Recognizing the increasing threat of cybersecurity breaches and digital fraud to African businesses, two tech entrepreneurs have developed a solution to address these critical issues.

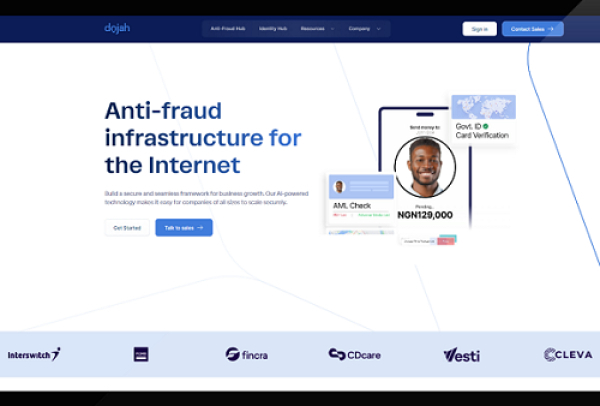

Dojah is a digital solution developed by a Nigerian startup to enhance cybersecurity in client onboarding processes. Through its API, the platform secures user integration by leveraging biometric verification (facial recognition and fingerprint scanning), official document analysis (national ID cards, passports, driver's licenses), and authentication via mobile and banking data. The startup was founded in 2021 by Tobi Ololade and Ayomide Oso.

"We help companies offering financial services and digital businesses stay secure, grow seamlessly, and ensure compliance. Our solution streamlines user onboarding, automates AML compliance checks, and proactively prevents fraud and identity theft through end-to-end verification and real-time monitoring," said Tobi Ololade.

Dojah enables businesses to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations while improving user experience with seamless identification processes. By integrating with multiple official databases and government services, the startup provides fintech companies, banks, marketplaces, and African startups with a fast and reliable solution to secure transactions and prevent identity fraud.

With clients across several African countries and strategic partnerships, Dojah aims to become the leading identity verification provider on the continent. Its flexible, API-based model allows for quick adoption across various sectors, from finance to on-demand services. In 2022, the startup was selected for Y Combinator’s Winter cohort, further accelerating its growth.

By Adoni Conrad Quenum,

Editing by Feriol Bewa