Solutions (581)

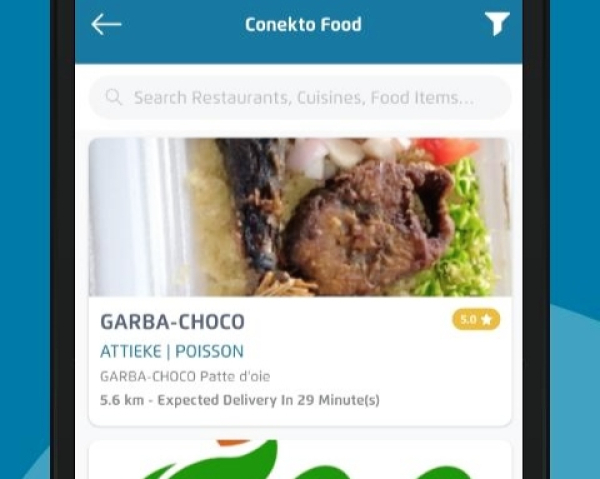

Since its launch in 2016, Mpoto, the startup behind Coneckto Food, has developed several interesting solutions in the Burkinabe market. The latest allows users to order food.

Conekto Food is a mobile app developed by the Burkinabe start-up Mpoto. It allows its users to order food in Burkina Faso. It also gives users the possibility to get the food delivered when needed.

The app is available for iOS and Android devices. To access its services, users need to create an account. Then, they can access the menus offered by listed restaurants and place orders. When ordering, they can ask restaurants not to add so or so ingredients to their foods. They can also choose whether the foods need to be delivered or they will pick them up. For payment options, they can pay either with cash or by mobile money.

In 2021, Mpoto announced that Conekto Food was already downloaded more than 2,500 times. On Playstore, which is the official app store for Android devices, the app has been downloaded some 100 times.

Currently, the solution covers only Ouagadougou, Burkina Faso’s capital. It lists over twenty restaurants with hopes to conquer other towns and restaurants in the near future.

Adoni Conrad Quenum

The solution aims to help law enforcement agencies help as many people as possible in some of DRC’s regions where residents are faced with numerous security challenges.

SOS Secours is a digital solution developed by Congolese start-up Yangu. It helps users notify the startup and get help when their lives are endangered. It has an Android app that can send alerts or even report incidents.

With the app, users can send geolocalized alerts by just shaking their phones. They can also “use the call and messaging options to notify the relatives they selected when activating the app,” Yangu explains.

When it receives an alert, Yangu -thanks to a team of experts- analyzes the threat and sends support or emergency help as needed. The startup also analyses the various threats to pinpoint the locations where users can face such threats at a given period.

Adoni Conrad Quenum

She got her agritech business idea during an academic internship. With some of her classmates, she developed a system to reduce the post-harvest losses incurred by smallholder farmers in her country. Thanks to her system, she has earned several awards and recognitions.

Sara Benlafqih (photo) is a Moroccan industrial management engineer. She is also the CEO and one of the co-founders of agritech startup BMTA&C which develops innovative solutions to challenges like access to energy and food insecurity.

Through BMTA&C, she created a storage unit to help farmers extend the shelf life of their crops from 2 to 20 days. The unit uses a solar cooling system to help smallholder farmers in remote areas reduce crop losses in Morocco and the sub-region.

The said unit was inspired by a discovery Sara made during an academic internship. Indeed, she found out that farmers used to lose almost one-third of their harvest yearly just because they had no storage facility. The storage unit she created can now store up to six tons of fruit and vegetables without using coolants, which are harmful to the environment.

“By giving access to clean, reliable, and affordable energy, our technology promotes food security, fights climate change, and improves farmers’ livelihoods,” Sara told Forbes in early 2022.

Before launching BMTA&C, the CEO who holds an MSc in industrial management engineering interned at various companies and organizations. In June 2017, she was a blue-collar intern at OCP SA, a mineral exploration firm. The following month, she spent a two-week summer internship at Cardiff Metropolitan University. In April 2018, she took on a 1-month shadowing internship at the mining firm Group Managem.

From June to August 2018, she was an engineering intern at the Portuguese group Águas de Portugal (AdP). Her last internship was in 2019 with an end-of-studies internship at the Mohammed VI Polytechnic University, where she got her MSc in industrial management engineering.

