In order to provide employees with easy access to financial services, two tech entrepreneurs launched a custom fintech solution. They named it after salad, a dish known for its various health-benefiting ingredients.

Salad Africa, a fintech solution developed by a Nigerian startup, is designed to ease employees’ access to financial services through partnerships with employers. The startup, established in Lagos in 2022 by Chikodi Ukaiwe and Seunfunmi Omotunde, works directly with employers for prequalification and access to unique employee data. “By working with us, employers maintain their cash flow from no longer having to fund salary advances, boost their employees’ productivity and attract the best talent,” Ukaiwe said.

The fintech’s goal is to create a system that enables employees to access their wages on demand, avail of savings products and wealth-building, pay for airtime and internet data, or subscribe to online services. To achieve this, it has developed a mobile application, available on iOS and Android (downloaded over 500 times, according to Play Store statistics).

To use the service, users must create an account by providing information such as their company’s name and address, registration number, tax identification number, total number of employees, and volume of monthly payments. After this step, Salad Africa sends an email, and it takes 24 hours to finalize account creation following routine verifications. Once the account is created, users can access the services offered by Salad Africa.

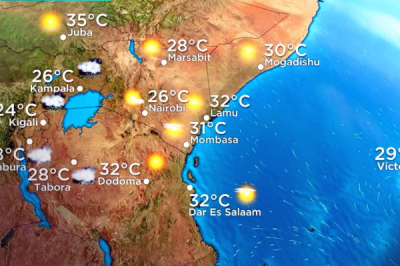

“Our services are live and available to employers and employees across all states in Nigeria, with plans to expand into Ghana and two new markets in East Africa over the coming months,” Ukaiwe told Disrupt Africa in May 2023.

Salad Africa charges transaction fees for all operations on its platform, including interest on loans, commissions from third-party financial service providers, and net interest income from customer deposits.

Adoni Conrad Quenum