With 12,000 readers using his online bookshop, Vincent Milewa wants to transmit his love of reading to his fellow Kenyans. As his startup RafuBooks grows, he wants to attract more customers in other East African countries.

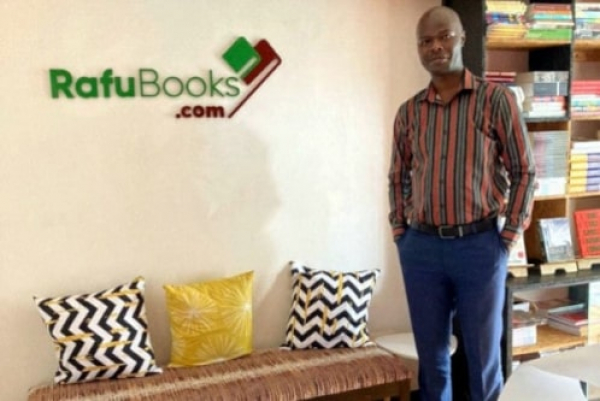

Growing up in a poor family, Vincent Milewa (pictured) used books as a roadmap to escape poverty. In school, he became fascinated with personal development and business. Later, he trained in computer science and worked in the telecom industry for more than ten years in sales and marketing. While going through a difficult phase in 2018, he dived back into reading but found it difficult to get the books he wanted. The idea came to him to create a library. That's how RafuBooks was born.

To make his project a reality, Vincent Milewa invested half of his monthly salary and received support from his family and friends. He was also able to secure some funding from an investment group of which he was a part. The resources collected allowed him to start his project in an office space with some books, a website, and three employees.

“I went through a tough phase in 2018 and read a lot. At some point, I was reading two to three books a week but obtaining them was a challenge and I hated going to town to shop. I had always wanted to start an e-commerce platform. At first, I had a small selection of books with the primary goal of fast, same-day delivery in Nairobi. People can order at 3 pm and still get it the same day,” he explains.

In a context where bookstores are not as common as other types of businesses, Vincent Milewa uses new technologies to ensure the availability of books for many Kenyans. To meet demand, he works with both international and local suppliers. “Nobody should wait for a book for four days within the same city, except if it is coming from abroad. Like food, it should be delivered fast,” he says.

RafuBooks initially sold novels and self-help books, before expanding to religious texts, textbooks, and children's books. Nearly 150 local authors are listed, with about 300 titles. Since its launch in 2018, the library has processed over 15,000 orders. In 2020, sales increased significantly as a result of lockdowns. The following year, the startup grew by 30%. The company currently has 12,000 registered customers on its website.

The main barrier to the company’s business is the lack of a reading culture in Kenya. “The number of bookshops in Nairobi says it all and most of what they sell are textbooks. The majority of Kenyans read for academic reasons, they do not read purely for enjoyment,” Vincent Milewa regrets.

The promoter has developed a gift strategy to retain his customers. “We realized books and gifts go well together. So, when we thought about diversification, we offered gift items such as chocolate, wine, and flowers. It has been a great learning experience for us, and the gift part has been an ideal complement to the book business,” he said.

For now, RafuBooks delivers to Uganda and Tanzania, but Vincent Milewa's vision for his startup is to become the Amazon of East Africa and provide other product categories besides books.

Aïsha Moyouzame

Senegalese computer engineer Adji Anta Dabo (pictured) develops a solution to facilitate birth registration in her country. With a degree in computer science, management and entrepreneurship, the young woman founded the startup Digital Nisa with partners. In 2021, one of her solutions, namely Sama Keyittu Juddu, won the third prize of the 2021 Orange Social Venture Prize in Africa and the Middle East (OSVP).

In Wolof, Sama Keyittu Juddu means "my birth certificate". The digital solution is a platform on which parents can register the birth of their child. The platform is associated with a bracelet attached to the wrist of the babies. On the seventh or eighth day, the bracelet will flash to remind parents who have not yet registered their newborn's birth to do so. The Sama Keyittu Juddu platform can be installed in maternity hospitals.

“The absence of identity documents […] violates the right to nationality, the right to claim civil protection etc.,” said Adji Anta Dabo who believes that her solution is an answer to this problem.