In 2017, she was a speaker at the Dean’s Forum held at MINES ParisTech. The following year, she was also a speaker at the Economy Days, in Lyon, Paris, where the discussions revolve around the growth of the digital sector in Africa.

Nominated for the Aviram Awards - Tech for Humanity launched by the Aviram Family Foundation and Forbes to celebrate the most impactful startups in the Middle East and North Africa in 2022, Sara Benlafqih's startup participated in the four-month accelerator program, MassChallenge Switzerland 2022. In 2021, it was in third place in the EDF Pulse Africa 2021 innovation competition and was the Grand Prize winner of the Global Food Challenge.

Melchior Koba

The solution was launched to provide reliable and quicker courier and delivery services.

ChapChap is a digital solution developed by Togolese start-up GLC Services. It allows users to get packages delivered through its web platform or mobile application.

According to Alao Lawal, one of GLC Services’s co-founders, ChapChap is an outstanding platform launched to meet the demand of organizations that need quick and reliable courier services.

From the solution’s online platform or its mobile app -available for Android and iOS devices-, users can create their accounts and start placing delivery orders. Once they place orders, they can track them via the embedded geolocation feature.

ChapChap also gives users the possibility to plan when the parcels or any type of package should be delivered to the recipient. It also allows e-tailers to integrate its API into their platforms.

According to PlaySgtroer data, the Android version of ChapChap has been downloaded more than a thousand times.

Adoni Conrad Quenum

During the Covid-19 pandemic, remote education proved a crucial choice to ensure education continuity in Africa. Since then, the edtech segment has been growing steadily with a growing number of Africans adopting this option to further their education.

Sweetch is an e-learning platform developed by a Cameroonian eponymous start-up. It allows its users access to paid and free educational content online. It aims to create new opportunities for people and businesses by leveraging emerging technologies.

The platform has a mobile application -accessible for Android and iPhone users- that enables users to register accounts to access the courses. The edtech offers a multitude of academic and professional courses as well as masterclasses in various fields. Users can choose to learn at their own pace by defining their schedules. They can learn by watching high-quality videos and reading slides and PDFs and asking coaches questions when they don’t understand some topics.

The platform also offers live courses, training, and workshops. Learners can interact with the trainers, which greatly expedites the learning curve. Learners can also take part in live events such as webinars, fairs, conventions, forums, exhibitions, etc.

In June 2022, Sweetch was claiming over 2,500 members and setting its sight for 10,000 members and 200 trainers by January 2023. It also hopes to expand to 15 countries in the next 24 months.

Adoni Conrad Quenum

The recent rise in e-commerce adoption in Africa has boosted the interest in last-mile delivery solutions, encouraging a growing number of startups to enter the segment.

Messenger is a digital platform developed by a Nigerian eponymous startup. It allows users -individuals or small and medium-sized businesses to deliver goods across Nigeria.

It also provides "premium haulage and cold-chain delivery services for large-scale clients across, in addition to last-mile delivery services for e-commerce and small business owners."

With over 40 bikes and motorcycles, and about 50 employees, the startup serves over 25 Nigerian cities. It boasts all the tools required to fulfill various orders including on-demand shipping services, transportation, cold chain solutions, warehousing, or last-mile delivery. Its ambition is to the start-up has all the tools to fulfill these various orders. Its ambition is "to become a globally recognized logistics and dispatch company reputable for package

delivery and haulage inNigeria.”

Thanks to its system, the start-up has signed partnerships with companies such as Jumia Foods and DHL Express Nigeria. In 2022, co-founder Amanda Etuk was selected as one of the 50 finalists of Africa's Business Heroes competition.

Adoni Conrad Quenum

With the emergence of digital reading platforms, it has become easier to sell content online. In Egypt, a tech entrepreneur offers a similar solution to Arab authors.

Kotobna is a digital platform developed by an Egyptian eponymous startup. It helps Arab authors publish their content online and get an audience.

Apart from its web platform, the solution has a mobile application accessible on Android and iOS. Through the app, Internet users can access various books, including short stories- collections, poems comics, biographies, and specialized books.

With Kotobna, the Egyptian startup offers an alternative solution to authors who are unable to get their works published, and above all to new authors.

Its pricing strategy depends on the popularity of the book. According to Egypt Innovate, the books are free for the first 25 readers and then, the startup starts charging “readers a small fee to benefit the writer.”

