In the past five years, Africa’s startup ecosystem has grown rapidly and several unicorns were created. With new opportunities still open, the continent is sparking investors’ growing interest.

Japanese investment fund AAIC Investment announced Tuesday (April 29), the formation of the Africa Innovation & Healthcare Fund VCC (AHF2); its second investment fund dedicated to African startups. Supported by Asahi Intecc Co., Ltd., Eisai Inc., Ohara Pharmaceuticals, and major Japanese trading firms, the fund will support healthtech startups over the next ten years.

Currently, it is still open for subscriptions and will remain open until its closing at US$150 million.

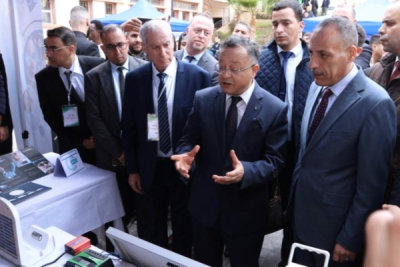

According to Hiroki Ishida (photo), AAIC Investment’s Principal and Representative of the Kenya office, “the fact that hospitals in Africa are still lacking in basic infrastructure highlights the greater importance of the role of technology in developing countries than in developed economies.”

“I am looking forward to the next ten years of development, which is also the period of operation for our second fund,” he added.

AAIC Investment launched its first Africa Healthcare Fund in 2017. Through the fund, it raised US$47 million, which was invested in 30 startups. One of those startups is Chipper Cash, a cross-border payment provider which became a unicorn in 2021. That year, the startup raised US$150 million in Series C funding, raising its valuation to US$2 billion.

AAIC Investment already has offices in Kenya (2015), Nigeria (December 2020), and South Africa (March 2022). With AHF2, it plans to expand its operational footprint by covering the whole of Africa.

In the past five years, Africa’s startup ecosystem has grown rapidly. The growth was recently accelerated by the coronavirus pandemic, which highlighted the importance of digital solutions on the continent. Nigeria, Kenya, South Africa, and Egypt have attracted a sizeable amount of investment due to their innovation-enabling ecosystems. According to Partech, those countries captured close to 74% of the overall investments attracted by African startups in 2021.

Muriel Edjo