to add more features to give an improved financial education to children.

“We are considering creating an age-appropriate simulation that features different types of investment to expose children to investment experiences through their mobile application,” Mostafa Abd Elkhabir explains.

Adoni Conrad Quenum

The solution was developed to reduce STIs and STDs among young Africans. It leverages digital tools to raise awareness about issues related to sexual health and rights.

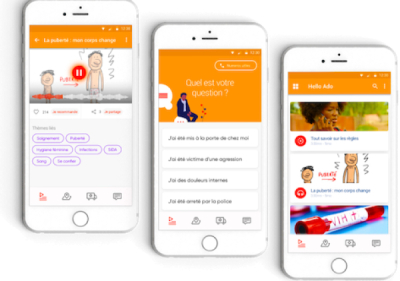

Hello Ado is a digital solution launched, in November 2020, by the Senegalese NGO African Network of Health Education (NGO RAES), UNESCO Dakar, and the National Alliance against AIDS (ANCS). It aims to educate Central and West African youth on sexual and reproductive health and rights and direct them to the health, protection, and support services they may need.

Its Android app has been downloaded more than 10,000 times on Playstore already. It offers audio, video, and written content that answers most of the questions young people are asking themselves nowadays. Once they download the app, they can create their accounts, which allows them to ask questions in a forum when they can't find answers to their concerns.

Apart from the contents available, the app helps locate the nearest health centers where users can discuss sexual health and reproductive issues. Its forum moderators always try to keep everyone focused so that the discussions can always be educational.

Let's note that before launching, the solution underwent a beta testing phase in Mali, Senegal, Côte d'Ivoire, and the Democratic Republic of Congo. Over 400 young people took part in that phase to improve its functioning before deployment. Additional tests were carried out in Gabon and Cameroon in the first quarter of 2021. Nowadays, Hello Ado is accessible in every Francophone African country.

Adoni Conrad Quenum

In Africa, several cities are faced with rising and persistent insecurity. In South Africa, where the problem is ever-present, a startup has decided to leverage digital tools to address it.

Namola is a digital solution developed by a South African start-up. It allows users to protect themselves and their families. When a Namola user requests assistance for self or a relative, the startup calls “immediately [...] to confirm details and then dispatch help from Namola Communities, Emergency Services or Private Response.”

Its mobile app -available for Android, iOS, and Huawei devices- has a “panic button” that can be pressed to request assistance. The app also sends notifications to members when their relatives safely leave or arrive whenever they are traveling.

The startup uses GPS technologies to locate users or their relatives when there is an issue. It also uses the technologies for advanced monitoring to ensure safety when there are threats or any other situation that may endanger life. With its national network, it can respond wherever the user or relative needing assistance is.

Since its launch, the Android version of the application has been downloaded more than 100,000 times, according to Play Store. Apart from its free plan, it has a paying offer (Namola Plus that cost ZAR59 or US$3.47 monthly) that entitles to the free services and a range of private services for fast responses.

Adoni Conrad Quenum

In recent years, voices against sexual assaults have grown louder worldwide. In that context, to give voice to victims and eventually prevent such acts, Moroccan authorities have set up a digital solution.

Kolonamaak is a support platform developed by Moroccan authorities for women and girls in vulnerable situations. It allows users to "report any abuse or violence suffered by women and girls, and to direct them to the appropriate authorities."

The solution was launched on January 29, 2020, and was set up on the instructions of Her Royal Highness Princess Lalla Meryem, President of the National Union of Moroccan Women (UNFM).

Its Android and iOS apps help localize women in case of emergency. They just have to dial 8350 to reach support and get directions on the competent authorities to reach out to.

The solution also helps them get coaching after a major trauma. Among other things, it offers various tips on "employment opportunities, training, business creation or income-generating projects at the local and regional levels.”

Since its launch, the Android version has already been downloaded more than a thousand times on PlayStore.

Adoni Conrad Quenum

Data security has become a concern in almost every industry with the development of digital tools. In Ghana, a startup has partially tackled the issue with a solution that allows microfinance institutions to build digital trust by letting their customers “know that their money and data are safe.”

Fluid is a digital solution developed by Ghanaian startup Fluid Finance Technologies. It allows microfinance institutions’ field agents to collect data faster and more efficiently.