It is really easy for authors to join the platform. They just need to register as a new user and click on the “Publish your book now” link on the homepage. Then, they will follow the required procedure.

In August 2022, the platform’s founder, Mohammed Gamal, was selected as one of the 50 finalists for Africa's Business Heroes competition, which entitles finalists to a slice of a US$1.5 million prize fund.

Adoni Conrad Quenum

The solution was initially developed to help one of the co-founders' sister overcome dyslexia, a learning disability that can pose huge problems for children.

Sghartoon is a teletherapy platform developed by a Tunisian eponymous start-up. It helps parents and therapists detect learning difficulties, including dyslexia in children, and turn them into "superpowers" through educational games.

Through its mobile app -available for Android and iOS devices, users can register for its services by creating accounts either as parents, therapists, or even a child.

The child can then take an online exam to detect the presence of a learning disability. If a disability is detected, parents and therapists can monitor children’s progress thanks to the games embedded in the platform.

Sghartoon also offers parents and therapists access to a digital game library, a patient management tool with the results of various sessions, and a calendar management tool.

Its Android app has already been downloaded more than a thousand times on PlayStore. In 2020, the startup was among the eight ventures selected for the fifth cohort of the Flat6Labs accelerator, winning a check of US$65,000. The following year, it was one of the eleven African startups that won the Migration Entrepreneurship Prize. The financial supports allowed it to accelerate its growth in the Tunisian market and consider a possible expansion to other countries.

Adoni Conrad Quenum

In African countries, small-scale farmers contribute a significant portion of the food supply. They are nevertheless affected by several problems including lack of funding, post-harvest, and yield losses. In Ethiopia, a tech entrepreneur has decided to tackle the issue of yield loss by leveraging digital technologies.

Lersha is a digital solution developed by an Ethiopian eponymous startup. It allows access to agricultural inputs for farmers and helps them hire mechanization services and request dynamic agro-climatic advice.

Smallholder farmers can access its services via its mobile app and call center. Once farmers download its app, they need to register their accounts by providing some personal information. The startup has also dispatched agents to familiarize farmers with the tools and services it offers. Via those agents, the farmers can also access its services.

Currently, Lersha has identified more than 44,160 farmers. It has deployed over 88 agents to manage those farmers and added more than 172 mechanization service providers to its database. Its Android app has been downloaded more than 500 times according to stats shown by PlayStore, the official Android Appstore.

In 2022, Lersha was among the eight startups selected for the Global System for Mobile Communications (GSMA) Innovation Fund which aims to support solutions that boost low-income and vulnerable communities’ capacity to adapt to, anticipate or absorb climate-related shocks or stresses.

Adoni Conrad Quenum

With the technological revolution underway, Africa needs to build its tech talent pool. The first step in that endeavor is to teach the youth how to code.

EaziCode is a digital platform developed by a South African eponymous startup. It connects young people who want to learn to code with experienced tutors.

"We were able to identify in our research that most local curriculums for primary and secondary education in South Africa do not have programming as a taught fundamental skill. Within an increasingly digital world, our goal is to bridge this gap and enable students to learn to program and build creative products at a much younger age," said EaziCode founder Thato Tshukudu to explain why the platform was launched.

Most of the courses offered feature a variety of fun programming activities designed to stimulate creativity. The curriculum is inspired by Google and the tutors are computer science students from South Africa's top universities trained to deliver the courses pedagogically.

EaziCode offers free and paid sessions. About 20 learners are taken in monthly for the paid sessions against some 30 learners for the free sessions monthly. At the end of their training, every learner receives a completion certificate.

According to Thato Tshukudu, the startup is mainly focused on the South African market but it plans to extend to other African countries. "We currently have two paid courses, introduction to web development and a Scratch course, which we have seen great financial success with. Due to our business model, we have very few operating expenses and thus it is easy for us to make a profit. We do believe that we are still in the early stages of our growth but with the current success of all our courses, potential partnerships shortly as well as our focus on growing our selection of courses, we hope to see an exponential increase in turnover," he indicated.

Adoni Conrad Quenum

More...

The solution helps Mauritians in need get loans and individuals help their compatriots while making small profits in the process.

FinClub is a fintech solution developed by a Mauritian eponymous start-up, launched in 2018. It allows users to borrwwo money directly from other users with no middleman in the process.