The entrepreneur has won several awards. In 2020, she won the 7th edition of the JIGGEN CITIC competition organized by the Ministry of Digital Economy with an amount of CFA1.5 million (nearly $ 2,500). She also won CFA3 million with the 2021 OSVP.

Adoni Conrad Quenum

After a recent $10.5 million fundraising round, Naqla is getting ready for a new stage in the development of its business in Egypt.

Egyptian logistics platform Naqla announced last March 7 it has raised $10.5 million in pre-series A funding. The company, which connects truck owners with freight companies, plans to use the money to digitalize its operations.

“We are now perfectly positioned to grow our digital logistics offering and market presence, bringing a much-needed technology infrastructure to the badly served Egyptian logistics and trucking industry, at a critical time in the country’s economic growth. We thank our investors for their part in the Naqla journey – this investment will enable rapid acceleration of our business and our planned vertical expansion into new segments,” said co-Founder and CEO Sherif Taher.

The fundraising comes three years after Naqla expanded into heavy-duty trucking in 2019, with a fleet of trucks carrying heavy items accounting for 16% of the company's business, and two years after its expansion into domestic light-duty trucking in 2020, transporting SMEs’ light materials. Since its inception in 2017, the company -which works with more than 400 shippers and 10,500 drivers across Egypt, claims to have delivered more than 4.6 million tons of cargo.

Egypt's logistics industry is worth an estimated $13 billion and accounts for nearly 3.5% of GDP, according to data published last December by Naqla.

Chamberline MOKO

A Graduate of financial management from Cadi Ayyad University in Marrakech, he also conducted research in information and technology at Ryerson University in Canada. In 2012, he joined Avito.ma as Finance and Administration Manager. Following the merger between Bikhir and Avito in 2014, he held key positions in the startup, in finance as well as Product and Business Development Manager. In 2016, he was appointed Director of Operations and Strategy, and a year later, he became the new CEO of Avito.ma.

Now at the head of the company, Zakaria Ghassouli wants to make it the leading platform for classified ads in Morocco. In October 2020, Avito.ma was acquired by Malaysian Frontier Digital Ventures after 6 years under the control of Norwegian Adevinta. The new parent company made a group shot, spending A$56 million (more than $40 million), to acquire Avito.ma, Tunisian classifieds site Tayara.tn, and Colombian real estate portal Fincaraiz.com.

"It allows us to continue to execute our strategy and to pursue the mission we have set ourselves. We want to assist Moroccans in the search for the best opportunities at every stage of their lives," said Zakaria Ghassouli. True to his development ambitions, he announced last March 6, a new offer targeting VSEs and SMEs. Called avitoboutiques.com, the new service aims to facilitate the transition of companies to the digital space and expose their brands to millions of potential customers. The decision to launch a digital store platform was driven by a sharp increase in the number of stores created on the Avito.ma platform by 2022. In addition to this, avitoboutiques.com will provide data analytics to help business owners make better decisions to improve the customer experience.

Avito.ma claims more than 6 million unique visitors and more than 28 million visits per month. Already present in the automotive, real estate, and IT/multimedia sectors, the new avitoboutiques.com platform will allow the startup to reach other sectors.

"As the first marketplace in Morocco, we have decided to help professionals in their transition to the digital by offering them the opportunity to reach more than 8.4 million potential contacts per month," said Zakaria Ghassouli.

Aïsha Moyouzame

Malian entrepreneur Hawa Bah (pictured), who operates in the e-commerce sector, has developed an online marketplace -Local Market Bamako- to facilitate access to local and neighboring countries' food products, as well as imported food products, in and around Bamako. With her service mainly accessible on Facebook and WhatsApp, Hawa Bah won the third Orange Prize for Social Entrepreneurship in Africa and the Middle East 2021 (Poesam). She was granted CFA3 million ($5,000).

"As part of our catering division, we cook and deliver meals (lunch) to organizations and individuals. We also provide catering services during events [...] we make daily African dishes: Kedjenou, foutou, tchièp, braised fish and chicken, woudjoula, peanut sauce, etc."

