BNPL (Buy Now, Pay Later) is a financing option that allows consumers to purchase goods or services and pay for them over time, usually with no interest if payments are made on schedule. In Senegal, a startup is offering a similar solution.

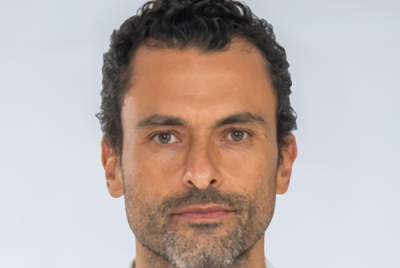

Nixacom is an online shopping platform developed by a Senegalese startup. It allows customers to purchase tech gadgets through a BNPL (Buy Now, Pay Later) system. Founded in 2023 by Cheikh Gueye, Elhadji Fall, and Wangel Yohannes, the platform offers a convenient way to access technology products.

Users can browse Nixacom’s web platform to access a wide range of products, including smartphones, tablets, and computers. "A customer logs onto our website and picks which product they are looking for, fill out a KYC, and once we receive all the information we see which of our partner institutions they are eligible with and get them financed directly through us, and get them their product," Cheikh Gueye told Disrupt Africa explaining the application process.

Nixacom works with various financial institutions, offering payment plans of 12 or 24 months based on the user’s income and the selected product. During the process, the startup requires documents such as an ID and proof of income.

However, it does not conduct a credit check when assessing the user’s eligibility. Application processing times range from 5 to 10 business days. "After approval, your product will be prepared for local pickup within 5 to 10 business days, and you will receive a notification when your order is ready for collection," Nixacom explained.

By Adoni Conrad Quenum,

Editing by Feriol Bewa