“FinClub acts as a facilitator to connect Lenders directly with Borrowers. Using a seamless and fully automated online platform, with minimal overheads, we pass on the savings to Borrowers who get competitive loans and to Lenders who get higher interest rates,” the startup explains on its website.

To access its services, users can register their accounts, either as lenders or borrowers, via the solution’s mobile app -accessible for Android and iOS devices-. Then they need to upload the required documents.

Once fully verified, borrowers can start borrowing funds for emergency purposes and lenders can put their money to work as FinClub connects to “credit-worthy” borrowers.

Currently, the solution’s Android app has been downloaded more than a thousand times on PlayStore. In 2022, FinClub was selected along with seven other Mauritian startups to take part in Viva Technology, one of the European most important tech events that help gain national and international exposure.

Adoni Conrad Quenum

The digital solution aims to help people stay fit.

Eat & Fit is a digital platform developed by a Tunisian eponymous startup to help its users have a good nutritional follow-up. It allows the said users to buy diet foods and have them delivered.

The balanced and varied meals it offers help users maintain the nutritional proportions required for specific purposes, be it weight gain, weight loss, or muscle toning. Every week, the platform customizes the meals and adapts them to help its users quickly reach their goals.

To access its services, users must register, subscribe to one of its plans and then meet a nutritionist for a complete assessment. The result of that assessment informs the instruction given to chefs for the meals delivered to every user. Users also receive nutritional and sports support with regular follow-up.

For a healthier environment, Eat & Fit seeks the best ways to reduce its ecological footprint. It also adopts a "zero waste" policy by calculating the exact amount of ingredients needed for every meal. Currently, it is only operational in Tunisia but, it plans to expand to other countries in the region.

Adoni Conrad Quenum

Although agriculture is a significant contributor to the economies of most African countries, the continent has no or just a few agricultural banks. This significantly impedes the development of the sector but, thanks to new technologies, entrepreneurs are stepping in to fill the void left by authorities.

Emata is a digital solution developed by a Ugandan eponymous startup. It allows farmers access to loans to invest in their farms. It also gives them the possibility to create an online business to sell their products.

"We invest in farmers and dare them to dream big. […] We install Emata on your cooperative or aggregator's computer and phone. Our local impact team trains your staff on how to use it. […]. The cooperative or aggregator uses Emata to register farmer deliveries, update prices, create payment schedules, and share daily SMS updates with farmers," the Emata platform indicates

The platform enables the collection of crucial data on new online business operations. Such data informs new decisions aimed at improving operating performance. It should also be noted that the startup uses credit scoring algorithms to identify good farmers and offer loans they can afford. According to Emata, these are "instant and affordable loans," that allows beneficiaries “to invest in the productivity of their farms.”

To date, the startup has supported 8,091 farmers, issuing 1,429 loans. In 2021, it was selected, along with 11 other startups, to participate in the third edition of CATAPULT: Inclusion Africa. This allowed Emata to gain visibility and strengthen its presence in the Ugandan market.

Adoni Conrad Quenum

Côte d’Ivoire currently has an important shortage of physicians, with 1.4 doctors for every 10,000 individuals. E-health solutions are therefore important tools that can help bridge the gap. In that context, Skanmed wants to help by leveraging new technologies.

Skanmed is an e-health solution developed by Ivorian start-up Skan Technologies, launched in 2011. It allows users to remotely consult doctors, notably general physicians, pediatricians, and cardiologists.

Once registered on the e-health platform, users can search for doctors by specialty or by name. They can click on each medical practitioner suggested to check their information, register on their waiting list, or request an urgent video consultation.

In addition to the online consultations, the healthtech solution also offers home service. It has a team of doctors and nurses ready to provide home care 24 hours a day.

In 2021, Skanmed was the winner of the CGECI’s Grand Prix Business Plan Competition. The healthtech also won the first innovation prize awarded by the Ivorian Ministry of Health the same year. Currently, it plans to conquer the whole country before expanding outside. However, its debut was shaky as Skan founder Anicet Amani explains.

"The main challenge we faced was the lack of trust. During the prospecting phase, after the first version of the app, hospitals and physicians were not buying into our idea,” he said. The skepticism, however, disappeared after the startup signed an agreement with the Ministry of Health.

Adoni Conrad Quenum