"As part of the sale of food products, we distribute fresh attiéké, plantain, seafood, and other products to supermarkets, restaurants, and individuals," she explains.

Hawa Bah holds a master's degree in business management and administration from the Ecole supérieure des hautes études technologiques et commerciales (HETEC) in Bamako and stepped into the entrepreneurship world after her training. She launched the Local Market Bamako Facebook page in July 2019.

Today, she seeks to better organize her activity. Under her expansion plan, she plans to develop a mobile application to strengthen visibility and facilitate the ordering/purchasing process for customers; integrate breakfast and dinner services in addition to lunch; establish a physical headquarters to house the different activities, the staff and to provide on-site service. Hawa Bah will also install a cold room to expand her range of products and increase storage and packaging capacity.

Adoni Conrad Quenum

Since 2019, she has been accumulating awards that testify to the great value her commitment has according to various public and private actors. In addition to her skills as a graphic designer, Winnie Katengwa Nyota (pictured) has added several others throughout her career. She also developed skills in tech innovation, which she combines with her first passion, drawing.

Her endeavor earned her the 2nd Orange Prize for Social Entrepreneurship in Africa and the Middle East (Poesam) in 2021. She won this award with Android Africa, a smartphone interface that she designed to promote African culture. The icons used to access functions are different from those found on most smartphones.

Android Africa is a tool of knowledge within reach of the hands, the promoter said. The idea is to bring a typically African added value to the mobile industry through apps oriented to several themes such as learning African languages and networking. It can help people find their country of origin, region, ethnicity, etc.

Winnie Katengwa Nyota wants to show a continent rich in its diversity, beautiful in its cultures, population dynamic, and open to life to those who only know Africa through the images of war, famine, political instability, and poverty conveyed by foreign media.

In February 2021, at the Academy of Fine Arts in Kinshasa, she was nominated for the second edition of Sodeico's 100 jeunes pages d'espoir initiative, in the "solution through technologies and innovations for creation" category. She was also laureate of the 2019 Inventor and Innovator Masterclass organized by the Ministry of Industry in collaboration with the Ministry of Scientific Research and Technological Innovation.

Muriel Edjo

Almost seven years after launching, the online payment company has entered a fourth African market. Its ambition remains to make digital payments accessible to a larger number of people.

Paydunya, the Senegal-based online payment start-up, has recently started operations in Togo.

Already present in Senegal, Côte d'Ivoire, Benin, and Burkina Faso, Paydunya is coming to Togo with the ambition to “make digital payments accessible, regardless of the payment method used, regardless of the area and region, and regardless of the sector of activity, whether public or private.”

The payment aggregator maintains that it wants to provide "real added value" with secure solutions for receiving and making payments via mobile money (T-money, Flooz) and bank cards.

“We want to facilitate access to digital payments to all businesses regardless of their size or sector of activity and thus participate and contribute to the vast financial inclusion project in Togo,” Aziz Yérima, CEO of PayDunya told We are Tech. “Our launch in Togo is a response to the needs of our customers," intended to "provide them with accessible payment solutions,” he added.

A growing fintech ecosystem

In Togo, Paydunya joins a growing fintech ecosystem that has welcomed in recent years, young "promising" startups such as CinetPay, Semoa, and Gozem, the super App specialized in e-transport and e-logistics.

Paydunya, which reached 65,000 transactions per day in 2021, intends to take advantage of this Togolese environment that fosters digitalization and financial inclusion. Data from the BCEAO shows that over 72% of the Togolese population holds at least one account in a financial institution or a mobile money account.

Given the greater use of Mobile Money in Togo, since it was adopted in 2016, more Fintechs have been eyeing Togo. Wave, a mobile money solution - which Paydunya integrates into its range of solutions - is among them; it revealed plans to come to Lomé. Due to its competitive fee structure, the U.S. unicorn, whose operational base is in Dakar, will surely shake the Togolese mobile money transfer ecosystem (which is presently shared between Moov and Togocel), and aggregators like Paydunya could gain the most from this digitalization-driven disruption.

An idea born on campus

Paydunya’s founders, Aziz Yerima, Youma Fall, Honoré Hounwanou, and Christian Palouki, came up with the idea in 2014 while studying at the École Supérieure Multinationale des Télécommunications (ESMT), in Benin, Ivory Coast, Senegal, and Togo. They launched the fintech the following year.

