Ecommerce is booming in several African countries. So, most governments have introduced reforms and incentives to encourage the activity. To benefit from those incentives, some buyers indulge in fraudulent acts. Therefore, Morocco is introducing the tax to protect the local industry and secure more revenues.

Morocco will tax every good purchased online and shipped from abroad starting from July 1, 2022. The decision is decreed in ordinance n° 2-22-438 issued during the ministerial council carried out last Thursday, June 16. According to the decision, all the goods purchased via electronic platforms are now subjected to import duties no matter their value. Goods delivered before the law’s effective date will not be affected, the ordinance stresses.

The new ordinance amends article 190-E of decree n°2-77-862, which exempts some goods and parcels from import duty. Goods and parcels worth less than MAD2,000 (US198.65$) imported by individuals with ordinary residence in Morrocco and those worth less than MAD1,250 (about US$125) (except for alcoholic drinks and tobacco) sent to natural or legal persons domiciled in the country were included.

Article 190-E is amended because Morocco noticed that with the boom of e-commerce activity in the country, some users have developed fraudulent practices to benefit from the exemption. For instance, large goods exceeding the exemption limits are fractioned and sent to multiple persons even though they are destined for one individual or legal person.

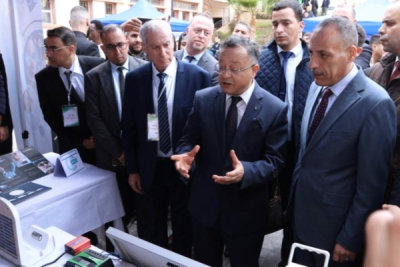

Speaking during a press conference after the June 16 ministerial council, government spokesperson Mustapha Baitas explained that the new decisions are aimed at combating fraudulent practices. "The project aims to strengthen customs control procedures for parcels bought online and delivered from abroad,” he said.

For the spokesperson, those acts harm the Moroccan economy-local businesses particularly- and deprive the government of important resources. In 2021, he estimates, more than MAD1 billion worth of goods bypassed taxation using fraudulent schemes to benefit from the exemption provided by article 190-E. For the government official, that figure could rise to MAD2 billion this year.

Ruben Tchounyabe