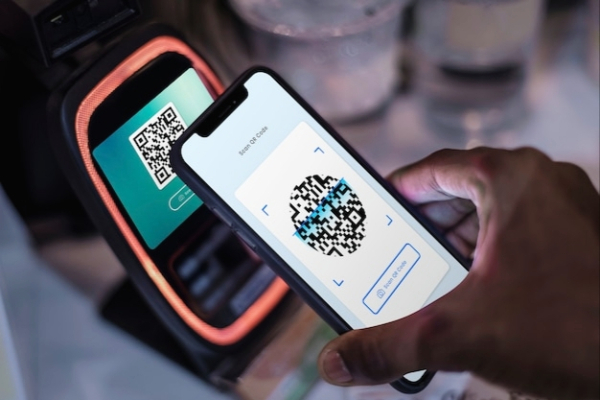

Digital payments in India have experienced explosive growth in recent years, largely due to the success of its Unified Payments Interface (UPI) system. Buoyed by this achievement, India has expressed its readiness to support other nations in developing their own digital payment systems.

India is working to assist several African nations in establishing their own digital payment systems, inspired by the success of its Unified Payments Interface (UPI). The National Payments Corporation of India (NPCI) has begun discussions with at least 20 countries across Africa and South America to adapt the UPI model, with the goal of enhancing financial inclusion on the continent.

Launched in 2016, UPI facilitates real-time payments, allowing users to transfer funds directly between bank accounts for both peer-to-peer transactions and transactions between customers and businesses. The system has already been successfully implemented in countries such as Sri Lanka, the United Arab Emirates, and most recently, Namibia. In February 2023, Mauritius also adopted UPI as part of a broader strategy that includes the introduction of RuPay cards.

The initiative to implement this payment system in Africa is motivated by the positive outcomes observed in India, where UPI has significantly transformed the financial landscape. By December 2023, UPI transactions reached 12 billion for that month alone, totaling over 100 billion transactions for the year and exceeding a value of $2 trillion.

In Africa, where a substantial portion of the population remains unbanked, this digital solution offers a vital opportunity to promote both digital and economic inclusion. A report from November 2023 by AfricaNenda, an independent organization focused on developing instant payment systems on the continent, indicated that 27 African countries have yet to adopt instant payment functionalities. Additionally, a McKinsey study forecasts that electronic payment revenues in Africa could reach $40 billion by 2025, underscoring the growing interest in investing in this infrastructure.

Samira Njoya