PayBox Revolutionizes Cross-Border Payments in Africa with Buddy App

Ghanaian fintech startup PayBox has launched a mobile application that leverages blockchain technology and artificial intelligence (AI) to reduce transaction fees and simplify cross-border payments.

The application, Buddy, offers streamlined financial solutions for small and medium-sized enterprises (SMEs) across more than 23 African countries.

By functioning as both a mobile and decentralized app, Buddy offers a user-friendly interface, empowering users to manage their personal and business finances with ease.

Egyptian Fintech Startup Lucky Raises $3 Million to Expand Credit Services

Lucky, an Egyptian fintech startup, has secured a US$3 million in a funding round led by Lorax Capital Partners, KEM, DisrupTech Ventures, and other existing investors.

The newly raised funds will be strategically allocated to expand Lucky's credit services, reinforcing its position as a leading consumer credit fintech in Egypt.

Lucky offers financial flexibility and increased spending power through its lending schemes, discounts, and cashbacks.

Nigeria to Regulate the Crypto Industry by September 2024

Over the past five years, Nigeria has experienced significant adoption of crypto assets, coinciding with successive declines in the value of the naira. The government, viewing these assets as contributing to the depreciation of the local currency, has decided to regulate the sector to restore order.

The Nigerian government is set to regulate the cryptocurrency industry by September 2024. Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service (FIRS), announced this during the FIRS 2024 Stakeholders Engagement with the Senate and House of Representatives Committees on Finance on August 17.

The proposed legislation will address the regulation of cryptocurrency transactions, an area currently lacking legal oversight in Nigeria. "While we cannot ignore cryptocurrency as there is currently no law in Nigeria regulating it, there is a need for legislation to govern this type of transaction," he stated.

In parallel, the Securities and Exchange Commission (SEC) is encouraging virtual asset service providers to join its Accelerated Regulatory Incubation Programme (ARIP) to expedite their registration and compliance with the upcoming Digital Assets Rules.

Nigeria is currently Africa’s largest cryptocurrency market and one of the leading markets worldwide. According to New York-based research firm Chainalysis, the country ranked second in the 2023 Global Crypto Adoption Index that measures crypto adoption across the globe. The widespread adoption highlights the need for a legal framework that can both harness the economic potential of cryptocurrencies and address associated risks, ensuring that the sector contributes positively to Nigeria's economic development.

Hikmatu Bilali

Flutterwave Gains Enhanced Payment License in Ghana

Pan-African fintech firm Flutterwave has been granted an Enhanced Category Payment Service Provider license by the Bank of Ghana, it announced on August 1. This license enables Flutterwave to offer a wide range of payment services directly in Ghana, eliminating the need for third-party services and simplifying payment processes for businesses and consumers.

The firm aims to unify the fragmented payment infrastructure in Africa and support local fintech companies, contributing to a more integrated financial ecosystem.

Kenya: DTB Partners with Network International to Enhance Digital Payments

Kenya's Diamond Trust Bank (DTB), listed on the Nairobi Securities Exchange, has teamed up with Network International, a top digital commerce provider in the Middle East and Africa (MEA). The partnership, announced on July 23, aims to enhance DTB's digital payment solutions.

DTB, with over 155 branches in East Africa, aims to leverage Network's advanced payment solutions and security protocols amidst growing digital payment adoption. The partnership includes debit, credit, and prepaid card processing, e-commerce, fraud prevention, and more.

Zimbabwean Financial Firm Launches Platform to Improve Remittance Sector

Zimbabwean financial firm BARD Santner Incorporated launched TX Money Transfer on July 10. The new platform is designed to enhance reliability and transparency in the remittance sector.

BARD aims to improve transparency regarding charges to avoid hidden costs and foster collaboration to eliminate process bottlenecks.

With the launch of TX Money Transfer, BARD Santner aims to set a new standard in Zimbabwe's remittance sector, ensuring better service for clients and strong business returns.

Tanzanian Payments Company Nala Secures $40M Series A Funding

Nala, a Tanzanian payments company headquartered in Kenya, has raised $40 million in Series A funding, Founder and CEO Benjamin Fernandes announced on July 9, on X. The fund will support the company’s global expansion and enhance its payment systems in Africa.

Nala allows users to transfer money from the UK, US, and EU to Kenya, Uganda, Tanzania, Rwanda, and Ghana.

UNDP and Timbuktoo Africa Innovation Foundation Launch Fintech Hub in Lagos

Supporting and establishing youth-led tech startups can boost economic activities in finance, agriculture, and healthcare, contributing to overall growth on the continent. Such moves create jobs, address unemployment among Africa's youth, and provide livelihoods.

