Solutions (581)

The growing number of fintechs in Africa is comforting many countries in their ambition to develop cashless economies. In Ethiopia, innovative solutions are being shaped to accelerate this development.

One of them is ArifPay, a fintech solution developed by a local startup of the same name. The solution is an app that allows users to transfer, save and receive money directly with their mobile phones. The fintech was founded in 2021 by Habtamu Tadesse (pictured, center) and has already raised over $3.5 million in expansion funds. With his startup, the entrepreneur seeks to provide convenient, innovative, safe, and secure electronic payment processing services and platforms for the Ethiopian market.

“ArifPay aspires to make a significant contribution to the financial sector by offering digital-based payments services that meet the needs of consumers and merchants towards cash-lite transactions in line with the national agenda of the digital economy,” Habtamu Tadesse said. “We also believe ArifPay will support the country’s aspiration towards building a digital economy by empowering businesses and entrepreneurs who are looking for digital payment solutions to digitalize their business and services deliveries,” he pointed out.

The app is available on both android and iOS systems. Merchants using the app will be able to make electronic invoices, record taxes, and perform 100% cashless transactions with their clients if they also use ArifPay.

In addition to the mobile and web platforms, the fintech has developed a mobile point-of-sale system that will allow ATM cardholders to conduct electronic transactions on smartphones.

Adoni Conrad Quenum

The solution aims to facilitate the acquisition of real estate properties for the Senegalese population.

Alpha Digicrédit is a digital platform developed by a Senegalese eponymous start-up. It aims to democratize access to housing for Senegalese, both locals and the diaspora, by allowing access to real estate loans.

According to Dina El Kadry, the mastermind behind the solution, with Alpha, users have a precise idea of the overall cost of their real estate acquisitions (both the loan and the fees), thus avoiding additional costs. They can also negotiate the best conditions, with experts helping them reduce costs along the entire acquisition process, he adds.

The startup has a mobile app that provides users with all the information they need when they initiate an acquisition process. It then gives them information to assess the quality of the property they want and choose the adequate financing model.

Through the mobile app, on registration, users can view all the properties listed on the platform and use the mortgage calculator to assess whether their acquisition projects are feasible.

"For many Senegalese and even Africans living on the continent or abroad, acquiring a real estate property is a life goal. [..] As a single point of contact, Alpha manages the entire process by applying for loans and dealing with notaries insurance companies, and developers. It oversees the case till completion,” Dina El Kadry explains.

Adoni Conrad Quenum

Though they are not yet popular like fintech and healthtech solutions, insuretech tools are garnering a fair share of attention in Africa. In Rwanda, a tech entrepreneur has developed a solution to allow access to decent healthcare for corporate employees.

Eden Care is a digital platform developed by a Rwandan eponymous start-up. It helps users subscribe to health insurance without even passing through insurance brokers.

"Eden Care was founded to create the kind of health insurance we wanted for ourselves – one that is affordable and doesn’t require filling six pages of documents at the hospital and a three-hour wait time. One where we can easily see our benefits and provides wellness tools, community, and incentives to enable us to get and stay healthy,” explains Moses Mukundi, CEO and founder of Eden Care.

The solution offers customizable and affordable health plans allowing firms to subscribe to plans based on the number of their employees. It boasts an extensive network of providers for good national coverage. If necessary, it resorts to telehealth.

It significantly reduces the paperwork with faster pre-authorizations and also reduced reimbursement times for medical providers.

"We see Eden Care as having what it takes to deliver that increase in value and service for consumers. […]By digitizing insurance processes and providing a wellness-first insurance cover to employers, Eden Care is making quality health insurance accessible to an underserved market – growing SMEs and businesses,” says Arnold Mwangi, partner at the Dutch impact investment firm DOB Equity, which contributed to the healthtech startup’s recent pre-seed round.

Adoni Conrad Quenum

It is sometimes challenging to send money to relatives in Africa because of the high fees charged by transfer companies. The situation has improved in recent years, with tech entrepreneurs developing innovative solutions to address the issue.

Yalla Xash is a fintech solution developed by a Moroccan eponymous startup. It allows users to quickly send money to Canada, Senegal, and Côte d’Ivoire, via its mobile app.

Using its mobile app -Android and iOS apps, registered users can send funds, which will be available for withdrawals in cash within 30 seconds. For bank transfers, it takes a max of 48 hours to clear.

