Brief (431)

Egyptian Fintech Fawry announced on February 26 that it has invested 80 million EGP (1,579,200 US Dollar) in three leading Egyptian tech firms—Dirac Systems, Virtual CFO, and Code Zone. The new investment is part of the fintech’s strategy to expand its business solutions ‘Fawry Business’ and drive digital transformation in Egypt,

The EGX-listed company has acquired 51% of Dirac Systems, 56.6% of Virtual CFO, and 51% of Code Zone, strengthening its role as a one-stop provider of ERP, financial management, and digital payment solutions for businesses.

This investment aligns with Fawry’s vision to accelerate Egypt’s fintech and business technology sectors, equipping companies with cutting-edge digital solutions to enhance growth in an increasingly cashless and digital economy.

The GSMA Innovation Fund, supported by the UK Foreign, Commonwealth & Development Office (FCDO), is providing grants to small and growing enterprises (SGEs) using AI and mobile technology to address socio-economic and climate challenges in low- and middle-income countries (LMICs).

The fund is open to for-profit enterprises with up to 250 employees. Eligibale businesses must be based in Africa, South Asia, Southeast Asia, or the Pacific.

Successful enterprises will receive grants ranging from £100,000 to £250,000 for projects lasting 15 to 18 months. They will also gain tailored venture-building support, partnerships with mobile network operators, and increased visibility through GSMA platforms and events.

The deadline for pitch submissions is 19 March 2025.

Oze, a Ghanaian fintech startup supporting small businesses, has secured funding from Visa and German development finance institution DEG, it announced today February 24.

With this funding, Oze will expand its Lending Management System (LMS), enabling banks, microfinance institutions, and fintechs to offer no-collateral digital loans using its machine-learning credit risk algorithm.

Oze enables banks to automate lending while providing MSMEs with tools to track finances and customers. It analyzes this data to offer insights, training, and funding.

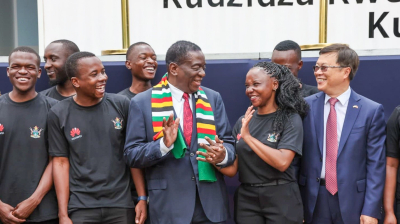

The President of Zimbabwe officially launched the Digital Skills Ambassador Program on February 19. This initiative aims to equip communities with essential digital skills, supporting the country’s vision of becoming a fully digital economy by 2030.

The program, backed by China and the United Arab Emirates (UAE), seeks to bridge the digital divide by empowering individuals with the knowledge and tools needed to thrive in an increasingly technology-driven world.

With this initiative, Zimbabwe takes a significant step toward enhancing digital literacy, boosting innovation, and preparing its workforce for the future.

South African Police Minister Senzo Mchunu has announced the rollout of body-worn cameras for police officers, starting April 2025.

The decision comes in response to a question from the Democratic Alliance, a South African nonprofit, asking when the police service will implement body cameras.

The South African Police Service (SAPS) revealed that it will purchase 100 cameras this year at R28,818 per unit, totaling R2.88 million annually and R14.4 million over five years.

The use of body cameras is crucial for enhancing transparency, accountability, and public trust in policing.

The Federal Ministry of Communication, Innovation, and Digital Economy has launched the National Girls in ICT Competition to increase female participation in technology. The initiative provides secondary school girls with a platform to showcase their skills in coding, web development, cybersecurity, and data analytics while addressing gender gaps in the industry.

Participants will develop hands-on ICT skills and gain recognition from industry leaders. They will also access mentorship, workshops, and networking opportunities.

Interested participants must register online and form a team of three with teacher support. Teams must identify a community problem and develop a tech-based solution. Applications close by March 6, 2025.

NIGCOMSAT invites Nigerian startups to develop innovative solutions using space technology. The program offers mentorship, global exposure, networking, and funding opportunities.

Applicants must be at least 18, have a registered Nigerian startup, possess a Minimum Viable Product, and integrate space-based technology into their solutions.

