To democratize access to long-term investments for young South Africans, two tech entrepreneurs have launched a fintech solution.

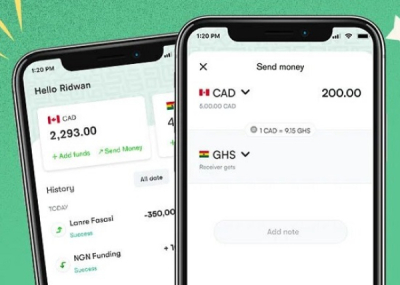

Fynbos Money is a fintech solution designed to simplify and make long-term investing more attractive in South Africa. Launched in 2024 by Matthew de Haast and Adrian Hope-Bailie, the platform offers an intuitive web-based interface that eliminates financial jargon and advisor fees.

“The platform is designed to make investing easy to understand by distilling the basics of long term wealth building into a platform that does it all for you without charging a share of your investment as a fee,” explains Adrian Hope-Bailie. “Instead we are trying to disrupt the way financial service providers structure their fees by only charging a flat subscription fee.”

Fynbos Money offers a free emergency account with low-risk savings that deliver an “attractive” annual return, as well as a savings account that allows users to choose from five equity funds to maximize long-term investment growth, all without capital gains tax. Unlike traditional platforms that charge fees based on the amount invested, Fynbos Money operates on a two-tier model: a free “Roots” plan and a paid “Protea” plan.

The “Roots” plan provides access to both types of accounts without requiring a subscription, enabling users to start investing with no upfront costs. The “Protea” plan, on the other hand, is a fixed monthly subscription that unlocks additional features, such as family accounts and dedicated savings options.

“We started with a friends and family pilot in October and have been growing steadily from there. We’re just over 2,000 users now and are seeing great growth week-on-week,” adds Adrian Hope-Bailie.

By Adoni Conrad Quenum,

Editing by Feriol Bewa