The startup claims its withdrawal fees, which start from CAD1.99 (US$1.5), are up to six times lower than the competition. It always sends SMSs to notify recipients of incoming transactions and the details of the specific transactions. Also, once the funds sent are withdrawn it sends SMSs to senders informing them of the successful withdrawal.

Currently, PlayStore data shows its Android app has been downloaded more than 5,000 times. After the Covid-19 pandemic, it recorded a 35% rise in transaction volume and is steadily gaining ground in Africa. It has over 4,300 pickup points in Morocco. In June 2021, it announced the raise of MAD6 million (US$560,000) from the Maroc Numeric Fund, which was seduced by its solution and social impact.

Adoni Conrad Quenum

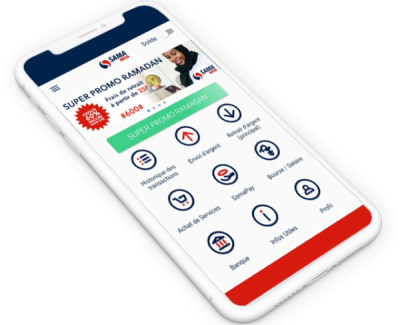

From Mali, where it has established a strong base, the startup wants to conquer other African countries. It has already taken initial steps in that regard by entering two additional countries.

Sama Money is a fintech solution developed by a Malian eponymous start-up. It allows its users to send money anywhere in Mali at rates 60% cheaper than the competition.

On its website, the fintech startup behind the solution explains that it aims to boost financial inclusion in Africa. For that purpose, it “developed an innovative and accessible system that offers not only very competitive rates but also a multi-channel solution that can be used with or without an Internet connection.” It also offers additional services that can be paid fee-free using the Sama e-wallet”

The solution is accessible via a mobile app, available for Android and iOS devices. Once they sign up with a Sama account, users can access the various services offered, including money transfers and withdrawals, electricity and water bill payments, airtime top-ups, etc.

It is worth noting that several institutions have adopted Sama Money for various payments, including Covid-19 financial assistance, scholarship, insurance, salaries, and pensions. It is also accessible via a USSD code, which allows rural communities with no access to the internet to use its services.

According to PlayStore data, the Android version of its mobile app has already been downloaded more than 100,000 times. This year, the solution was scaled into Côte d’Ivoire and Burundi. It intends to enter more African markets.

Adoni Conrad Quenum

Despite public authorities’ efforts, not everyone has access to education in Africa. Tech entrepreneurs are entering the field, leveraging digital solutions to bring education to everyone.

Foondamate is a study chatbot developed by a South African eponymous startup. The chatbot allows users access to online courses. The startup behind the bot was founded, in 2020, to help students access study materials.

"At FoondaMate, we believe talent is equally distributed yet opportunities are not. There are often competing factors that contribute to educational inequality – not just in Africa, but across the world – and our technology is helping to universally address these," said Dacod Magagula, CEO and co-founder of FoondaMate, the startup behind the chatbot.

The chatbot can be accessed on WhatsApp and Facebook Messenger. The bot, which speaks 13 languages (French, English, Sesotho, afrikaans, setswana, etc.), usually asks questions to assess first-time users’ education level. Then, they can assess the education materials and support they want. Among other things, they can download documents and memos, find solutions to maths problems and ask the meaning of words they don’t understand.

The startup claims more than 900,000 users in about 30 countries. "It's humbling to think that so many learners trust us to support their desire to learn, and that's a responsibility we take incredibly seriously," CEO Magagula indicated earlier this year when the startup raised US$2 million to accelerate its expansion.

Adoni Conrad Quenum

The solution aims to offer efficient logistics solutions to retailers in a context marked by rising transportation costs, which cost some retailers their operating profits.

Renda is a digital platform developed by a Nigerian eponymous start-up. It helps online businesses streamline their order fulfillment and retail distribution process across Africa.

The solution provides access to storage warehouses, inventory management, order processing, or even real-time delivery tracking solutions, making the delivery chain more reliable, and lifting a burden off businesses’ necks. Renda also allows van owners to get money by putting their vans for hire for deliveries.

To access its services, users have to fill out an online form, state the reason they are getting in touch and wait for the startup to contact them for further details.

Renda claims more than US$10 million of orders fulfilled in ten cities, 90+ warehouses, over 300 drivers, and a 96% fulfillment rate. It is among the nine African startups selected for the 2022 Techstars Toronto accelerator. It will thus undergo a 13-week mentoring program, a US$120,000 equity investment, and the opportunity to pitch for additional financing during demo days.