“With Fluid’s software, Field Agents work faster and create trust with customers. Payment collections and account creation are now fully digital and video-traceable. This allows microfinance customers to know that their money and data are safe with you,” the startup indicates on its website.

Microfinance agents are thus equipped with the software to better perform their fieldwork. To convince potential customers to subscribe to the services offered, the fintech has created educational videos and various educational content to “upskill” both customers and microfinances’ field agents. Also, the solution is designed to be used completely offline to allow field agents to reach remote communities and provide financial services.

In October 2022, Fluid was selected, along with five other Ghanaian startups, to participate in the first cohort of the MEST Express accelerator focused on sustainability.

Adoni Conrad Quenum

The solution facilitates virtual payments and various day-to-day transactions.

Noupia is a fintech solution developed by Cameroonian startup Noupia Limited. It allows users to make online purchases, pay bills online, get paid online, buy cryptocurrencies or make top-ups from telecom operators.

Through its mobile app -Android and iOS, users can sign up for its services. They can for instance instantly top-up their bank cards, pay Netflix subscriptions or for ads on various social networks. They can also connect the solution to their Paypal, Apple Pay or Google Play accounts.

Noupia also integrates a QR code that allows to make payments when they forget their IDs. It also has a feature (Noupia Tip) for users to send tips to content creators to let them “concentrate on the work they're passionate about, without depending solely on advertising revenues.”

The platform also allows users to pay bills at Eneo, Camwater or Canal Plus, to buy Orange, Camtel, Nexttel or MTN airtime. According to Play Store statistics, the Android version of the application has already been downloaded over 50,000 times. The fintech is expanding rapidly and hopes to sustain its growth in Cameroon and the sub-region in the coming months.

Adoni Conrad Quenum

In recent years, a number of fintech solutions have entered the African market. Their aim is to be alternatives for largely under-banked populations.

Cassbana is a fintech solution developed by an Egyptian start-up. It allows small merchants to buy goods from partners and pay in small installments.

"Cassbana is a technology solution that builds financial identities for the underserved communities in Egypt through managing their business needs and building a behavior-based scoring system, making us the future data-based financial advisory collective," the explains on its website.

The solution has an Android app that allows users to create their accounts and access Cassbana’s services. Based on the usage data collected, the startup uses AI and machine learning to customize and improve the services offered to each merchant.

On Playstore, the Android app has been downloaded more than 50,000 times. With the solution attracting a growing number of users, Cassbana founder Haitham Nassar wants to roll out new services to better serve users. In 2021, the startup had already raised US$1 million to support its growth.

Adoni Conrad Quenum

By paying €15 daily, cab drivers can become owners within 48 to 60 months.

Cmontaxi is a digital solution developed by a Senegalese eponymous startup, founded in 2015. It allows cab drivers to become car owners within a given time frame.

"With an average monthly salary of €600, cab drivers] don’t earn enough to be able to access traditional bank loans or the car manufacturers’ leasing packages,” says Aziz Senni, founder and CEO of Cmontaxi.

The package set up by Cmontaxi includes lease-purchase, maintenance, and insurance agreements. Drivers have to pay €15 daily and become owners within 48 and 60 months. The amount is about 10% lower than the price drivers have to pay for other lease-purchase agreements. This is probably why the startup also uses the cabs as advertising media.

Its stated goal is to improve its drivers’ living standards by making transforming them into entrepreneurs, not just cab drivers. "I decided to allow these drivers to become cab owners without upfront payment, give them micro-business management training and help them reduce their insurance and maintenance costs,” Aziz Senni explains.

With its booking platform, the startup allows its drivers to boost their revenues. Cmontaxi also set up "Taxishop", a concept that allows drivers to increase their revenues by offering additional products and services on board their taxis.

Adoni Conrad Quenum

More...

In the growing music streaming market, giants like Apple Music, Spotify, and Deezer have captured the bulk of the demand. Nevertheless, African platforms are gradually poking the market by focusing on local content.

Mdundo is a digital platform developed by a Kenyan eponymous startup. It allows users to legally download and stream African songs.

According to its co-founder and CEO Martin Nielsen, the platform currently has some five million monthly users but, its potential is 30-fold higher. “With a steep growth curve and a very scalable solution, we plan to invest further in user growth to increase our market coverage in sub-Saharan Africa and within approximately three years establish Mdundo as the leading Pan-African music service for consumers and musicians. We want to achieve in Africa what Spotify has achieved in the West and what Tencent has achieved in Asia.,” he explains.