The application period runs from February 1 to March 17, 2025. The selection process will occur from March 24 to April 25, followed by the cohort presentation from April 28 to May 2. The program will launch on May 5, with an intensive deep-dive phase from May 12 to October 10.

Madica, a pre-seed investment program for African startups, announced on February 12, funding for four tech-driven ventures: Medikea, Motherbeing, Pixii Motors, and ToumAI.

Each received up to $200,000 and will join Madica’s 18-month support program, which includes mentorship, executive coaching, and immersion trips to startup hubs like Cape Town and London.

Marking its North African debut, Madica focuses on underrepresented founders in AI, FemTech, Mobility, and Healthcare. Affiliated with Flourish Ventures, it tackles funding and mentorship gaps in Africa’s startup ecosystem.

The Tony Elumelu Foundation (TEF) signed, on February 12, a $6 million partnership with the UAE Office of Development Affairs and the Khalifa Bin Zayed Al Nahyan Foundation to support 1,000 young African entrepreneurs with training, mentorship, networking opportunities, and non-refundable $5,000 seed capital each.

The agreement was signed at the World Governments Summit by TEF Founder, Tony O. Elumelu, and His Excellency Mohamed Haji Al Khoori, Director General of the Khalifa Bin Zayed Al Nahyan Foundation.

This initiative further reinforces TEF’s mission to empower young business leaders across all 54 African countries, strengthening Africa’s entrepreneurial ecosystem and driving economic growth on the continent.

Fintech Company Payaza has expanded to Ghana, introducing a ₵15 million ($973,000) business support initiative to help entrepreneurs, small businesses, and startups scale.

At its launch event, SME Thrive, attendees will gain networking opportunities, expert business insights, and access to funding and payment solutions designed to drive local and global growth.

Payaza aims to enhance financial accessibility and business expansion through seamless payment processing and tailored financial tools. This expansion cements Payaza’s role in boosting SME growth and strengthening Ghana’s digital economy.

More...

Digital banking platform Affinity Africa announced on February 11 that it had raised $8 million in an oversubscribed Seed Round led by Grazia Equity and BACKED VC to expand financial services for the unbanked.

Affinity operates a branchless model via a mobile app, agent network, and proprietary tech. Unlike traditional banks, it charges no monthly fees or transaction costs.

With this capital, Affinity will scale operations in Ghana and expand further across Africa, driving financial inclusion.

Fixed-satellite operator and service provider Spacecom announced on February 5 that it has signed a $3.8 million agreement with an undisclosed African government to deliver satellite communication services via the AMOS-17 satellite for a 12-month period.

This deal marks a major expansion of Spacecom’s operations in Africa, reinforcing its international presence in the satellite services sector.

With Africa's growing demand for reliable connectivity, Spacecom's expansion aligns with the continent's push for enhanced digital infrastructure, particularly in government, security, and public services.

Blockchain industry solutions provider StarkWare has launched a $4 million fund to accelerate blockchain adoption and support African startups. The fund, announced on February 4, is led by investor Kheireddine Kamal. It targets pre-seed and seed-stage startups deploying solutions on Starknet, StarkWare’s ZK rollup for Ethereum scaling.

Startups can apply for grants up to $150,000, with advanced teams eligible for investments up to $500,000. The fund will prioritize entrepreneurs in West, East, and South Africa, regions facing high fees, inefficient financial systems, and digital exclusion.

With this fund, StarkWare is paving the way for Africa’s blockchain-driven future by empowering startups and fostering financial inclusion.

Nigeria is set to develop a National Space Strategy to strengthen its position in the space sector, the Minister of Communications, Innovation & Digital Economy announced on February 6.

He met with Chief Uche Nnaji, Minister of Innovation, Science & Technology, to agree on the need for a clearly defined space policy. A committee with representatives from key government agencies will be established to shape the strategy.

Additionally, both ministries discussed the National Artificial Intelligence Trust, recently approved by the Federal Executive Council (FEC). The initiative aims to drive AI innovation and governance in Nigeria, with Minister Nnaji playing a key role in its implementation.