Adoni Conrad Quenum

The African startup ecosystem is currently dominated by the fintech segments, probably because of the continent’s low financial inclusion rate. The segment has become so attractive to investors with ever-rising VC financing and the number of innovative solutions developed by enterpreneurs is also on the rise.

Gwiza is a fintech solution developed by a Rwandan eponymous startup. It allows users to pay utility bills, manage their expenses, contribute to group events, donate to charities or even save money individually or join a group to save collectively.

Through its mobile -Android and iOS- app and USSD code (*737#), it allows users to carry out various financial operations or enter a password to access the collective savings group they belong to. Users who want to join new groups or create new ones can do so through the Gwiza Plus app or visit a nearby Gwiza office for more assistance.

Apart from allowing group savings, fundraising and bill payment, Gwiza also enables insurance subscriptions. Despite its features, which make it a worthy alternative to mainstream financial services, the startup is not yet gaining much traction. According to Play Store data, its Android app has been downloaded less than 100 times. It is true that with its USSD technology, it could be more popular in rural areas but, without official figures, nothing much can be said about it.

The fintech startup is among the six selected to participate in the second cohort of the Fintech Incubation program organized by the Co-Creation Hub (CcHub), Google, the Rwandan Ministry of ICT and the Mojaloop Foundation. In December 2022, in the framework of the program, it will present its idea to potential investors.

Adoni Conrad Quenum

The informal sector represents a sizeable portion of African economies. The situation negatively affects tax revenues in all the countries concerned. In Gabon, some tech entrepreneurs have launched an interesting solution that is expected to increase civic-mindedness, and hence increase tax revenues.

Gatax is an automated tax management solution developed by a Gabonese eponymous startup. It allows individuals and companies easy access to tax information.

From a smartphone or a computer, users can register and subscribe to a Gatax package, then fill out the required forms to be informed about the tax system, their tax status, benefits, etc.

The information the platform gives users depends on their subscription. The basic subscription (the free package) gives users information on the tax system and their tax status. Apart from the free package, the startup has three premium ones. The most expensive package gives users complete control over their tax situation by providing details on how to contact tax directorates, how to fill out their tax returns, and receive periodic alerts to avoid penalties.

The startup, which is still being matured at the incubator SING SA, aims to conquer a local market estimated at XOF2.4 billion. It aims to optimize tax collection and fight tax delinquency while empowering SMEs.

Adoni Conrad Quenum

Fintech is currently the most dynamic segment of the African tech ecosystem. It attracts a significant portion of financings and aims to foster financial inclusion on the continent.

Kiwe is a fintech solution developed by an Egyptian eponymous startup. It allows its users to transfer money in real-time, and quickly pay SMEs. It also helps event managers collect payments.

"We are strong believers in empowering freelancers and business owners by helping them identify their targets, level up their customer experience, and accept online and offline payments. Our vision is for KIWE to become a verb interchangeable with any word that speaks of payments. We strive to have our customers reach out to their phones instinctively whenever a receipt is printed, a cheque arrives at the table, or a friend’s pay-back is due," Kiwe explained in a release in 2021.

To fulfill its set mission, the startup developed a mobile app, accessible for Android and iOS devices. Once downloaded, the app allows users to register their accounts to start making transactions. In addition to the features mentioned above, the app also allows one-scan transactions, positioning itself as a pretty handy tool for making any type of payment. On PlayStore, it has already been downloaded more than 5,000 times.

Last month, it raised an undisclosed amount from vaIU, a subsidiary of universal bank EFG Herme Holding. "With its unique offering and simplified, engaging user experience, Kiwe will benefit greatly from leveraging our vast and ever-growing network of vendors. Hence, this is an investment that promises growth for all," said Habiba Naguib, Head of Strategy and Market expansion at valU.

Adoni Conrad Quenum

More...

In recent years, Africa’s booming tech ecosystem has attracted several investors. This dynamic environment encourages the development of various tech solutions to address local issues.

Nawali is a real estate platform developed by a Senegalese start-up, founded, in 2018. It allows the African diaspora to easily acquire real estate properties (from lands to turkey houses) in countries where it is currently active: Senegal, Mauritania, Gambia, Mali, and Côte d’Ivoire namely.

