In a continent where access to formal banking services remains limited for many, providing citizens with unique digital identities can facilitate easier access to banking services and improve the efficiency of financial transactions, contributing to economic stability and growth.

Somalia has launched a digital identification system to advance digitalization and financial inclusion. To formalize this initiative, the National Identification and Registration Authority (NIRA) and the Somali Banking Association signed a Memorandum of Understanding (MoU), on August 25, at an event in Mogadishu. The event gathered several government officials.

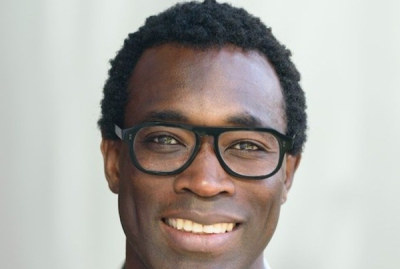

“We have signed a Collaborative Partnership with 13 Somali banks, creating a vital link between Identity Certificates and banking services,” NIRA Director General Abdiweli Timacade revealed in a post on his X account.

The initiative, Developed by the Central Bank of Somalia in partnership with the World Bank, provides citizens with unique identification numbers to facilitate easier access to financial services.

The system is particularly significant for Somalia, where many people have historically been excluded from formal banking. The United Nations Industrial Development Organization (UNIDO) highlights in its 2020 ‘Somalia Financial Sector Technical Report’ that only about 15 percent of Somalia's population has a bank account, and fewer than 5 percent of these account holders actively use their accounts. This low active usage rate underscores the urgent need for Somalia's new digital identification system. The initiative aims to enhance access to financial services and promote greater participation, potentially increasing the number of active users and improving overall financial inclusion in the country.

It is expected to enhance the security and efficiency of financial transactions, reduce fraud and money laundering risks, and stimulate economic growth by broadening access to financial services.

Hikmatu Bilali