In 2021, nearly 7 years later, the fintech claims to have processed more than 15 million transactions valued at CFA 110 billion. Its customer base is estimated at more than 1,200 B2B clients.

Fiacre E. Kakpo

The Congolese government has since 2019 stepped up initiatives to develop the digital economy in the country. Beyond connectivity infrastructure, it has also made the innovation industry – a major job generator- a priority.

The government of the Republic of Congo is working on a specific legal framework for startups. The related bill was approved by the Council of Ministers last March 2. The document was then submitted to Parliament for review by Léon Juste Ibombo (pictured), the Minister of Posts, Telecommunications, and the Digital Economy.

If it is validated, it will foster the implementation of various administrative, financial, fiscal, and measures that will promote the development of tech entrepreneurship in the country. Leon Juste Ibombo explained that the government decided to develop this tool due to "the absence of a specific legal framework for the digital industry, the lack of adequate funding, and the difficulties of access to public procurement as well as the absence of a strategy to promote innovation.” The law provides for a “startup” quality label that will only be issued to young companies that have met certain conditions.

Startups are increasingly gaining ground in Africa. Between 2015 and 2021, the amount they managed to raise increased from $277 million to $5.2 billion. Fintech, e-logistics, e-commerce, e-health, have gained value with Covid-19. As digital transformation has accelerated on the continent, the Congolese government wants to enable local innovators to also benefit from the growing business opportunities.

In its report "2021 Africa Tech Venture Capital", Partech reveals that Congolese startups captured $1 million from investment funds and other VCs in 2021. Senegal, which has been enjoying a startup law since December 28, 2019, saw the volume of funds raised by its startups reach $353 million in 2021. It was $6.50 million in 2016 according to Partech.

The new framework in Congo will facilitate the emergence of more tech innovators and entrepreneurs who will promote a dynamic local industry.

Muriel Edjo

For nearly 20 years, Baratang Miya (pictured) has been encouraging women and girls to step into STEM. In 2003, she founded GirlHype to pursue her vision.

The South African entrepreneur had the opportunity to strengthen her coding skills in Silicon Valley, in the U.S., after being selected by the TechWomen program. The idea for GirlHype was born out of Baratang Miya's personal experience. When she was a university student, she did not know about the Internet. Later, one of her acquaintances introduced her to the digital world. “It has changed my life to the level I could never have dreamed of. It has taken me to the policy level to speak at platforms like the United Nations. I’ve just come back from the UN, in December, speaking as one of the high-level panel members at the Internet Governance Forum,” she remembered.

GirlHype combines both theoretical courses and practical experiences in the field of computer science. The organization offers girls and young women the opportunity to participate, develop technical skills and social skills necessary to fully engage in the new 21st-century job market and higher education.

Baratang Miya’s mission is to address gender inequality in access to digital opportunities and skills. Her work has earned her partnership with international organizations, including UN Women, Mozilla, TechWomen, Silicon Cape, and Technovation. In December 2021, she attended the UN Internet Governance Forum where she shared her vision. "It is high time that the United Nations takes the initiative to ensure that no one is left behind, especially women and girls," she said.

African girls and women should be at the heart of global technology solutions that will be used by their communities, she believed. "We are committed to preparing each of our students to be problem solvers, collaborative leaders, and innovative entrepreneurs of tomorrow," she said.

Aïsha Moyouzame

Over the past five years, the Ghanaian government has developed various means of securing tax revenues from the exploitation of its subsoil resources. The measures have been reinforced with digital tools.

Ghana has digitized its national laboratory for the analysis of all precious minerals intended for export. The transformation of the facility managed by the Precious Minerals Marketing Company (PMMC), was unveiled last March 2 in Accra by Vice President Mahamudu Bawumia.

Nana Akwasi Awuah, MD of PMMC, explained that the digitization of assays will now make it possible “to generate assay certificates which have unique security features. These unique features will make it difficult for gold scammers to follow to facilitate their dubious activities.”