The platform functions like a marketplace where real estate properties are listed, allowing users to acquire any property they are attracted to.

The startup has developed several funding mechanisms allowing buyers to either pay in cash, by installments, or by joining Nawali tontine (a mutual savings scheme that allows users to save collectively and purchase properties at the end of the savings period when they collect the amount saved.)

Nawali also offers its buyers eco-friendly houses made of raw earth bricks. It recently launched a project aimed at building an eco-city in Southern Cameroon. In July 2022, the startup opened a funding round to raise €460,000 to support the project. According to its founder, Aïta Magassa, apart from helping create massive jobs for qualified workers, the project, which is “perfectly adapted to the needs in Africa,” would allow the African diaspora to reclaim its lands.

Adoni Conrad Quenum

In Africa, hospitals are still recording numerous deaths caused by the shortage of blood products. To solve this problem in his country, a Sierra Leonean tech entrepreneur has set up an e-health solution facilitating blood donation.

LifeBlood is a digital platform developed by a Sierra Leonean eponymous startup. It allows users to donate blood in a few clicks.

With its mobile app "Donate Blood," it streamlines the blood donation process. Once a user downloads the app and registers an account, he/she can carry out a blood test and, if everything goes well, donate blood and set a donation frequency. The app reminds its users of upcoming donations.

The Sierra Leonean startup has numerous blood donation centers, across the country. Its centers are usually set up in hospitals, giving users the choice to get to the centers closer to their homes or offices depending on their schedules. This approach helps users donate blood without causing much disruption to their tight schedules.

It also allows users to set up blood donation campaigns, and define the targets, periods, etc. With this feature, it aims to allow users to support its actions, therefore increasing the number of unpaid voluntary donors and improving the operational efficiency of blood services and the national blood safety service.

For its actions, the startup won the first prize of the Orange Social Venture Prize in Africa and the Middle East (POESAM), going home with a €25,000 check.

Adoni Conrad Quenum

The developer of the innovative tool is passionate about digital technologies given their importance in helping address key issues. He sees Nkwa as a way to improve the population’s financial discipline.

Nkwa is a web and mobile - available for Android and iOS devices- financial solution developed and launched by Cameroonian tech entrepreneur Akwo Ashangndowah in 2020. It allows users to regularly save money directly from their mobile phones simply and more safely for their future projects.

To start saving with Nkwa, users need to register and set specific targets, including duration or overall amount to save. Once the targets are set, the user can start saving via mobile money.

Like bank savings accounts, Nkwa offers a yearly 3% interest rate for amounts saved. In case of an emergency, users can withdraw the amounts they saved without waiting for their set targets or amounts. However, in that case, the startup applies a 5% penalty on the amount withdrawn.

In 2021, Akwo Ashangndowah explained that Nkwa helps users have a clear view and control over their money and the things they want to achieve with the savings since they are not required to make big savings.

Nkwa is an initiative of Maealth Tech Limited, an innovative company founded and led from 2015 to 2020 by Akwo Ashangndowah, who has also worked in the health technology. In October 2022, the startup was selected as one of 15 African fintech startups that will participate in the fifth edition of "CATAPULT: Inclusion Africa" organized by the Luxembourg House of Financial Technologies (LHoFT). The start-up will also participate in the Arch Summit taking place on October 26-27, 2022.

Melchior Koba

Freight transport has become an attractive sector for tech entrepreneurs in recent years. The volume of investment and number of innovations is ever rising to allow timely and affordable deliveries.

Chargel is a digital platform developed by a Senegalese eponymous start-up. It allows truckers to quickly find clients without driving around with empty trucks. It also allows shippers to quickly find truck drivers to transport their goods at affordable prices.

It connects shippers and carriers, and offers value-added services like GPS tracking, discounted fuel purchases, and repair assistance to allow truckers to focus on their “core business and get shipments to their destination.”

Shippers can book available trucks instantly or in advance, track their goods in real time and get electronic proof of delivery.

The startup behind the solution aims to become the largest digital logistics platform in Francophone Africa. Earlier this year, it secured US$750,000 in pre-seed funding to support its growth. It is also hopeful for seed funding, by the end of the year, to scale up.

For Raja Kaul, founder and managing partner of Logos Ventures, one of Chargel's investors, the startup's founders are well "positioned to build Chargel into a leading logistics marketplace in Senegal, and eventually across West Africa."

Adoni Conrad Quenum