The UNDP and the Timbuktoo Africa Innovation Foundation launched the first Fintech Timbuktoo Hub in Lagos, Nigeria on July 9. This facility aims to drive innovation and growth within Africa's fintech ecosystem.

The moment is here!

— UNDP Nigeria (@UNDPNigeria) July 9, 2024

We are live at the launch of the premier #timbuktoo Fintech Hub.

Today, we are revolutionizing the future of fintech in Africa.

Join us: https://t.co/olFgxgSmlV pic.twitter.com/9i0oLVlBh8

Speaking during the launch, Ms Ahunna Eziakonwa, the UN Assistant Secretary-General and UNDP Regional Director for Africa,said: “Africa is the place where ideas comes from to unite the world. Our innovators are finding solutions to the most pressing global problems. timbuktoo is about changing the way development works and investing in young talents. I invite you all to join and begin to see Africa from the lens of opportunity."

Timbuktoo is a partnership between the UNDP, African governments, and the private sector, positioned as the world's largest initiative supporting Africa's innovation ecosystem and reshaping financial technology and development across the continent. Launched in January 2024 at the World Economic Forum in Davos and headquartered in Kigali, Rwanda, the initiative leverages collective power to create scalable and impactful conditions across Africa. Timbuktoo aims to mobilize and invest US$1 billion in capital to transform 100 million livelihoods and create 10 million dignified new jobs across African countries.

This hub, located at UNDP's Innovation Center in Lagos, isthe first of eight tech hubs, with additional hubs planned for 2024 in Kigali, Rwanda (Healthtech), Accra, Ghana (Agritech), and Lusaka, Zambia (Minetech). Forty-two young startups from 31 African countries have been selected for the first cohort.

The launch is pivotal to innovation and financial inclusion across Africa. It will serve fintech entrepreneurs, investors, and experts, offering collaborative workspaces, mentorship programs, and advanced technology to support startups across Africa in building impactful solutions.

Africa, with 60% of its population under 25, presents a fertile ground for innovation despite a low unique mobile subscriber penetration rate of 43% in 2022, according to the 2023 ‘Mobile Economy Sub-Saharan Africa’ report by GSMA. GSMA projects that by 2025, 634 million Sub-Saharan Africans (52%) will subscribe to mobile services, driving digital transformation.By nurturing local talent and fostering cross-border collaborations, the Timbuktoo Fintech Hub will play a pivotal role in shaping Africa's financial technology future, reflecting the UNDP's commitment to sustainable development through technology.

Hikmatu Bilali

Accelerex Launches "Pay with Fingerprint" Payment Solution in Nigeria

Accelerex, a leading African fintech company, has launched the “Pay with Fingerprint” solution, Nigeria's first biometric-enabled PoS payment system.

Designed to address card fraud and eliminate the need for physical cards, the technology allows bank account holders to make secure payments using their fingerprints at merchant locations.

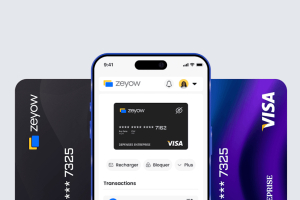

Benin: Fintech Startup Zeyow Empowers Online Shopping with Virtual Cards

With over 150,000 users in its four years of existence, according to the startup's data, Axa Zara offers several fintech solutions to African populations. The startup aims to become one of the leading players in this segment in Africa.

Zeyow is a fintech solution developed by the Beninese startup Axa Zara, allowing users to create virtual bank cards for conducting online financial transactions. Founded in 2019 by Elias Mahugnon Missihoun, the startup operates out of Abomey-Calavi (Benin) and Abidjan (Côte d'Ivoire).

“Axa Zara’s mission is to create infinite opportunities through technology. By leveraging the potential of technology, our goal is to provide access to new possibilities, break down barriers, and enable people from all walks of life to achieve their professional goals,” the startup explained to We Are Tech Africa. It continued, “We focus on developing digital solutions that are not only effective but also inclusive, ensuring that no one is left behind in the digital revolution.”

Zeyow does not have a mobile app. Users must access the service through a web browser by visiting the Axa Zara website. To use Zeyow, users click on “create an account” and provide information such as name, email address, and phone number.

After this step, users can create their virtual bank card and perform online operations like shopping on e-commerce platforms or subscribing to services. The card can be recharged using various methods, including mobile money, which is popular among African populations.

Talking about its continental expansion plans, Axa Zara says: “We are actively looking to expand into other countries. This process involves a rigorous market analysis to pinpoint exactly where the needs lie. We consider the local ecosystem and all available opportunities to ensure that our intervention is not only relevant but also beneficial to the communities we aim to serve.”

Adoni Conrad Quenum