“Digitization has also now made it possible to monitor in real-time, gold exports passing through the National Assay Laboratory. At the click of a button, persons given access to the dashboard can see, in real-time, the amount of gold exported in both kilograms and ounces, where it was exported to, the value in Ghana cedis and dollars, the withholding tax, the exporter, and many other relevant data to aid national economic planning,” he added.

The transformation of the precious minerals analysis laboratory is part of the government’s strategy to secure tax revenue from this sector. Five years ago, the President of the Republic ordered the government to identify a means of independently verifying gold exports. The PMMC officially started operations in February 2018 following several engagements with the Ghana Chamber of Mines, the Association of Gold Exporters, and the Ghana Chamber of Bullion Dealers.

"President Nana Addo Dankwa Akufo-Addo recognizes that our progress as a nation in the modern world is inextricably linked to digitalization and will, therefore, continue its adoption for enhanced service delivery. It is a critical path for our nation to remain competitive in the world of today and tomorrow," Vice President Mahamudu Bawumia said.

Adoni Conrad Quenum

More...

Moroccan B2B e-commerce and retail startup Chari.ma announced it has made an offer of $22mln to acquire consumer credit company Axa Crédit.

“We are thrilled to announce a cross-selling partnership between Axa Insurance Morocco and Chari. This partnership will allow Axa Insurance to keep growing on the Moroccan market and play a central role in financial inclusion,” commented Meryem Chami, CEO of Axa Assurance Maroc.

The offer comes less than a month after Chari.ma raised an undisclosed amount of funds. The company co-founded in 2020 by Ismaël and Sophia Belkhayat, had indicated the new capital valued it at $100 million. Chari.ma also announced it would, following this operation, test the Buy Now and Pay Later service with its customers, before considering an extension into the customer loan sector.

The new partnership will allow Axa to refocus on insurance, its core business. Chari.ma, for its part, could now offer credit to its customer base of consumer goods retailers. The company will use the Karny.ma platform, which it acquired in August 2021, to assess the creditworthiness of its unbanked customers with no credit history. These retailers will in turn be able to grant consumer products on credit to their customers.

Chamberline Moko

The low bancarization in Africa has long kept a large part of the population away from traditional financial services such as savings and credit. Tontines have become the way for the unbanked to access these services.

To make this informal savings method more effective, given its proven social impact over many years in Africa, Nigerian Bernie Akporiaye launched MaTontine- a financial service platform that uses digital technology to modernize traditional savings circles. MaTontine, currently available in Senegal, provides access to small loans and a range of financial services such as micro-insurance to its customers. “We solve the problem by utilizing mobile phones and our platform to digitize the benefits of traditional savings circles (ROSCAs), thereby reducing the cost of borrowing by 75% or more,” explains Bernie Akporiaye.

The platform's members contribute to an online kitty and collect the amount in turns. According to Bernie Akporiaye, members receive a credit score based on their payment morality, from which partners can offer them small loans or contracts. The use of the basic service is free of charge, the startup being financed via the commissions taken from the services of its partners Cofina and Sunu Assurance.

The particularity of MaTontine is that it uses old-generation mobile phones, unlike most competing fintech companies that use smartphones; 90% of the platform’s members are women. Bernie Akporiaye stressed that the Covid-19 pandemic has highlighted how vulnerable these women are, most of whom “live on less than $5 a day." MaTontine is therefore working on integrating other services such as financial education, to better prepare users for a possible future crisis.

The startup won the 3rd prize in Orange’s AfricaCom Awards competition in 2016 and a grant from the GSMA Ecosystem Accelerator innovation fund in February 2018. It was honored in 2019 by Inclusive Fintech 50 Fintech, an initiative by MetLife Foundation, Visa, Accion, and IFC. Since its launch, MaTontine has registered 6,000 customers and disbursed $200,000 in loans.

Ruben Tchounyabe

French banking group Societe Generale is ending its mobile money service YUP, created in 2017, in Côte d'Ivoire, Senegal, Burkina Faso, Cameroon, Guinea, Ghana, and Madagascar. The information was disclosed in a letter sent on March 1, 2022, by Nicolas Pichou, CEO of Societe Generale Cameroon, to his employees.

