Many African populations lack access to traditional banking services. As a result, fintech solutions are growing in popularity across the continent. These solutions provide alternative ways to access financial services.

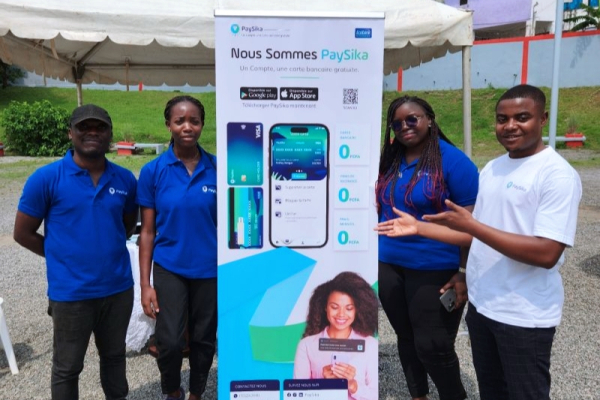

PaySika, a fintech startup based in Douala, Cameroon, provides users with access to online financial services through a smartphone app.

Founded in 2020 by Roger Nengwe Ntafam and Stezen Bisselou, it aims to create affordable, seamless, and transparent banking experiences, with a focus on simplifying online payments.

The mobile app, available on iOS and Android platforms, has garnered over 50,000 downloads on the Play Store. Through that app, users can create an account within minutes to access various services.

PaySika offers virtual and physical cards, allowing users to receive payments from PayPal, trading platforms, online betting, royalties from YouTube, Facebook, Instagram, TikTok, and many others.

The service enables purchases at local and international stores, ATM withdrawals worldwide, and card management features such as blocking, unblocking, deleting, or setting spending limits.

It charges 1% on online payments and ATM withdrawals, and 2% for international transactions and mobile money withdrawals. However, it does not charge for alerts, monthly management fees, or card maintenance.

The minimum recharge amount is XOF100 ($0.16), with a minimum withdrawal of XOF600.

In August 2024, PaySika was named among the twelve finalists in the Ecobank Fintech Challenge.

Adoni Conrad Quenum