In Nigeria, financial inclusion remains a challenge, as 36% of the population lacks access to banking services. Efforts are underway to expand financial services and ensure that everyone can benefit from technological and financial advancements.

On Monday, August 19, in Lagos, Nigerian businessman Tony Elumelu launched the operations of the new digital microfinance bank, UCEE Microfinance Bank. This institution is a subsidiary of United Capital Group, a major investment bank, and aims to harness the synergy between technology and finance to reach financially excluded populations in Nigeria.

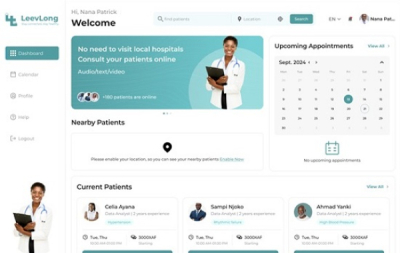

During the launch, United Capital Group CEO Peter Ashade praised UCEE Microfinance Bank's hybrid model, which combines traditional microfinance with digital innovations. "In today's market, it is essential to provide solutions that cater to both tech-savvy customers and those who prefer traditional banking. UCEE is well-positioned to address these diverse needs," he stated.

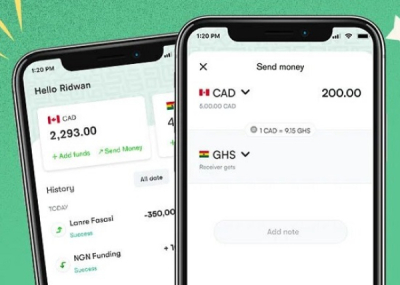

UCEE Microfinance Bank offers a mobile application that allows users to manage their accounts, access loans, and conduct transactions with ease, no matter where they are. Additionally, a USSD code will be introduced for customers in rural areas and those without smartphones.

The launch of UCEE, the seventh subsidiary of the group, marks a significant milestone in expanding access to financial services for all, particularly marginalized populations. This initiative is expected not only to support individuals and businesses in achieving their financial goals but also to help bridge the financial inclusion gap in Nigeria.

According to a report by EFInA, an organization that promotes inclusive finance in Nigeria, financial inclusion in the country has seen significant growth, rising from 56% in 2020 to 64% in 2023, reflecting ongoing efforts to make financial services more accessible to everyone.

Samira Njoya