"Dear colleagues, 5 years ago, anxious to promote financial inclusion and facilitate access to innovative fund transfer means by notably dematerializing companies’ payment flow, the AFMO (Ed.note: Africa and the Middle East) Business Unit launched an electronic money service and created a dedicated entity YUP. Despite all the efforts made by the YUP teams in the 7 geographic zones concerned, including Cameroon, to develop our market share and improve the experience, the service has not succeeded in creating a viable model and the market outlooks do not comfort us in planning for the continuation of this segment. In that circumstance, Societe Generale Group, in consultation with all its local subsidiaries, took the difficult decision to stop the operations of YUP in all the geographic areas where it was deployed,” explains the letter sent by Nicolas Pichou.

In short, despite all the resources deployed over the past five years to capture shares of the highly dynamic mobile money market, YUP has proven unprofitable for Société Générale. In the case of Cameroon, the reason for this failure is the undisputed supremacy of the country's two main mobile operators (MTN and Orange namely) in this market. Those operators entered the local market almost ten years before YUP and have had the opportunity to establish a network that leaves almost no room for newcomers.

Over 19 million active mobile money accounts

In July 2021, when celebrating its 10th anniversary in the Cameronian mobile money market, Orange Cameroon claimed it was controlling 70% of the market share, with cumulative transactions amounting to CFA800 billion yearly. "When I say cumulative transaction values, I mean deposits and withdrawals, money transfers, bill payments, salary payments, and everything else that is merchant payment, etc. Our daily cumulative transactions amount to CFA3 million,” explained Emmanuel Tassembedo, director of Orange Money Cameroon.

MTN Cameroon is a bit cautious as far as its mobile money market share is concerned. Its executives claim MTN Mobile Money had 5.6 million active subscribers in the second quarter of 2021, at least 168,000 points of presence across the country, including 108,000 merchant points and 60,000 distribution points.

Both operators offer innovative services like insurance subscriptions and tax payments. According to the Ministry of Finance, in Cameroon, close to CFA10 billion of taxes were paid through the two mobile money operators.

Let’s note that Cameroon is CEMAC’s leader in the mobile money segment. According to data published by the central bank BEAC, in 2020, there were 19.1 million active mobile money accounts in Cameroon. This was 64.8% of the 30.1 million mobile money accounts active in the CEMAC region whose membership includes six countries (Cameroon, Congo, Gabon, Chad, the Central African Republic, and Equatorial Guinea). During the period, mobile money service providers active in Cameroon carried out 73.13% of the transactions recorded in the community space.

Brice R. Mbodiam

Malian pastoralist communities now have a digital solution to help them identify good pastures for their herds. The solution -STAMP (Sustainable Technology Adaptation for Mali’s Pastoralists) - is the fruit of a public-private partnership between the Malian Ministry of Agriculture, Livestock and Fisheries, Orange-Mali, the herders' organization "Tassaght," the international remote sensing service provider HSS, and the Netherlands International Development Organization (SNV). It was launched in 2017, the year in which the service won the 1st Orange Prize for Social Entrepreneurship Mali.

STAMP is a response to the grazing problems of pastoral populations in the Gao region, where industrial and agricultural activities, human and animal overpopulation, and climate change have reduced resources for livestock. The solution provides the beneficiaries with geo-satellite information on the availability and quality of biomass for feeding their livestock, the availability of surface water for watering, and also the concentration of animals around these resources. It also provides information on livestock and grain prices, as well as advice on animal health and financial products for livestock farmers. Users only have to call a center managed by Orange Mali or dial a USSD code on basic mobile phones to instantly obtain important data for their movement.

On December 17, 2020, during a press conference in Bamako, Thomas Sommerhalter, the STAMP project manager explained that the "producer surveys (carried out as part of the project, ed) revealed that reliability and the need for timely information are key to decision-making by pastoralists."

STAMP also integrates two other services to help farmers obtain information on weather, planting methods, seeds, planting time, fertilizers, etc. The head of the corporate social responsibility division at Orange Mali, Abdoul Malick Diallo, explained that the client advisors speak local languages, including Fulani, Dogon, Songhai, and Bamanankan to facilitate talks with the community.

Ruben Tchounyabe