Despite growth, many Africans still face challenges in accessing digital financial tools. By collaborating, Network International and GIM-UEMOA can bridge gaps in financial access, offering secure and seamless digital payment solutions that cater to both banked and unbanked populations.

Network International, a payment solutions provider in the Middle East and Africa, has partnered with GIM-UEMOA, the regional payment scheme for the West African Economic and Monetary Union (WAEMU). The partnership, announced on January 28, aims to drive digital payment innovation and financial inclusion across the eight WAEMU member states. The two parties signed a memorandum of understanding (MoU) to that effect.

Dr. Reda Helal, Managing Director & Co-Head of Processing, Africa at Network International, described the partnership as a major milestone for Network International. "Together, we aim to harness our combined expertise to empower the UEMOA region with state-of-the-art payment solutions that drive economic inclusion and prosperity," he said.

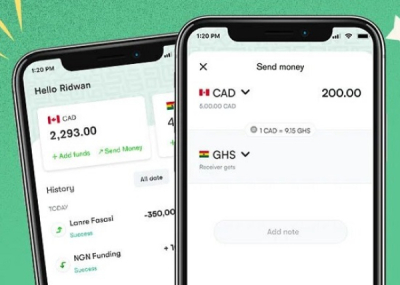

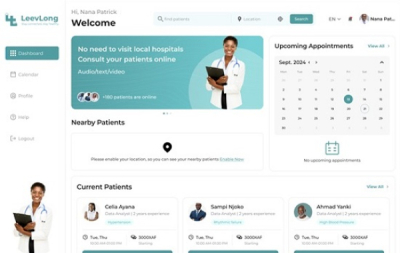

Under the collaboration, both organizations will enhance the GIM-Pay framework, providing secure and seamless digital payment solutions that cater to the growing needs of businesses and consumers in the region. The initiative is expected to strengthen the value proposition for GIM-UEMOA’s member banks, equipping them with advanced payment technologies to better serve their customers and support economic growth.

GIM-UEMOA Managing Director Minayegnan Coulibaly emphasized the significance of the collaboration, stating, “This collaboration with Network International allows for the pooling of infrastructure and solutions to bring cutting-edge digital payment solutions to the West African banking sector."

In its State of Financial Inclusion in WAEMU (2021) report, the Central Bank of West African States (BCEAO) reported a financial inclusion rate of 67.2%, indicating that nearly 30% of the population remained unbanked. By introducing innovative digital payment solutions, this partnership will bridge this gap, providing more individuals with access to financial services.

The partnership reaffirms both organizations' commitment to innovation and collaboration in West Africa’s financial technology space, highlighting the role of strategic alliances in addressing the region’s evolving financial and economic needs.

Hikmatu Bilali