To achieve its growth targets, the startup, which claims to be the leader in the pan-African music market, has already raised more than US$6.4 million.

Apart from a web platform, its solution has an Android app, through which users can sign up for streaming services. Currently, the services are available in more than 15 countries in Sub-Saharan Africa. Its Android app has been downloaded more than a million times while the startup claims over 20 million monthly music downloads and streaming through its web and mobile apps.

The solution is the successor of the proprietary solution AppZone. Its stated mission is "to connect every monetary store of value using blockchain."

Zone is a fintech solution developed by the Nigerian start-up Appzone Group. As the successor of the startup’s fintech solution Appzone, it “allows participating institutions to connect directly with each other and perform payment transactions without an intermediary while completely automating settlement, reconciliation, and dispute management.”

The solution is a regulated Blockchain network that enables payments and acceptance of digital currencies. According to the startup, its Layer-1 blockchain network guarantees 100% transaction success for payments made in fiat currency or digital currencies. In addition, it guarantees frictionless transactions and universal interoperability. As the platform says, "the network ensures that end-users interact in an easy and natural way and that service providers don’t need to make any extra effort to support payment functionality."

Zone also “supports integration to all systems that store monetary value and all touchpoints used to initiate payments.” To make the system more efficient, it provides simple and effective programming interfaces that can be used multiple times for different payment transactions.

In early 2021, to support the expansion of its technology, AppZone raised US$10 million in Series A financing. “As Appzone, we launched the first core banking and omnichannel software on the cloud as well as the first multi-bank direct debit service based on single global mandates. With this transition to Zone, we are utilizing the power of blockchain technology to connect every monetary store of value and enable reliable, frictionless, and universally interoperable payments,” says Obi Emeratom (photo, center), Co-founder and CEO of AppZone.

Adoni Conrad Quenum

The solution capitalizes on the free-movement-agreement between West African countries to easily move goods across the sub-region, facilitating transport and logistics operations for whosoever needs such services.

Anaxar is a digital platform developed by a Togolese eponymous start-up, founded in 2020. It helps users easily transport goods across West Africa. In fact, it connects freight owners, truck owners, and freight recipients.

Using its platform, users can request free quotes by filling out a dedicated form and providing information such as the nature of the goods, the weight, and the departure and arrival areas. Once the form is submitted, the startup gets in touch to evaluate needs and provide personalized and the most competitive quotes. When the user accepts the quote, he/she needs to validate it to get the goods transported to the desired location.

Let’s note that once the goods arrive at the stated location, the startup once again contacts the user to notify it. Apart from transporting goods, Anaxar also specializes in removal and delivery. It is present in all the West African countries with a network of over 1,000 professional transporters. It claims competitive prices and points out that its priority is customer satisfaction, with the goal of becoming the leader in the sector.

Adoni Conrad Quenum

The solution is unveiled after more than ten months of testing. It allows millions of Kenyans access to various stock markets and information to up their investment skills.

Hisa is a fintech solution developed by a Kenyan eponymous start-up. It enables users (individuals and businesses alike) to buy fractional Kenyan and US stocks and pay via mobile money.

“At Hisa, we are building the infrastructure for borderless investments in Africa through micro-investments. Less than one percent of the population in Sub-Saharan Africa invests in the capital markets, caused mainly by a lack of access, low financial literacy levels, lack of IPOs as well as low liquidity of the local stock exchanges. [...] Through Hisa, anyone in Kenya can invest in their favorite companies such as Safaricom, KCB, Equity, Tesla, Apple, Microsoft, and many more,” explains Erick Asuma, Hisa’s co-founder, and CEO.

The solution was launched after ten months of beta testing. It has a mobile app -for both Android and iOS devices, through which users can create their accounts to access its numerous features. Among other things, they can access over 400 podcasts about the stock market, technologies, and asset management.

According to Eric Jackson, another Hisa co-founder, the startup is planning a funding round to expand its operations. The co-founder says the fintech already has more than 15,000 users with more than US$1 million in transactions processed. On Playstore, the Hisa Android app has already been downloaded more than 10,000 times. Its rating is 2.8 out of 5.

Adoni Conrad Quenum